Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ExHIBIT 3-12<br />

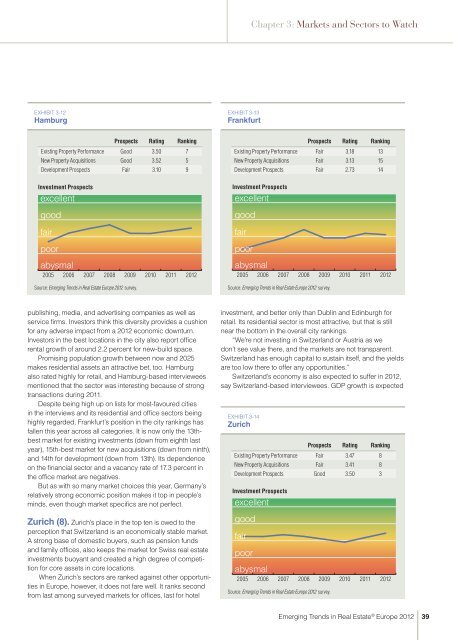

Hamburg<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Good 3.50 7<br />

New Property Acquisitions Good 3.52 5<br />

Development Prospects Fair 3.10 9<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

publish<strong>in</strong>g, media, and advertis<strong>in</strong>g companies as well as<br />

service firms. Investors th<strong>in</strong>k this diversity provides a cushion<br />

for any adverse impact from a <strong>2012</strong> economic downturn.<br />

Investors <strong>in</strong> the best locations <strong>in</strong> the city also report office<br />

rental growth of around 2.2 percent for new-build space.<br />

Promis<strong>in</strong>g population growth between now and 2025<br />

makes residential assets an attractive bet, too. Hamburg<br />

also rated highly for retail, and Hamburg-based <strong>in</strong>terviewees<br />

mentioned that the sector was <strong>in</strong>terest<strong>in</strong>g because of strong<br />

transactions dur<strong>in</strong>g 2011.<br />

Despite be<strong>in</strong>g high up on lists for most-favoured cities<br />

<strong>in</strong> the <strong>in</strong>terviews and its residential and office sectors be<strong>in</strong>g<br />

highly regarded, Frankfurt’s position <strong>in</strong> the city rank<strong>in</strong>gs has<br />

fallen this year across all categories. It is now only the 13thbest<br />

market for exist<strong>in</strong>g <strong>in</strong>vestments (down from eighth last<br />

year), 15th-best market for new acquisitions (down from n<strong>in</strong>th),<br />

and 14th for development (down from 13th). Its dependence<br />

on the f<strong>in</strong>ancial sector and a vacancy rate of 17.3 percent <strong>in</strong><br />

the office market are negatives.<br />

But as with so many market choices this year, Germany’s<br />

relatively strong economic position makes it top <strong>in</strong> people’s<br />

m<strong>in</strong>ds, even though market specifics are not perfect.<br />

Zurich (8). Zurich’s place <strong>in</strong> the top ten is owed to the<br />

perception that Switzerland is an economically stable market.<br />

A strong base of domestic buyers, such as pension funds<br />

and family offices, also keeps the market for Swiss real estate<br />

<strong>in</strong>vestments buoyant and created a high degree of competition<br />

for core assets <strong>in</strong> core locations.<br />

When Zurich’s sectors are ranked aga<strong>in</strong>st other opportunities<br />

<strong>in</strong> <strong>Europe</strong>, however, it does not fare well. It ranks second<br />

from last among surveyed markets for offices, last for hotel<br />

ExHIBIT 3-13<br />

Frankfurt<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey. Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

<strong>2012</strong><br />

Chapter 3: Markets and Sectors to Watch<br />

<strong>in</strong>vestment, and better only than Dubl<strong>in</strong> and Ed<strong>in</strong>burgh for<br />

retail. Its residential sector is most attractive, but that is still<br />

near the bottom <strong>in</strong> the overall city rank<strong>in</strong>gs.<br />

“We’re not <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> Switzerland or Austria as we<br />

don’t see value there, and the markets are not transparent.<br />

Switzerland has enough capital to susta<strong>in</strong> itself, and the yields<br />

are too low there to offer any opportunities.”<br />

Switzerland’s economy is also expected to suffer <strong>in</strong> <strong>2012</strong>,<br />

say Switzerland-based <strong>in</strong>terviewees. GDP growth is expected<br />

ExHIBIT 3-14<br />

Zurich<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 3.47 8<br />

New Property Acquisitions Fair 3.41 8<br />

Development Prospects Good 3.50 3<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 3.18 13<br />

New Property Acquisitions Fair 3.13 15<br />

Development Prospects Fair 2.73 14<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2009<br />

2010<br />

2010<br />

2011<br />

2011<br />

<strong>2012</strong><br />

<strong>2012</strong><br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

39