January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

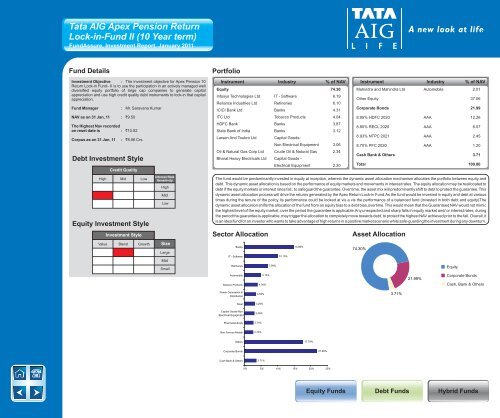

<strong>Tata</strong> AIG Apex Pension ReturnLock-in-Fund II (10 Year term)FundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The investment objective for Apex Pension 10Return Lock-in Fund– II is to use the participation in an actively managed welldiversified equity portfolio of large cap companies to generate capitalappreciation and use high credit quality debt instruments to lock-in that capitalappreciation.Fund ManagerNAV as on 31 Jan, 11 : `9.50The Highest Nav recordedon reset date is : `10.52Corpus as on 31 Jan, 11: Mr. Saravana Kumar: `8.06 Crs.Debt Investment StyleCredit QualityHigh Mid LowEquity Investment StyleInvestment StyleInterest RateSensitivityHighMidLowValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 74.30Infosys Technologies Ltd IT - Software 6.19Reliance Industries Ltd Refineries 6.10ICICI Bank Ltd Banks 4.31ITC Ltd Tobacco Products 4.04HDFC Bank Banks 3.87State Bank of India Banks 3.12Larsen And Toubro LtdSector AllocationCapital Goods-Non Electrical Equipment 3.06Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.34Bharat Heavy Electricals Ltd Capital Goods -Electrical Equipment 2.20Instrument Industry % of NAVMahindra and Mahindra Ltd Automobile 2.01Other Equity 37.06Corporate Bonds 21.998.95% HDFC 2020 AAA 12.268.80% RECL 2020 AAA 6.078.93% NTPC 2021 AAA 2.458.70% PFC 2020 AAA 1.20Cash Bank & Others 3.71Total 100.00The fund would be predominantly invested in equity at inception, wherein the dynamic asset allocation mechanism allocates the portfolio between equity anddebt. This dynamic asset allocation is based on the performance of equity markets and movements in interest rates. The equity allocation may be reallocated todebt if the equity markets or interest rates fall , to safeguard the guarantee. Over time, the asset mix will predominantly shift to debt to protect the guarantee. Thisdynamic asset allocation process will drive the returns generated by the Apex Return Lock-in Fund.As the fund would be invested in equity and debt at varioustimes during the tenure of the policy, its performance could be looked at vis a vis the performance of a balanced fund (invested in both debt and equity). Thedynamic asset allocation shifts the allocation of the fund from an equity bias to a debt bias,overtime. This would mean that the Guaranteed NAV would not mimicthe highest level of the equity market ,over the period the guarantee is applicable.Any unexpected and sharp falls in equity market and/ or interest rates, duringthe period the guarantee is applicable, may trigger the allocation to completely move towards debt, to protect the highest NAV achieved prior to the fall. Overall, itis an ideal fund for an investor who wants to take advantage of high returns in a positive market scenario while safe-guarding the investment during any downturn.BanksIT - SoftwareRefineriesAutomobileTobacco Products5.13%4.04%7.09%10.10%14.86%Asset Allocation74.30%21.99%EquityCorporate BondsCash, Bank & OthersPower Generation &Distribution3.55%3.71%Steel3.25%Capital Goods-NonElectrical Equipment3.06%Pharmaceuticals2.74%Non Ferrous Metals2.70%Others17.79%Corporate Bonds21.99%Cash Bank & Others3.71%0% 5% 10% 15% 20% 25%Equity FundsDebt FundsHybrid Funds