January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

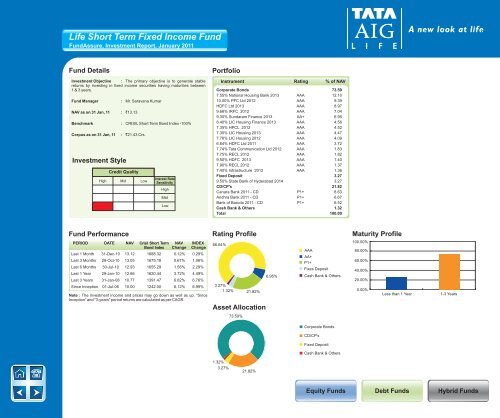

<strong>Life</strong> Short Term Fixed Income FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The primary objective is to generate stablereturns by investing in fixed income securities having maturities between1 & 3 years.Fund ManagerNAV as on 31 Jan, 11 : `13.13Benchmark :Investment Style: Mr. Saravana KumarCorpus as on 31 Jan, 11 : `21.43 Crs.Credit QualityHigh Mid LowCRISIL Short Term Bond Index -100%Interest RateSensitivityHighMidLowPortfolioInstrument Rating % of NAVCorporate Bonds 73.597.55% National Housing Bank 2013 AAA 12.1010.00% PFC Ltd 2012 AAA 9.39HDFC Ltd 2013 AAA 8.979.68% IRFC 2012 AAA 7.049.30% Sundaram Finance 2013 AA+ 6.958.40% LIC Housing Finance 2013 AAA 4.567.35% HPCL 2012 AAA 4.527.30% LIC Housing 2013 AAA 4.477.76% LIC Housing 2012 AAA 4.096.84% HDFC Ltd 2011 AAA 3.727.74% <strong>Tata</strong> Communication Ltd 2012 AAA 1.837.75% RECL 2012 AAA 1.829.50% HDFC 2013 AAA 1.407.90% RECL 2012 AAA 1.377.40% Infrastructure 2012 AAA 1.36Fixed Deposit 3.279.50% State Bank of Hyderabad 2014 3.27CD/CP's 21.82Canara Bank 2011 - CD P1+ 8.63Andhra Bank 2011 - CD P1+ 6.67Bank of Baroda 2011 - CD P1+ 6.52Cash Bank & Others 1.32Total 100.00Fund PerformancePERIOD DATE NAV Crisil Short Term NAV INDEXBond Index Change ChangeLast 1 Month 31-Dec-10 13.12 1688.32 0.12% 0.29%Last 3 Months 29-Oct-10 13.05 1675.18 0.67% 1.08%Last 6 Months 30-Jul-10 12.93 1655.29 1.56% 2.29%Last 1 Year 29-Jan-10 12.66 1620.44 3.72% 4.49%Last 3 Years 31-Jan-08 10.77 1391.47 6.82% 6.76%Since Inception 01-Jul-06 10.00 1242.00 6.12% 6.99%Note : The investment income and prices may go down as well as up. “SinceInception” and "3-years" period returns are calculated as per CAGR.Rating Profile66.64%3.27%1.32%21.82%Asset Allocation6.95%AAAAA+P1+Fixes DepositCash Bank & OthersMaturity Profile100.00%80.00%60.00%40.00%20.00%0.00%Less than 1 Year1-3 Years73.59%Corporate BondsCD/CP'sFixed DepositCash Bank & Others1.32%3.27%21.82%Equity FundsDebt FundsHybrid Funds