January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

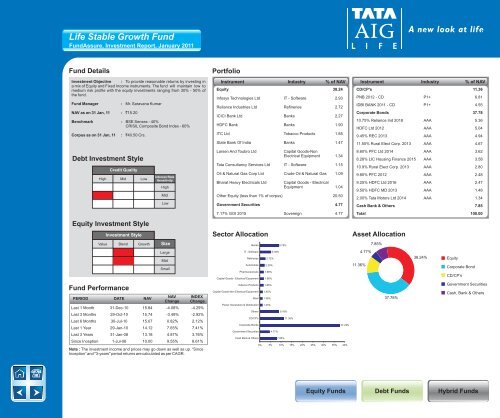

<strong>Life</strong> Stable Growth FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : To provide reasonable returns by investing ina mix of Equity and Fixed Income instruments. The fund will maintain low tomedium risk profile with the equity investments ranging from 30% - 50% ofthe fund.Fund ManagerNAV as on 31 Jan, 11 : `15.20Benchmark :Debt Investment StyleCredit QualityHigh Mid LowEquity Investment StyleInvestment StyleValue Blend Growth SizeFund Performance: Mr. Saravana KumarCorpus as on 31 Jan, 11 : `40.50 Crs.PERIOD DATE NAVBSE Sensex - 40%CRISIL Composite Bond Index - 60%Interest RateSensitivityHighLargeMidSmallNAVChangeINDEXChangeLast 1 Month 31-Dec-10 15.84 -4.08% -4.29%Last 3 Months 29-Oct-10 15.74 -3.49% -2.92%Last 6 Months 30-Jul-10 15.07 0.82% 2.12%Last 1 Year 29-Jan-10 14.12 7.65% 7.41%Last 3 Years 31-Jan-08 13.18 4.87% 3.76%Since Inception 1-Jul-06 10.00 9.55% 8.61%Note : The investment income and prices may go down as well as up. “SinceInception” and "3-years" period returns are calculated as per CAGR.MidLowPortfolioInstrument Industry % of NAVEquity 38.24Infosys Technologies Ltd IT - Software 2.93Reliance Industries Ltd Refineries 2.72ICICI Bank Ltd Banks 2.27HDFC Bank Banks 1.90ITC Ltd Tobacco Products 1.85State Bank Of India Banks 1.47Larsen And Toubro LtdSector AllocationCapital Goods-NonElectrical Equipment 1.34<strong>Tata</strong> Consultancy Services Ltd IT - Software 1.15Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 1.09Bharat Heavy Electricals LtdCapital Goods - ElectricalEquipment 1.04Other Equity (less than 1% of corpus) 20.50Government Securities 4.777.17% GOI 2015 Sovereign 4.77BanksIT - SoftwareRefineriesAutomobilePharmaceuticalsCapital Goods - Electrical EquipmentTobacco ProductsCapital Goods-Non Electrical EquipmentSteelPower Generation & DistributionOthersCD/CP'sCorporate BondsGovernment SecuritiesCash Bank & Others2.72%2.29%1.98%1.96%1.85%1.45%1.36%1.33%5.39%4.77%8.75%9.18%7.85%11.36%37.78%0% 5% 10% 15% 20% 25% 30% 35% 40%Instrument Industry % of NAVCD/CP's 11.36PNB 2012 - CD P1+ 6.81IDBI BANK 2011 - CD P1+ 4.55Corporate Bonds 37.7810.75% Reliance Ind 2018 AAA 5.36HDFC Ltd 2012 AAA 5.049.45% REC 2013 AAA 4.9411.50% Rural Elect Corp. 2013 AAA 4.678.60% PFC Ltd 2014 AAA 3.628.28% LIC Housing Finance 2015 AAA 3.5810.9% Rural Elect Corp. 2013 AAA 2.809.80% PFC 2012 AAA 2.489.25% HDFC Ltd 2016 AAA 2.479.50% HDFC MD 2013 AAA 1.482.00% <strong>Tata</strong> Motors Ltd 2014 AAA 1.34Cash Bank & Others 7.85Total 100.00Asset Allocation7.85%4.77%38.24% Equity11.36%Corporate BondCD/CP’sGovernment SecuritiesCash, Bank & Others37.78%Equity FundsDebt FundsHybrid Funds