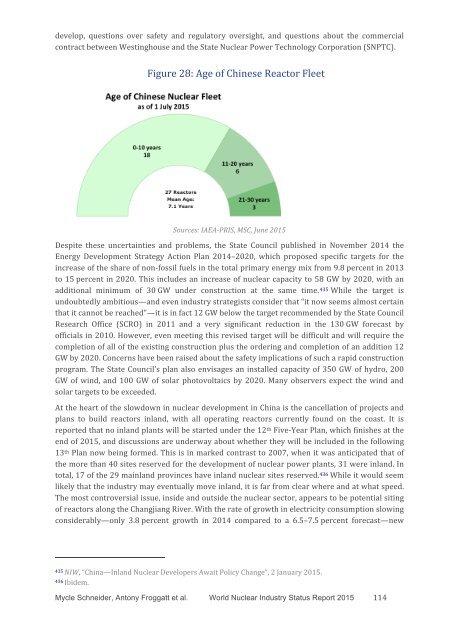

limit their competitiveness to meet new demand in the Reference case. In the near term, 5.5 GWof planned additions are put into place by 2020, offset by 3.2 GW of retirements over the sameperiod”, the report states. Recalling the 19 percent nuclear share in 2013, the EIA notes: “From2013 to 2040, the nuclear share of total generation declines in all cases, to 15 percent in the HighOil and Gas Resource case and to 18 percent in the High Oil Price case….” The EIA summarizes thetrend:Rising long-term natural gas prices, the high capital costs of new coal and nuclear generation capacity,state-level policies, and cost reductions for renewable generation in a market characterized by relativelyslow electricity demand growth favor increased use of renewables.In 2014, renewable sources (including conventional hydro) covered 9.8 percent of the primaryenergy consumption in the U.S., the highest share since the 1930s. Slightly more than half of thatrenewable energy was used to generate electricity, and the renewable share of electricity reached13 percent. 433China started construction of its first commercial reactor in 1985 and according to the IAEA, bythe middle of June 2015 had 27 reactors (23 GWe net) in operation (see Annex 7 for detailedoverview of the Chinese Reactor Program). In 2014, nuclear provided a record 130 TWh or 2.4percent of the country’s electricity, but still the lowest nuclear share of any country operatingmore than one commercial nuclear plant. During 2014, three new reactors were connected to thegrid, and so far in 2015 an additional four units have come on line. The nuclear industry has saidthat another two to four are likely to be approved for startup this year, which would make it thebiggest increase in China’s history. 434 Logically, China has the youngest reactor fleet in the worldwith an average age of 7.1 years (see Figure 28).While the 3 GW of new nuclear capacity in 2014 in China represented two‐thirds of the world'stotal, it is only a small fraction of the total electricity capacity added in China, with 47 GW fossilfueledpower plants, 21 GW of hydro, 23 GW of wind, and 11 GW of solar photovoltaics added tothe grid.Despite being the global leader in nuclear construction, with work underway on 24 reactors(23.7 GWe net) or nearly 40 percent of the global total, no new projects were approved in 2014.Only in February 2015 were units 5 and 6 at Hongyanhe given the green light; yet apparentlythese two units were already approved prior to the March 2011 Fukushima disaster. On7 May 2015, first concrete was poured for Fuqing‐5, which houses the first of the ChineseNational Nuclear Company’s (CNNC) Hualong design. Even so, this hiatus in orders highlights thechallenges to China’s nuclear power program. These include delays in construction and costincreases for the Westinghouse AP1000 reactors and AREVA EPRs, continuing doubts over thesiting of reactors in inland provinces, questions over which design or designs of reactors to433 U.S.EIA, “Today in Energy”, 28 May 2015, see http://www.eia.gov/todayinenergy/detail.cfm?id=21412,accessed 3 June 2015.434 South China Morning Post, “China to approve up to eight more nuclear reactors this year”, 22 April 2015,see http://www.scmp.com/news/china/policies‐politics/article/1773417/china‐approve‐eight‐more‐nuclearreactors‐year,accessed 20 May 2015.Mycle Schneider, Antony Froggatt et al. World Nuclear Industry Status Report 2015 113

develop, questions over safety and regulatory oversight, and questions about the commercialcontract between Westinghouse and the State Nuclear Power Technology Corporation (SNPTC).Figure 28: Age of Chinese Reactor FleetSources: IAEA‐PRIS, MSC, June 2015Despite these uncertainties and problems, the State Council published in November 2014 theEnergy Development Strategy Action Plan 2014–2020, which proposed specific targets for theincrease of the share of non‐fossil fuels in the total primary energy mix from 9.8 percent in 2013to 15 percent in 2020. This includes an increase of nuclear capacity to 58 GW by 2020, with anadditional minimum of 30 GW under construction at the same time. 435 While the target isundoubtedly ambitious—and even industry strategists consider that “it now seems almost certainthat it cannot be reached”—it is in fact 12 GW below the target recommended by the State CouncilResearch Office (SCRO) in 2011 and a very significant reduction in the 130 GW forecast byofficials in 2010. However, even meeting this revised target will be difficult and will require thecompletion of all of the existing construction plus the ordering and completion of an addition 12GW by 2020. Concerns have been raised about the safety implications of such a rapid constructionprogram. The State Council’s plan also envisages an installed capacity of 350 GW of hydro, 200GW of wind, and 100 GW of solar photovoltaics by 2020. Many observers expect the wind andsolar targets to be exceeded.At the heart of the slowdown in nuclear development in China is the cancellation of projects andplans to build reactors inland, with all operating reactors currently found on the coast. It isreported that no inland plants will be started under the 12 th Five‐Year Plan, which finishes at theend of 2015, and discussions are underway about whether they will be included in the following13 th Plan now being formed. This is in marked contrast to 2007, when it was anticipated that ofthe more than 40 sites reserved for the development of nuclear power plants, 31 were inland. Intotal, 17 of the 29 mainland provinces have inland nuclear sites reserved. 436 While it would seemlikely that the industry may eventually move inland, it is far from clear where and at what speed.The most controversial issue, inside and outside the nuclear sector, appears to be potential sitingof reactors along the Changjiang River. With the rate of growth in electricity consumption slowingconsiderably—only 3.8 percent growth in 2014 compared to a 6.5–7.5 percent forecast—new435 NIW, “China—Inland Nuclear Developers Await Policy Change”, 2 January 2015.436 Ibidem.Mycle Schneider, Antony Froggatt et al. World Nuclear Industry Status Report 2015 114

- Page 2:

This page is intentionally left bla

- Page 9:

Figure 32: Age Pyramid of the 131 N

- Page 12 and 13:

new company called Uniper. And in A

- Page 14 and 15:

Reactor Status and Nuclear Programs

- Page 16 and 17:

in 2015. Historic analysis shows th

- Page 18 and 19:

Olympic swimming pools. A groundwat

- Page 20 and 21:

"For all intents and purposes, AREV

- Page 22 and 23:

On 8 June 2015, the U.S. utility in

- Page 24 and 25:

The world’s nuclear statistics re

- Page 26 and 27:

According to the latest assessment

- Page 28 and 29:

first in which there was zero nucle

- Page 30 and 31:

definitive closure of the Indian re

- Page 32 and 33:

Table 1: Nuclear Reactors “Under

- Page 34 and 35:

and ‐4 in Ukraine are approaching

- Page 36 and 37:

Figure 9: Construction Starts in th

- Page 38 and 39:

ecent design and compliant with sig

- Page 40 and 41:

clear that the 3/11 events had an i

- Page 42 and 43:

Figure 15: The 40‐Year Lifetime P

- Page 44 and 45:

Bangladesh, Belarus, Turkey, UAE, a

- Page 46 and 47:

eports on the faulty components’

- Page 48 and 49:

January 2015, both the Chamber of T

- Page 50 and 51:

conditions of financing and partici

- Page 52 and 53:

of the contract, with Rosatom cover

- Page 54 and 55:

start construction in the next 2-3

- Page 56 and 57:

In the late 1990s, the nuclear indu

- Page 58 and 59:

AES‐2006 have received orders, wh

- Page 60 and 61:

shortage of skilled labor; quality

- Page 62 and 63:

use of passive features in the EPR

- Page 64 and 65: there have been a number of other i

- Page 66 and 67: standardize. Without standardizatio

- Page 68 and 69: Leningrad‐2‐1 Russia AES‐2006

- Page 70 and 71: ut noted that these “had varying

- Page 72 and 73: (IRIS) design. The design started i

- Page 74 and 75: or early 2013. 219 In 2011, it was

- Page 76 and 77: national energy bureau around two w

- Page 78 and 79: scale they would manage to lower th

- Page 80 and 81: The top of the reactor building of

- Page 82 and 83: TEPCO and the Government are planni

- Page 84 and 85: out that TEPCO’s lax management o

- Page 86 and 87: physical condition or suicide (“e

- Page 88 and 89: In March 2015, Fukushima Prefecture

- Page 90 and 91: “Rising long‐term natural gas p

- Page 92 and 93: projects came in at an average of U

- Page 94 and 95: Figure 20: Wind, Solar and Nuclear,

- Page 96 and 97: to rapidly accelerate the use of lo

- Page 98 and 99: • In Germany, renewables provided

- Page 100 and 101: target is undoubtedly ambitious, bu

- Page 102 and 103: Annex 1: Overview by Region and Cou

- Page 104 and 105: U.S. that have “shown interest in

- Page 106 and 107: The construction of Angra‐3 was s

- Page 108 and 109: project boosted the nameplate capac

- Page 110 and 111: Shuttering old, uneconomic reactors

- Page 112 and 113: In the case of Vogtle, a report for

- Page 116 and 117: generation projects in oversupplied

- Page 118 and 119: identified and solved will we allow

- Page 120 and 121: commercial operation only on 31 Dec

- Page 122 and 123: TEPCO that its staff had deliberate

- Page 124 and 125: produce plutonium for use in MOX fu

- Page 126 and 127: Power's Takahama‐3 and ‐4, with

- Page 128 and 129: Kansai Electric, along with Kyushu

- Page 130 and 131: permanent closure of five reactors

- Page 132 and 133: contractor and China Nuclear Indust

- Page 134 and 135: in May 2013, when the NSSC, followi

- Page 136 and 137: The political consequences of the m

- Page 138 and 139: The European Union 28 member states

- Page 140 and 141: In the absence of any successful ne

- Page 142 and 143: of the serious concerns by a range

- Page 144 and 145: negative outlook, “owing to conti

- Page 146 and 147: The average age of France’s power

- Page 148 and 149: EDF shares lost up to 85 percent of

- Page 150 and 151: power output is expected to rise si

- Page 152 and 153: low 639 , and coal‐fired generati

- Page 154 and 155: under construction. It was therefor

- Page 156 and 157: utilize the fuel that it obtained b

- Page 158 and 159: opinion at any of the sites propose

- Page 160 and 161: In Bulgaria, nuclear power provided

- Page 162 and 163: criteria defined in the tender”.

- Page 164 and 165:

signed a binding agreement that mad

- Page 166 and 167:

let the reactor operate until 2026.

- Page 168 and 169:

time of ordering, the reactors were

- Page 170 and 171:

intergovernmental agreement to comp

- Page 172 and 173:

Takahama‐1 (PWR) 826 1974 - 40 10

- Page 174 and 175:

IAEA have chosen to limit the LTS c

- Page 176 and 177:

Note: SFP: Spent Fuel Pool, RPV: Re

- Page 178 and 179:

Table 10: Definition of Credit Rati

- Page 180 and 181:

Monticello 3/71 3/05 11/06Palisades

- Page 182 and 183:

(as of 10 June 2015) 764Table 12: C

- Page 184 and 185:

2. Chinese Nuclear Power Plants Und

- Page 186 and 187:

2006-08, he carried out research at

- Page 188 and 189:

CGN or CGNPC - Chinese General Nucl

- Page 190 and 191:

INS - Indian Nuclear SocietyINSAC -

- Page 192 and 193:

NSSC - Nuclear Safety and Security

- Page 194 and 195:

UNSCEAR - United Nations Scientific

- Page 196 and 197:

Romania 2 1 300 14 18. 5% (‐) 8%

- Page 198 and 199:

Shandong Shidaowan 200 01/12/12 2/2

- Page 200 and 201:

USA 5 5 633Virgil C. Summer‐2 111

- Page 202:

25 Delayed numerous times. Latest I