The Impact of Mungbean Research in China

The Impact of Mungbean Research in China

The Impact of Mungbean Research in China

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

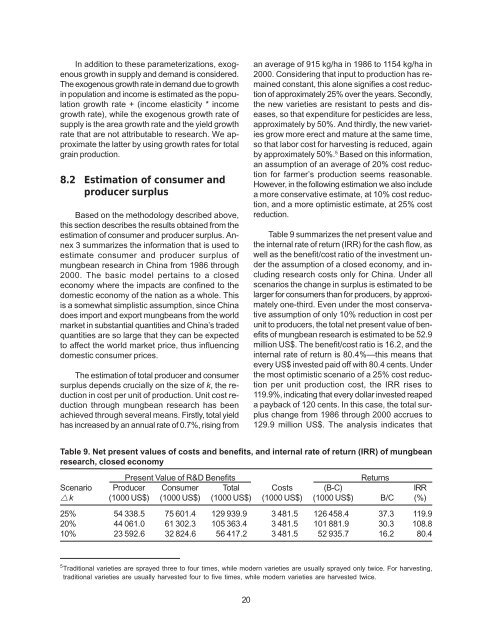

In addition to these parameterizations, exogenousgrowth <strong>in</strong> supply and demand is considered.<strong>The</strong> exogenous growth rate <strong>in</strong> demand due to growth<strong>in</strong> population and <strong>in</strong>come is estimated as the populationgrowth rate + (<strong>in</strong>come elasticity * <strong>in</strong>comegrowth rate), while the exogenous growth rate <strong>of</strong>supply is the area growth rate and the yield growthrate that are not attributable to research. We approximatethe latter by us<strong>in</strong>g growth rates for totalgra<strong>in</strong> production.8.2 Estimation <strong>of</strong> consumer andproducer surplusBased on the methodology described above,this section describes the results obta<strong>in</strong>ed from theestimation <strong>of</strong> consumer and producer surplus. Annex3 summarizes the <strong>in</strong>formation that is used toestimate consumer and producer surplus <strong>of</strong>mungbean research <strong>in</strong> Ch<strong>in</strong>a from 1986 through2000. <strong>The</strong> basic model perta<strong>in</strong>s to a closedeconomy where the impacts are conf<strong>in</strong>ed to thedomestic economy <strong>of</strong> the nation as a whole. Thisis a somewhat simplistic assumption, s<strong>in</strong>ce Ch<strong>in</strong>adoes import and export mungbeans from the worldmarket <strong>in</strong> substantial quantities and Ch<strong>in</strong>a’s tradedquantities are so large that they can be expectedto affect the world market price, thus <strong>in</strong>fluenc<strong>in</strong>gdomestic consumer prices.<strong>The</strong> estimation <strong>of</strong> total producer and consumersurplus depends crucially on the size <strong>of</strong> k, the reduction<strong>in</strong> cost per unit <strong>of</strong> production. Unit cost reductionthrough mungbean research has beenachieved through several means. Firstly, total yieldhas <strong>in</strong>creased by an annual rate <strong>of</strong> 0.7%, ris<strong>in</strong>g froman average <strong>of</strong> 915 kg/ha <strong>in</strong> 1986 to 1154 kg/ha <strong>in</strong>2000. Consider<strong>in</strong>g that <strong>in</strong>put to production has rema<strong>in</strong>edconstant, this alone signifies a cost reduction<strong>of</strong> approximately 25% over the years. Secondly,the new varieties are resistant to pests and diseases,so that expenditure for pesticides are less,approximately by 50%. And thirdly, the new varietiesgrow more erect and mature at the same time,so that labor cost for harvest<strong>in</strong>g is reduced, aga<strong>in</strong>by approximately 50%. 5 Based on this <strong>in</strong>formation,an assumption <strong>of</strong> an average <strong>of</strong> 20% cost reductionfor farmer’s production seems reasonable.However, <strong>in</strong> the follow<strong>in</strong>g estimation we also <strong>in</strong>cludea more conservative estimate, at 10% cost reduction,and a more optimistic estimate, at 25% costreduction.Table 9 summarizes the net present value andthe <strong>in</strong>ternal rate <strong>of</strong> return (IRR) for the cash flow, aswell as the benefit/cost ratio <strong>of</strong> the <strong>in</strong>vestment underthe assumption <strong>of</strong> a closed economy, and <strong>in</strong>clud<strong>in</strong>gresearch costs only for Ch<strong>in</strong>a. Under allscenarios the change <strong>in</strong> surplus is estimated to belarger for consumers than for producers, by approximatelyone-third. Even under the most conservativeassumption <strong>of</strong> only 10% reduction <strong>in</strong> cost perunit to producers, the total net present value <strong>of</strong> benefits<strong>of</strong> mungbean research is estimated to be 52.9million US$. <strong>The</strong> benefit/cost ratio is 16.2, and the<strong>in</strong>ternal rate <strong>of</strong> return is 80.4%—this means thatevery US$ <strong>in</strong>vested paid <strong>of</strong>f with 80.4 cents. Underthe most optimistic scenario <strong>of</strong> a 25% cost reductionper unit production cost, the IRR rises to119.9%, <strong>in</strong>dicat<strong>in</strong>g that every dollar <strong>in</strong>vested reapeda payback <strong>of</strong> 120 cents. In this case, the total surpluschange from 1986 through 2000 accrues to129.9 million US$. <strong>The</strong> analysis <strong>in</strong>dicates thatTable 9. Net present values <strong>of</strong> costs and benefits, and <strong>in</strong>ternal rate <strong>of</strong> return (IRR) <strong>of</strong> mungbeanresearch, closed economyPresent Value <strong>of</strong> R&D BenefitsReturnsScenario Producer Consumer Total Costs (B-C) IRRk (1000 US$) (1000 US$) (1000 US$) (1000 US$) (1000 US$) B/C (%)25% 54 338.5 75 601.4 129 939.9 3 481.5 126 458.4 37.3 119.920% 44 061.0 61 302.3 105 363.4 3 481.5 101 881.9 30.3 108.810% 23 592.6 32 824.6 56 417.2 3 481.5 52 935.7 16.2 80.45 Traditional varieties are sprayed three to four times, while modern varieties are usually sprayed only twice. For harvest<strong>in</strong>g,traditional varieties are usually harvested four to five times, while modern varieties are harvested twice.20