Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

portfolios report <strong>in</strong>creases <strong>in</strong> rents and purchase prices for<br />

well-located <strong>in</strong>ner-city areas. Confidence <strong>in</strong> cont<strong>in</strong>ued future<br />

demand is based on an <strong>in</strong>creas<strong>in</strong>g population <strong>in</strong> the city,<br />

especially <strong>in</strong> central districts such as Mitte, Friedrichsha<strong>in</strong>-<br />

Kreuzberg, Pankow, and Treptow-Köpenick.<br />

Interviewees also rated the office market well, where high<br />

demand for office space is believed to exist. It was rated<br />

among the five most attractive office markets <strong>in</strong> surveys.<br />

“Berl<strong>in</strong> is often the first entry po<strong>in</strong>t for foreign <strong>in</strong>vestors. But<br />

it is not only residential; they like offices, too.” “Berl<strong>in</strong> is very<br />

attractive <strong>in</strong> terms of both office and residential real estate.”<br />

Firm occupational demand from service companies such as<br />

lawyers, tax advisers, and auditors helped take-up <strong>in</strong> the first<br />

three quarters of 2011 reach its highest volume <strong>in</strong> ten years,<br />

result<strong>in</strong>g <strong>in</strong> upwards pressure on prime rents <strong>in</strong> the city,<br />

accord<strong>in</strong>g to Jones Lang LaSalle research.<br />

The figures reflect the wider bus<strong>in</strong>ess confidence <strong>in</strong><br />

Germany, which climbed for a second month <strong>in</strong> December<br />

2011 on predictions that <strong>Europe</strong>’s largest economy had<br />

successfully steered away from recession <strong>in</strong> <strong>2012</strong>. Investors<br />

hope that consumer confidence will hold up while a decl<strong>in</strong>e<br />

<strong>in</strong> exports to the Eurozone is offset by demand <strong>in</strong> emerg<strong>in</strong>g<br />

markets and the United States.<br />

Bus<strong>in</strong>ess confidence with<strong>in</strong> the property sector was<br />

more modest; Germany-based <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong>terviewees<br />

came fourth <strong>in</strong> rank<strong>in</strong>gs for expected improvements <strong>in</strong><br />

confidence this year, and third for improvements <strong>in</strong> profits.<br />

However, Germans were the most positive about bus<strong>in</strong>ess<br />

for <strong>2012</strong> compared to peers <strong>in</strong> <strong>Europe</strong>’s core markets. Only<br />

respondents <strong>in</strong> high-growth markets, such as Turkey and<br />

Russia, ranked more positively.<br />

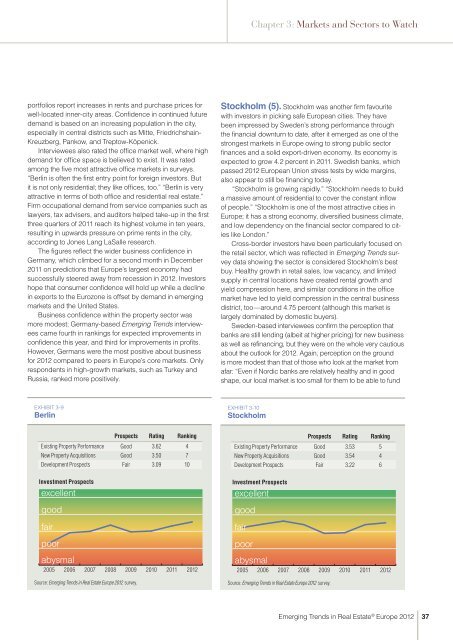

ExHIBIT 3-9<br />

Berl<strong>in</strong><br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Good 3.62 4<br />

New Property Acquisitions Good 3.50 7<br />

Development Prospects Fair 3.09 10<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Chapter 3: Markets and Sectors to Watch<br />

Stockholm (5). Stockholm was another firm favourite<br />

with <strong>in</strong>vestors <strong>in</strong> pick<strong>in</strong>g safe <strong>Europe</strong>an cities. They have<br />

been impressed by Sweden’s strong performance through<br />

the f<strong>in</strong>ancial downturn to date, after it emerged as one of the<br />

strongest markets <strong>in</strong> <strong>Europe</strong> ow<strong>in</strong>g to strong public sector<br />

f<strong>in</strong>ances and a solid export-driven economy. Its economy is<br />

expected to grow 4.2 percent <strong>in</strong> 2011. Swedish banks, which<br />

passed <strong>2012</strong> <strong>Europe</strong>an Union stress tests by wide marg<strong>in</strong>s,<br />

also appear to still be f<strong>in</strong>anc<strong>in</strong>g today.<br />

“Stockholm is grow<strong>in</strong>g rapidly.” “Stockholm needs to build<br />

a massive amount of residential to cover the constant <strong>in</strong>flow<br />

of people.” “Stockholm is one of the most attractive cities <strong>in</strong><br />

<strong>Europe</strong>; it has a strong economy, diversified bus<strong>in</strong>ess climate,<br />

and low dependency on the f<strong>in</strong>ancial sector compared to cities<br />

like London.”<br />

Cross-border <strong>in</strong>vestors have been particularly focused on<br />

the retail sector, which was reflected <strong>in</strong> <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> survey<br />

data show<strong>in</strong>g the sector is considered Stockholm’s best<br />

buy. Healthy growth <strong>in</strong> retail sales, low vacancy, and limited<br />

supply <strong>in</strong> central locations have created rental growth and<br />

yield compression here, and similar conditions <strong>in</strong> the office<br />

market have led to yield compression <strong>in</strong> the central bus<strong>in</strong>ess<br />

district, too—around 4.75 percent (although this market is<br />

largely dom<strong>in</strong>ated by domestic buyers).<br />

Sweden-based <strong>in</strong>terviewees confirm the perception that<br />

banks are still lend<strong>in</strong>g (albeit at higher pric<strong>in</strong>g) for new bus<strong>in</strong>ess<br />

as well as ref<strong>in</strong>anc<strong>in</strong>g, but they were on the whole very cautious<br />

about the outlook for <strong>2012</strong>. Aga<strong>in</strong>, perception on the ground<br />

is more modest than that of those who look at the market from<br />

afar: “Even if Nordic banks are relatively healthy and <strong>in</strong> good<br />

shape, our local market is too small for them to be able to fund<br />

ExHIBIT 3-10<br />

Stockholm<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Good 3.53 5<br />

New Property Acquisitions Good 3.54 4<br />

Development Prospects Fair 3.22 6<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

37