January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

January - Tata AIA Life Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

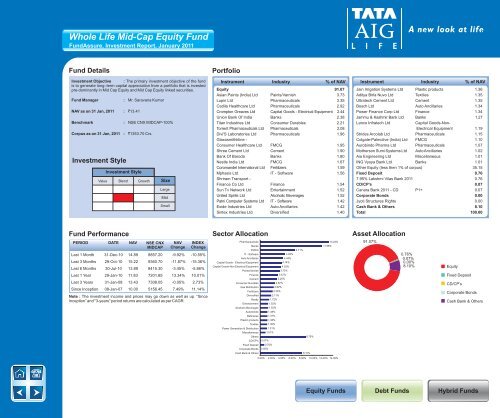

Whole <strong>Life</strong> Mid-Cap Equity FundFundAssure, Investment Report, <strong>January</strong> 2011Fund DetailsInvestment Objective : The primary investment objective of the fundis to generate long–term capital appreciation from a portfolio that is investedpre-dominantly in Mid Cap Equity and Mid Cap Equity linked securities.Fund ManagerNAV as on 31 Jan, 2011 : `13.41BenchmarkCorpus as on 31 Jan, 2011Investment Style: Mr. Saravana Kumar: NSE CNX MIDCAP-100%: `1353.70 Crs.Investment StyleValue Blend Growth SizeLargeMidSmallPortfolioInstrument Industry % of NAVEquity 91.07Asian Paints (India) Ltd Paints/Varnish 3.73Lupin Ltd Pharmaceuticals 3.35Cadila Healthcare Ltd Pharmaceuticals 2.92Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.44Union Bank Of India Banks 2.38Titan Industries Ltd Consumer Durables 2.21Torrent Pharmaceuticals Ltd Pharmaceuticals 2.08Divi'S Laboratories Ltd Pharmaceuticals 1.96Glaxosmithkline -Consumer Healthcare Ltd FMCG 1.95Shree Cement Ltd Cement 1.90Bank Of Baroda Banks 1.80Nestle India Ltd FMCG 1.67Coromandel International Ltd Fertilizers 1.59Mphasis Ltd IT - Software 1.56Shriram Transport -Finance Co Ltd Finance 1.54Sun Tv Network Ltd Entertainment 1.52United Spirits Ltd Alcoholic Beverages 1.52Patni Computer Systems Ltd IT - Software 1.42Exide Industries Ltd Auto Ancillaries 1.42Sintex Industries Ltd Diversified 1.40Instrument Industry % of NAVJain Irrigation Systems Ltd Plastic products 1.36Aditya Birla Nuvo Ltd Textiles 1.35Ultratech Cement Ltd Cement 1.35Bosch Ltd Auto Ancillaries 1.34Power Finance Corp Ltd Finance 1.34Jammu & Kashmir Bank Ltd Banks 1.27Lanco Infratech LtdCapital Goods-Non-Electrical Equipment 1.19Strides Arcolab Ltd Pharmaceuticals 1.15Colgate-Palmolive (India) Ltd FMCG 1.10Aurobindo Pharma Ltd Pharmaceuticals 1.07Motherson Sumi Systems Ltd Auto Ancillaries 1.02Aia Engineering Ltd Miscellaneous 1.01ING Vysya Bank Ltd Banks 1.01Other Equity (less then 1% of corpus) 35.15Fixed Deposit 0.767.95% Lakshmi Vilas Bank 2011 0.76CD/CP's 0.07Canara Bank 2011 - CD P1+ 0.07Corporate Bonds 0.00Jyoti Structures Rights 0.00Cash Bank & Others 8.10Total 100.00Fund PerformancePERIOD DATE NAV NSE CNX NAV INDEXMIDCAP Change ChangeLast 1 Month 31-Dec-10 14.89 8857.20 -9.92% -10.55%Last 3 Months 29-Oct-10 15.22 9360.70 -11.87% -15.36%Last 6 Months 30-Jul-10 13.89 8415.30 -3.45% -5.86%Last 1 Year 29-Jan-10 11.83 7201.85 13.34% 10.01%Last 3 Years 31-Jan-08 13.43 7308.05 -0.05% 2.73%Since Inception 08-Jan-07 10.00 5156.45 7.49% 11.14%Note : The investment income and prices may go down as well as up. “SinceInception” and "3-years" period returns are calculated as per CAGR.Sector AllocationPharmaceuticalsBanksFMCGIT - Software4.83%Auto Ancillaries4.44%Capital Goods - Electrical Equipment4.14%Capital Goods-Non Electrical Equipment4.02%Paints/Varnish3.73%Finance3.47%Cement3.25%Consumer Durables2.87%Gas Distribution2.62%Fertilizers2.39%Diversified2.11%Realty 1.72%Entertainment 1.52%Alcoholic Beverages 1.52%Automobile 1.38%Refineries 1.37%Plastic products 1.36%Textiles 1.35%Power Generation & Distribution 1.31%Miscellaneous 1.01%OthersCD/CP's 0.07%Fixed Deposit 0.76%Corporate Bonds 0.00%Cash Bank & Others6.71%8.75%8.10%13.23%11.98%Asset Allocation91.07%0.76%0.07%0.00%8.10%EquityFixed DepositCD/CP’sCorporate BondsCash Bank & Others0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00%Equity FundsDebt FundsHybrid Funds