January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

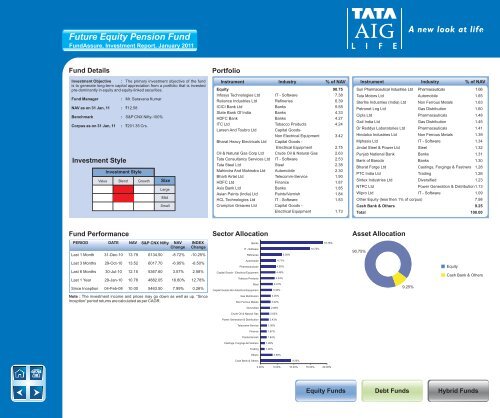

Future Equity Pension FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The primary investment objective of the fundis to generate long-term capital appreciation from a portfolio that is investedpre-dominantly in equity and equity-linked securities.Fund ManagerNAV as on 31 Jan, 11 : `12.58BenchmarkCorpus as on 31 Jan, 11Investment Style: Mr. Saravana Kumar: S&P CNX Nifty-100%: `201.35 Crs.Investment StyleValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 90.75Infosys Technologies Ltd IT - Software 7.38Reliance Industries Ltd Refineries 6.39ICICI Bank Ltd Banks 5.58State Bank Of India Banks 4.33HDFC Bank Banks 4.27ITC Ltd Tobacco Products 4.24Larsen And Toubro Ltd Capital Goods-Non Electrical Equipment 3.42Bharat Heavy Electricals Ltd Capital Goods -Electrical Equipment 2.75Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 2.63<strong>Tata</strong> Consultancy Services Ltd IT - Software 2.53<strong>Tata</strong> Steel Ltd Steel 2.38Mahindra And Mahindra Ltd Automobile 2.30Bharti Airtel Ltd Telecomm-Service 1.90HDFC Ltd Finance 1.87Axis Bank Ltd Banks 1.85Asian Paints (India) Ltd Paints/Varnish 1.84HCL Technologies Ltd IT - Software 1.83Crompton Greaves Ltd Capital Goods -Electrical Equipment 1.73Instrument Industry % of NAVSun Pharmaceutical Industries Ltd Pharmaceuticals 1.66<strong>Tata</strong> Motors Ltd Automobile 1.65Sterlite Industries (India) Ltd Non Ferrous Metals 1.63Petronet Lng Ltd Gas Distribution 1.60Cipla Ltd Pharmaceuticals 1.48Gail India Ltd Gas Distribution 1.45Dr Reddys Laboratories Ltd Pharmaceuticals 1.41Hindalco Industries Ltd Non Ferrous Metals 1.39Mphasis Ltd IT - Software 1.34Jindal Steel & Power Ltd Steel 1.32Punjab National Bank Banks 1.31Bank of Baroda Banks 1.30Bharat Forge Ltd Castings, Forgings & Fastners 1.28PTC India Ltd Trading 1.26Sintex Industries Ltd Diversified 1.23NTPC LtdPower Generation & Distribution1.13Wipro Ltd IT - Software 1.09Other Equity (less then 1% of corpus) 7.98Cash Bank & Others 9.25Total 100.00Fund PerformanceSector AllocationAsset AllocationPERIOD DATE NAV S&P CNX Nifty NAV INDEXChange ChangeLast 1 Month 31-Dec-10 13.79 6134.50 -8.72% -10.25%BanksIT - SoftwareRefineries6.39%14.75%18.78%90.75%Last 3 Months 29-Oct-10 13.52 6017.70 -6.95% -8.50%Last 6 Months 30-Jul-10 12.15 5367.60 3.57% 2.58%Last 1 Year 29-Jan-10 10.78 4882.05 16.80% 12.78%Since Inception 04-Feb-08 10.00 5463.50 7.99% 0.26%AutomobilePharmaceuticalsCapital Goods - Electrical EquipmentTobacco ProductsSteelCapital Goods-Non Electrical Equipment4.71%4.55%4.48%4.24%3.70%3.42%9.25%EquityCash Bank & OthersNote : The investment income and prices may go down as well as up. “SinceInception” period returns are calculated as per CAGR.Gas DistributionNon Ferrous Metals3.05%3.02%Diversified2.85%Crude Oil & Natural Gas2.63%Power Generation & Distribution2.43%Telecomm-ServiceFinancePaints/VarnishCastings, Forgings & FastnersTradingOthers1.90%1.87%1.84%1.28%1.26%3.58%Cash Bank & Others9.25%0.00% 5.00% 10.00% 15.00% 20.00%Equity FundsDebt FundsHybrid Funds