Galfar Engineering & Contracting (GECS.OM)

Galfar Engineering & Contracting (GECS.OM)

Galfar Engineering & Contracting (GECS.OM)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

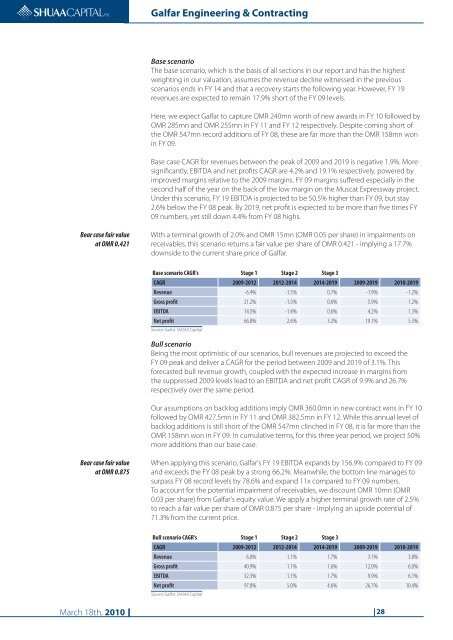

<strong>Galfar</strong> <strong>Engineering</strong> & <strong>Contracting</strong>Base scenarioThe base scenario, which is the basis of all sections in our report and has the highestweighting in our valuation, assumes the revenue decline witnessed in the previousscenarios ends in FY 14 and that a recovery starts the following year. However, FY 19revenues are expected to remain 17.9% short of the FY 09 levels.Here, we expect <strong>Galfar</strong> to capture <strong>OM</strong>R 240mn worth of new awards in FY 10 followed by<strong>OM</strong>R 285mn and <strong>OM</strong>R 255mn in FY 11 and FY 12 respectively. Despite coming short ofthe <strong>OM</strong>R 547mn record additions of FY 08, these are far more than the <strong>OM</strong>R 158mn wonin FY 09.Base case CAGR for revenues between the peak of 2009 and 2019 is negative 1.9%. Moresignificantly, EBITDA and net profits CAGR are 4.2% and 19.1% respectively, powered byimproved margins relative to the 2009 margins. FY 09 margins suffered especially in thesecond half of the year on the back of the low margin on the Muscat Expressway project.Under this scenario, FY 19 EBITDA is projected to be 50.5% higher than FY 09, but stay2.6% below the FY 08 peak. By 2019, net profit is expected to be more than five times FY09 numbers, yet still down 4.4% from FY 08 highs.Bear case fair valueat <strong>OM</strong>R 0.421With a terminal growth of 2.0% and <strong>OM</strong>R 15mn (<strong>OM</strong>R 0.05 per share) in impairments onreceivables, this scenario returns a fair value per share of <strong>OM</strong>R 0.421 - implying a 17.7%downside to the current share price of <strong>Galfar</strong>.Base scenario CAGR's Stage 1 Stage 2 Stage 3CAGR 2009-2012 2012-2014 2014-2019 2009-2019 2010-2019Revenue -6.4% -1.5% 0.7% -1.9% -1.2%Gross profit 21.2% -1.5% 0.6% 5.9% 1.2%EBITDA 14.5% -1.4% 0.6% 4.2% 1.3%Net profit 66.8% 2.6% 3.2% 19.1% 5.3%Source: <strong>Galfar</strong>, SHUAA CapitalBull scenarioBeing the most optimistic of our scenarios, bull revenues are projected to exceed theFY 09 peak and deliver a CAGR for the period between 2009 and 2019 of 3.1%. Thisforecasted bull revenue growth, coupled with the expected increase in margins fromthe suppressed 2009 levels lead to an EBITDA and net profit CAGR of 9.9% and 26.7%respectively over the same period.Our assumptions on backlog additions imply <strong>OM</strong>R 360.0mn in new contract wins in FY 10followed by <strong>OM</strong>R 427.5mn in FY 11 and <strong>OM</strong>R 382.5mn in FY 12. While this annual level ofbacklog additions is still short of the <strong>OM</strong>R 547mn clinched in FY 08, it is far more than the<strong>OM</strong>R 158mn won in FY 09. In cumulative terms, for this three year period, we project 50%more additions than our base case.Bear case fair valueat <strong>OM</strong>R 0.875When applying this scenario, <strong>Galfar</strong>'s FY 19 EBITDA expands by 156.9% compared to FY 09and exceeds the FY 08 peak by a strong 66.2%. Meanwhile, the bottom line manages tosurpass FY 08 record levels by 78.6% and expand 11x compared to FY 09 numbers.To account for the potential impairment of receivables, we discount <strong>OM</strong>R 10mn (<strong>OM</strong>R0.03 per share) from <strong>Galfar</strong>'s equity value. We apply a higher terminal growth rate of 2.5%to reach a fair value per share of <strong>OM</strong>R 0.875 per share - implying an upside potential of71.3% from the current price.Bull scenario CAGR's Stage 1 Stage 2 Stage 3CAGR 2009-2012 2012-2014 2014-2019 2009-2019 2010-2019Revenue 6.8% 1.1% 1.7% 3.1% 3.8%Gross profit 40.9% 1.1% 1.6% 12.0% 6.0%EBITDA 32.3% 1.1% 1.7% 9.9% 6.1%Net profit 97.8% 5.0% 4.6% 26.7% 10.4%Source: <strong>Galfar</strong>, SHUAA CapitalMarch 18th, 2010 28