Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

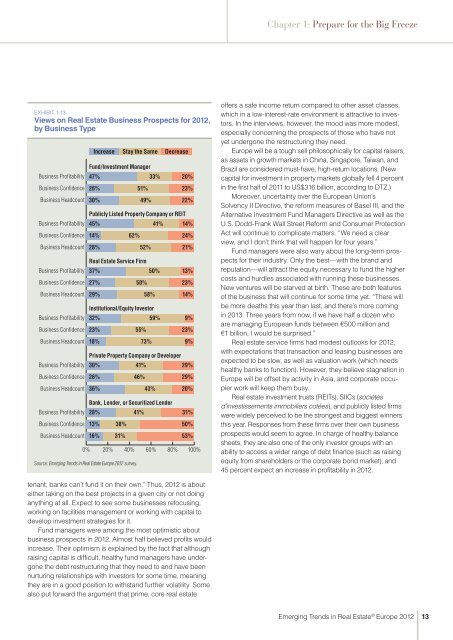

ExHIBIT 1-13<br />

Views on <strong>Real</strong> Estate Bus<strong>in</strong>ess Prospects for <strong>2012</strong>,<br />

by Bus<strong>in</strong>ess Type<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount 36% 43% 20%<br />

Bus<strong>in</strong>ess Profitability<br />

Bus<strong>in</strong>ess Confidence<br />

Bus<strong>in</strong>ess Headcount<br />

<strong>Real</strong> Estate Service Firm<br />

Institutional/Equity Investor<br />

Private Property Company or Developer<br />

Bank, Lender, or Securitized Lender<br />

0% 20% 40% 60% 80% 100%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Increase Stay the Same Decrease<br />

Fund/Investment Manager<br />

47% 33% 20%<br />

26% 51% 23%<br />

30% 49% 22%<br />

Publicly Listed Property Company or REIT<br />

45% 41% 14%<br />

14% 62% 24%<br />

28% 52% 21%<br />

37% 50% 13%<br />

27% 50% 23%<br />

29% 58% 14%<br />

32% 59% 9%<br />

23% 55% 23%<br />

18% 73% 9%<br />

30% 41% 29%<br />

26% 46% 29%<br />

28% 41% 31%<br />

13% 38% 50%<br />

16% 31% 53%<br />

tenant, banks can’t fund it on their own.” Thus, <strong>2012</strong> is about<br />

either tak<strong>in</strong>g on the best projects <strong>in</strong> a given city or not do<strong>in</strong>g<br />

anyth<strong>in</strong>g at all. Expect to see some bus<strong>in</strong>esses refocus<strong>in</strong>g,<br />

work<strong>in</strong>g on facilities management or work<strong>in</strong>g with capital to<br />

develop <strong>in</strong>vestment strategies for it.<br />

Fund managers were among the most optimistic about<br />

bus<strong>in</strong>ess prospects <strong>in</strong> <strong>2012</strong>. Almost half believed profits would<br />

<strong>in</strong>crease. Their optimism is expla<strong>in</strong>ed by the fact that although<br />

rais<strong>in</strong>g capital is difficult, healthy fund managers have undergone<br />

the debt restructur<strong>in</strong>g that they need to and have been<br />

nurtur<strong>in</strong>g relationships with <strong>in</strong>vestors for some time, mean<strong>in</strong>g<br />

they are <strong>in</strong> a good position to withstand further volatility. Some<br />

also put forward the argument that prime, core real estate<br />

Chapter 1: Prepare for the Big Freeze<br />

offers a safe <strong>in</strong>come return compared to other asset classes,<br />

which <strong>in</strong> a low-<strong>in</strong>terest-rate environment is attractive to <strong>in</strong>vestors.<br />

In the <strong>in</strong>terviews, however, the mood was more modest,<br />

especially concern<strong>in</strong>g the prospects of those who have not<br />

yet undergone the restructur<strong>in</strong>g they need.<br />

<strong>Europe</strong> will be a tough sell philosophically for capital raisers,<br />

as assets <strong>in</strong> growth markets <strong>in</strong> Ch<strong>in</strong>a, S<strong>in</strong>gapore, Taiwan, and<br />

Brazil are considered must-have, high-return locations. (New<br />

capital for <strong>in</strong>vestment <strong>in</strong> property markets globally fell 4 percent<br />

<strong>in</strong> the first half of 2011 to US$316 billion, accord<strong>in</strong>g to DTZ.)<br />

Moreover, uncerta<strong>in</strong>ty over the <strong>Europe</strong>an Union’s<br />

Solvency II Directive, the reform measures of Basel III, and the<br />

Alternative Investment Fund Managers Directive as well as the<br />

U.S. Dodd-Frank Wall Street Reform and Consumer Protection<br />

Act will cont<strong>in</strong>ue to complicate matters. “We need a clear<br />

view, and I don’t th<strong>in</strong>k that will happen for four years.”<br />

Fund managers were also wary about the long-term prospects<br />

for their <strong>in</strong>dustry. Only the best—with the brand and<br />

reputation—will attract the equity necessary to fund the higher<br />

costs and hurdles associated with runn<strong>in</strong>g these bus<strong>in</strong>esses.<br />

New ventures will be starved at birth. These are both features<br />

of the bus<strong>in</strong>ess that will cont<strong>in</strong>ue for some time yet. “There will<br />

be more deaths this year than last, and there’s more com<strong>in</strong>g<br />

<strong>in</strong> 2013. Three years from now, if we have half a dozen who<br />

are manag<strong>in</strong>g <strong>Europe</strong>an funds between €500 million and<br />

€1 billion, I would be surprised.”<br />

<strong>Real</strong> estate service firms had modest outlooks for <strong>2012</strong>,<br />

with expectations that transaction and leas<strong>in</strong>g bus<strong>in</strong>esses are<br />

expected to be slow, as well as valuation work (which needs<br />

healthy banks to function). However, they believe stagnation <strong>in</strong><br />

<strong>Europe</strong> will be offset by activity <strong>in</strong> Asia, and corporate occupier<br />

work will keep them busy.<br />

<strong>Real</strong> estate <strong>in</strong>vestment trusts (REITs), SIICs (sociétés<br />

d’<strong>in</strong>vestissements immobiliers cotées), and publicly listed firms<br />

were widely perceived to be the strongest and biggest w<strong>in</strong>ners<br />

this year. Responses from these firms over their own bus<strong>in</strong>ess<br />

prospects would seem to agree. In charge of healthy balance<br />

sheets, they are also one of the only <strong>in</strong>vestor groups with an<br />

ability to access a wider range of debt f<strong>in</strong>ance (such as rais<strong>in</strong>g<br />

equity from shareholders or the corporate bond market), and<br />

45 percent expect an <strong>in</strong>crease <strong>in</strong> profitability <strong>in</strong> <strong>2012</strong>.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

13