Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

match their liabilities. Although borrowers viewed this outcome<br />

as undesirable, the view was not universal. “The longer-term<br />

nature of <strong>in</strong>surance lend<strong>in</strong>g is more ak<strong>in</strong> to what the market<br />

wants and needs than the type of borrow<strong>in</strong>g people were<br />

do<strong>in</strong>g <strong>in</strong> 2002 to 2007.” Both borrowers and lenders also cited<br />

<strong>in</strong>stances of <strong>in</strong>surers lend<strong>in</strong>g on more flexible terms.<br />

Interviewees saw sovereign wealth funds, <strong>in</strong>surers, and<br />

fund managers with segregated accounts as be<strong>in</strong>g able to<br />

participate at all levels of the capital structure—from senior<br />

debt to equity—allow<strong>in</strong>g them to forage <strong>in</strong> the market very efficiently<br />

for deals, decid<strong>in</strong>g where <strong>in</strong> the capital stack to <strong>in</strong>vest<br />

for the most attractive risk-adjusted return.<br />

For really solid borrowers, such as some of the larger<br />

REITS, direct access to the capital markets to issue long-term<br />

bonds has cont<strong>in</strong>ued through the year, reduc<strong>in</strong>g the need for<br />

traditional senior lenders. Both borrowers and lenders saw this<br />

opportunity as someth<strong>in</strong>g that would cont<strong>in</strong>ue <strong>in</strong> the future. As<br />

one banker observed: “We have seen U.S. private placement,<br />

convertible bonds, even CMBS this year. We have seen oldfashioned<br />

debentures bonds, so [there is] a greater number of<br />

products. You need to be a big beast to access it, but that is a<br />

trend. There will be a larger range of providers—hedge funds,<br />

pension funds; we will see lots of different providers com<strong>in</strong>g<br />

<strong>in</strong>to the sector.”<br />

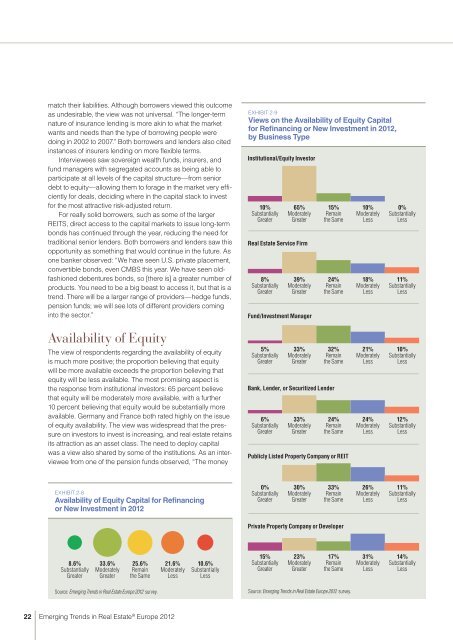

Availability of Equity<br />

The view of respondents regard<strong>in</strong>g the availability of equity<br />

is much more positive; the proportion believ<strong>in</strong>g that equity<br />

will be more available exceeds the proportion believ<strong>in</strong>g that<br />

equity will be less available. The most promis<strong>in</strong>g aspect is<br />

the response from <strong>in</strong>stitutional <strong>in</strong>vestors: 65 percent believe<br />

that equity will be moderately more available, with a further<br />

10 percent believ<strong>in</strong>g that equity would be substantially more<br />

available. Germany and France both rated highly on the issue<br />

of equity availability. The view was widespread that the pressure<br />

on <strong>in</strong>vestors to <strong>in</strong>vest is <strong>in</strong>creas<strong>in</strong>g, and real estate reta<strong>in</strong>s<br />

its attraction as an asset class. The need to deploy capital<br />

was a view also shared by some of the <strong>in</strong>stitutions. As an <strong>in</strong>terviewee<br />

from one of the pension funds observed, “The money<br />

ExHIBIT 2-8<br />

Availability of Equity Capital for Ref<strong>in</strong>anc<strong>in</strong>g<br />

or New Investment <strong>in</strong> <strong>2012</strong><br />

8.6%<br />

Substantially<br />

Greater<br />

33.6%<br />

Moderately<br />

Greater<br />

25.6%<br />

Rema<strong>in</strong><br />

the Same<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

21.6%<br />

Moderately<br />

Less<br />

22 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

10.6%<br />

Substantially<br />

Less<br />

ExHIBIT 2-9<br />

Views on the Availability of Equity Capital<br />

for Ref<strong>in</strong>anc<strong>in</strong>g or New Investment <strong>in</strong> <strong>2012</strong>,<br />

by Bus<strong>in</strong>ess Type<br />

+10+ +65+ +15+ +10+ +0<br />

Institutional/Equity Investor<br />

10%<br />

Substantially<br />

Greater<br />

65%<br />

Moderately<br />

Greater<br />

15%<br />

Rema<strong>in</strong><br />

the Same<br />

+8+ +39+ +24+ +18+ +11<br />

<strong>Real</strong> Estate Service Firm<br />

8%<br />

Substantially<br />

Greater<br />

39%<br />

Moderately<br />

Greater<br />

24%<br />

Rema<strong>in</strong><br />

the Same<br />

+5+ +33+ +32+ +21+ +10<br />

Fund/Investment Manager<br />

5%<br />

Substantially<br />

Greater<br />

33%<br />

Moderately<br />

Greater<br />

32%<br />

Rema<strong>in</strong><br />

the Same<br />

+6+ +33+ +24+ +24+ +12<br />

Bank, Lender, or Securitized Lender<br />

6%<br />

Substantially<br />

Greater<br />

33%<br />

Moderately<br />

Greater<br />

24%<br />

Rema<strong>in</strong><br />

the Same<br />

+0+ +30+ +33+ +26+ +11<br />

Publicly Listed Property Company or REIT<br />

0%<br />

Substantially<br />

Greater<br />

30%<br />

Moderately<br />

Greater<br />

33%<br />

Rema<strong>in</strong><br />

the Same<br />

+15+ +23+ +17+ +31+ +14<br />

Private Property Company or Developer<br />

15%<br />

Substantially<br />

Greater<br />

23%<br />

Moderately<br />

Greater<br />

17%<br />

Rema<strong>in</strong><br />

the Same<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

10%<br />

Moderately<br />

Less<br />

18%<br />

Moderately<br />

Less<br />

21%<br />

Moderately<br />

Less<br />

24%<br />

Moderately<br />

Less<br />

26%<br />

Moderately<br />

Less<br />

31%<br />

Moderately<br />

Less<br />

0%<br />

Substantially<br />

Less<br />

11%<br />

Substantially<br />

Less<br />

10%<br />

Substantially<br />

Less<br />

12%<br />

Substantially<br />

Less<br />

11%<br />

Substantially<br />

Less<br />

14%<br />

Substantially<br />

Less