Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

have so much choice that they will price accord<strong>in</strong>gly. What’s<br />

more, they will be able to go wherever they want.”<br />

However, respondents do th<strong>in</strong>k that although the situation<br />

may be “difficult, it is not hopeless.” They express some optimism<br />

that the Czech Republic will benefit from the grow<strong>in</strong>g<br />

divide between the north and south of <strong>Europe</strong>, fall<strong>in</strong>g <strong>in</strong>to the<br />

safer north camp. Optimism also exists that Prague will benefit<br />

from an <strong>in</strong>creased focus on this area of <strong>Europe</strong> long term,<br />

ow<strong>in</strong>g to the success of Warsaw.<br />

Interviewees also mentioned the <strong>in</strong>creas<strong>in</strong>g prom<strong>in</strong>ence<br />

of wealthy local families and entrepreneurs <strong>in</strong> the market.<br />

“Successful local players have brought real estate to the front<br />

of people’s m<strong>in</strong>ds. Czech companies and families are becom<strong>in</strong>g<br />

serious property <strong>in</strong>vestors. Fifteen years of profits from<br />

different bus<strong>in</strong>esses represents a lot of firepower. This money<br />

is real and will cont<strong>in</strong>ue to grow. Moreover, they have relationships<br />

with local banks and can raise f<strong>in</strong>anc<strong>in</strong>g.”<br />

Regional Cities: Lyon (16) and Ed<strong>in</strong>burgh<br />

(17). While they are well down the list, both Lyon and<br />

Ed<strong>in</strong>burgh have done better <strong>in</strong> the rank<strong>in</strong>gs this year for<br />

both new <strong>in</strong>vestment prospects and development prospects<br />

(although their overall scores were lower relative to last year,<br />

as shown <strong>in</strong> exhibits). While Ed<strong>in</strong>burgh did better for exist<strong>in</strong>g<br />

<strong>in</strong>vestment prospects, Lyon dropped one place.<br />

Although conditions <strong>in</strong> regional cities are still tough, this mild<br />

boost has been brought about because some <strong>in</strong>vestors are<br />

beg<strong>in</strong>n<strong>in</strong>g to search for value growth and opportunities outside<br />

of London and Paris, where competition is strong and prices<br />

are high. Investment activity <strong>in</strong> Ed<strong>in</strong>burgh <strong>in</strong> recent months has<br />

attracted bids from pan-<strong>Europe</strong>an <strong>in</strong>vestment managers and<br />

U.K. real estate <strong>in</strong>vestment trusts. But l<strong>in</strong>ger<strong>in</strong>g fear over how<br />

austerity measures, public sector cuts, and economic weakness<br />

will <strong>in</strong>crease the divide between prosperity <strong>in</strong> capital cities<br />

and the regions means that, for now, <strong>in</strong>vestors are still focused<br />

on the best assets or the best-located assets <strong>in</strong> city centres.<br />

“Someth<strong>in</strong>g well located and multi-let would be attractive<br />

<strong>in</strong> cities where there is restricted supply. We like Glasgow and<br />

Ed<strong>in</strong>burgh as they are hold<strong>in</strong>g up quite well.” “In France, it is<br />

about Paris, Lyon, and Marseille. Everyth<strong>in</strong>g located outside<br />

of these big cities will struggle to perform well.” “I would <strong>in</strong>vest<br />

<strong>in</strong> Marseille, Bordeaux, and Lyon, but only if I can do the<br />

right project.” “It is about buy<strong>in</strong>g <strong>in</strong>come with opportunities to<br />

reta<strong>in</strong> exist<strong>in</strong>g tenants and improve the build<strong>in</strong>g.” “I am open<br />

to <strong>in</strong>vest<strong>in</strong>g <strong>in</strong> smaller cities as long as the fundamentals are<br />

correct.” “If you go to regional markets, don’t compromise on<br />

build<strong>in</strong>g quality. It has to be centrally located with good transport<br />

l<strong>in</strong>ks. And look for tenant commitment.”<br />

Interviewees expected no rental growth <strong>in</strong> Ed<strong>in</strong>burgh this<br />

year, although it fell <strong>in</strong> 2010, and landlords have reported rentfree<br />

<strong>in</strong>centives <strong>in</strong>creased to three years on a ten-year lease.<br />

Lyon has a diverse occupier base and is home to <strong>in</strong>ternational<br />

headquarters for occupiers such as Interpol. Latest research<br />

reported a slowdown <strong>in</strong> leas<strong>in</strong>g activity dur<strong>in</strong>g the third<br />

Chapter 3: Markets and Sectors to Watch<br />

quarter of 2011 and flat rental growth, although no <strong>in</strong>crease <strong>in</strong><br />

<strong>in</strong>centives, which rema<strong>in</strong> at six months for a six- to n<strong>in</strong>e-year<br />

lease, accord<strong>in</strong>g to Jones Lang LaSalle.<br />

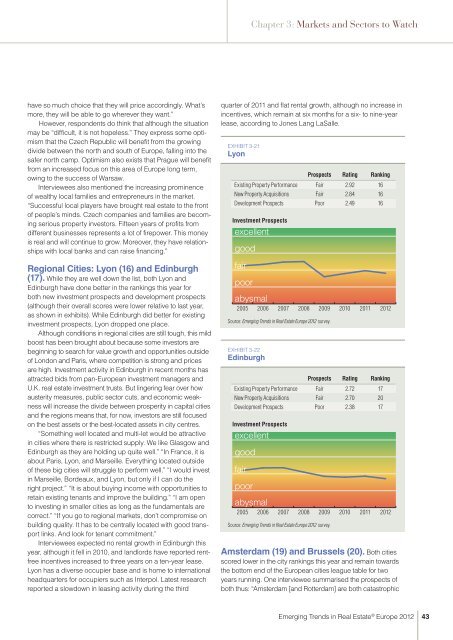

ExHIBIT 3-21<br />

Lyon<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 2.92 16<br />

New Property Acquisitions Fair 2.84 16<br />

Development Prospects Poor 2.49 16<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

ExHIBIT 3-22<br />

Ed<strong>in</strong>burgh<br />

2007<br />

2008<br />

2009<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 2.72 17<br />

New Property Acquisitions Fair 2.70 20<br />

Development Prospects Poor 2.38 17<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Amsterdam (19) and Brussels (20). Both cities<br />

scored lower <strong>in</strong> the city rank<strong>in</strong>gs this year and rema<strong>in</strong> towards<br />

the bottom end of the <strong>Europe</strong>an cities league table for two<br />

years runn<strong>in</strong>g. One <strong>in</strong>terviewee summarised the prospects of<br />

both thus: “Amsterdam [and Rotterdam] are both catastrophic<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

43