Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

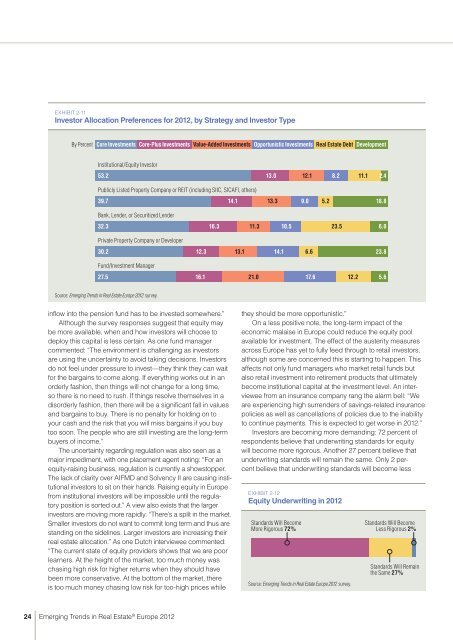

ExHIBIT 2-11<br />

Investor Allocation Preferences for <strong>2012</strong>, by Strategy and Investor Type<br />

By Percent Core Investments Core-Plus Investments Value-Added Investments Opportunistic Investments <strong>Real</strong> Estate Debt Development<br />

Institutional/Equity Investor<br />

53.2 13.0 12.1 8.2 11.1 2.4<br />

Publicly Listed Property Company or REIT (<strong>in</strong>clud<strong>in</strong>g SIIC, SICAFI, others)<br />

39.7 14.1 13.3 9.0 5.2 18.8<br />

Bank, Lender, or Securitized Lender<br />

32.3 16.3 11.3 10.5 23.5 6.0<br />

Private Property Company or Developer<br />

30.2 12.3 13.1 14.1 6.6 23.8<br />

Fund/Investment Manager<br />

27.5 16.1 21.0 17.6 12.2 5.6<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

<strong>in</strong>flow <strong>in</strong>to the pension fund has to be <strong>in</strong>vested somewhere.”<br />

Although the survey responses suggest that equity may<br />

be more available, when and how <strong>in</strong>vestors will choose to<br />

deploy this capital is less certa<strong>in</strong>. As one fund manager<br />

commented: “The environment is challeng<strong>in</strong>g as <strong>in</strong>vestors<br />

are us<strong>in</strong>g the uncerta<strong>in</strong>ty to avoid tak<strong>in</strong>g decisions. Investors<br />

do not feel under pressure to <strong>in</strong>vest—they th<strong>in</strong>k they can wait<br />

for the barga<strong>in</strong>s to come along. If everyth<strong>in</strong>g works out <strong>in</strong> an<br />

orderly fashion, then th<strong>in</strong>gs will not change for a long time,<br />

so there is no need to rush. If th<strong>in</strong>gs resolve themselves <strong>in</strong> a<br />

disorderly fashion, then there will be a significant fall <strong>in</strong> values<br />

and barga<strong>in</strong>s to buy. There is no penalty for hold<strong>in</strong>g on to<br />

your cash and the risk that you will miss barga<strong>in</strong>s if you buy<br />

too soon. The people who are still <strong>in</strong>vest<strong>in</strong>g are the long-term<br />

buyers of <strong>in</strong>come.”<br />

The uncerta<strong>in</strong>ty regard<strong>in</strong>g regulation was also seen as a<br />

major impediment, with one placement agent not<strong>in</strong>g: “For an<br />

equity-rais<strong>in</strong>g bus<strong>in</strong>ess, regulation is currently a showstopper.<br />

The lack of clarity over AIFMD and Solvency II are caus<strong>in</strong>g <strong>in</strong>stitutional<br />

<strong>in</strong>vestors to sit on their hands. Rais<strong>in</strong>g equity <strong>in</strong> <strong>Europe</strong><br />

from <strong>in</strong>stitutional <strong>in</strong>vestors will be impossible until the regulatory<br />

position is sorted out.” A view also exists that the larger<br />

<strong>in</strong>vestors are mov<strong>in</strong>g more rapidly. “There’s a split <strong>in</strong> the market.<br />

Smaller <strong>in</strong>vestors do not want to commit long term and thus are<br />

stand<strong>in</strong>g on the sidel<strong>in</strong>es. Larger <strong>in</strong>vestors are <strong>in</strong>creas<strong>in</strong>g their<br />

real estate allocation.” As one Dutch <strong>in</strong>terviewee commented:<br />

“The current state of equity providers shows that we are poor<br />

learners. At the height of the market, too much money was<br />

chas<strong>in</strong>g high risk for higher returns when they should have<br />

been more conservative. At the bottom of the market, there<br />

is too much money chas<strong>in</strong>g low risk for too-high prices while<br />

24 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

they should be more opportunistic.”<br />

On a less positive note, the long-term impact of the<br />

economic malaise <strong>in</strong> <strong>Europe</strong> could reduce the equity pool<br />

available for <strong>in</strong>vestment. The effect of the austerity measures<br />

across <strong>Europe</strong> has yet to fully feed through to retail <strong>in</strong>vestors,<br />

although some are concerned this is start<strong>in</strong>g to happen. This<br />

affects not only fund managers who market retail funds but<br />

also retail <strong>in</strong>vestment <strong>in</strong>to retirement products that ultimately<br />

become <strong>in</strong>stitutional capital at the <strong>in</strong>vestment level. An <strong>in</strong>terviewee<br />

from an <strong>in</strong>surance company rang the alarm bell: “We<br />

are experienc<strong>in</strong>g high surrenders of sav<strong>in</strong>gs-related <strong>in</strong>surance<br />

policies as well as cancellations of policies due to the <strong>in</strong>ability<br />

to cont<strong>in</strong>ue payments. This is expected to get worse <strong>in</strong> <strong>2012</strong>.”<br />

Investors are becom<strong>in</strong>g more demand<strong>in</strong>g: 72 percent of<br />

respondents believe that underwrit<strong>in</strong>g standards for equity<br />

will become more rigorous. Another 27 percent believe that<br />

underwrit<strong>in</strong>g standards will rema<strong>in</strong> the same. Only 2 percent<br />

believe that underwrit<strong>in</strong>g standards will become less<br />

ExHIBIT 2-12<br />

Equity Underwrit<strong>in</strong>g <strong>in</strong> <strong>2012</strong><br />

Standards Will Become<br />

More Rigorous 72%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Standards Will Become<br />

Less Rigorous 2%<br />

Standards Will Rema<strong>in</strong><br />

the Same 27%