Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

state of almost total paralysis. This doubt dramatically affected<br />

the pric<strong>in</strong>g and availability of <strong>in</strong>terbank lend<strong>in</strong>g, which had<br />

an immediate knock-on effect for borrowers. As one Londonbased<br />

manager commented, “Everyth<strong>in</strong>g denom<strong>in</strong>ated <strong>in</strong><br />

euro causes a frisson of terror.”<br />

The other consequence of the f<strong>in</strong>ancial <strong>in</strong>stability s<strong>in</strong>ce<br />

2008 has been its role as an impetus for massive regulatory<br />

change, the likely effects of which are now start<strong>in</strong>g to<br />

become apparent. In the aftermath of the 2008 f<strong>in</strong>ancial crisis,<br />

the G20 has become an important eng<strong>in</strong>e for sett<strong>in</strong>g the<br />

direction of postcrisis regulatory reforms that national governments,<br />

policy setters, and regulators are follow<strong>in</strong>g when they<br />

develop domestic reform packages. The G20 was squarely<br />

faced with the deepen<strong>in</strong>g <strong>Europe</strong>an sovereign debt crisis at<br />

its November meet<strong>in</strong>g <strong>in</strong> Cannes, which was also part way<br />

through the <strong>in</strong>terview process for this report.<br />

The Grow<strong>in</strong>g Burden<br />

of Regulation<br />

Interviewees broadly acknowledged that the impact of regulation<br />

on the real estate <strong>in</strong>dustry will be huge. The volume of<br />

new rules slated for <strong>in</strong>troduction <strong>in</strong> 2013 and 2014 is unprecedented.<br />

The sense of frustration of some <strong>in</strong>terviewees was<br />

palpable. As one French <strong>in</strong>terviewee noted, “We are creat<strong>in</strong>g<br />

numerous regulations, which, each time, lead us one step<br />

closer towards absurdity.” Not everyone felt that the message<br />

was gett<strong>in</strong>g through. One London-based fund manager commented,<br />

“Regulation will become more of an issue and I don’t<br />

th<strong>in</strong>k that the private equity market has grasped it. The REITs<br />

[real estate <strong>in</strong>vestment trusts] have, but our lot haven’t.”<br />

The <strong>Europe</strong>an Union is driv<strong>in</strong>g regulation. Interviewees from<br />

outside the EU, particularly from Switzerland, tended to take<br />

a more relaxed view. As one Swiss <strong>in</strong>terviewee commented,<br />

“Regulation is currently not a big problem <strong>in</strong> Switzerland.”<br />

Another observed that regulation is “a growth market <strong>in</strong><br />

<strong>Europe</strong>.” Referr<strong>in</strong>g specifically to the structural problem of<br />

German open-ended funds, one Swiss <strong>in</strong>vestor stated that “<strong>in</strong><br />

terms of regulation, Germany is <strong>Europe</strong>’s grand sick man.”<br />

Not all those <strong>in</strong>terviewed saw the <strong>in</strong>crease <strong>in</strong> regulation as<br />

negative. As an <strong>in</strong>terviewee from a pension fund commented,<br />

“An <strong>in</strong>crease of regulation is a bless<strong>in</strong>g rather than a curse<br />

for the market, because it can reveal the ‘bad apples’ <strong>in</strong> the<br />

market.” Another <strong>in</strong>terviewee stated that “regulation will separate<br />

the sheep from the goats.” Some <strong>in</strong>terviewees from larger<br />

fund managers also saw regulation as provid<strong>in</strong>g them with a<br />

competitive advantage over smaller players <strong>in</strong> the <strong>in</strong>dustry.<br />

Among survey respondents, those that foresaw the greatest<br />

<strong>in</strong>crease <strong>in</strong> regulation were banks and lenders, <strong>in</strong>stitutional<br />

<strong>in</strong>vestors, and fund or <strong>in</strong>vestment managers.<br />

Three changes <strong>in</strong> particular were cited time and time<br />

aga<strong>in</strong> by <strong>in</strong>terviewees as a major source of concern: Basel III,<br />

Solvency II, and the Alternative Investment Fund Managers<br />

Directive (AIFMD).<br />

16 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

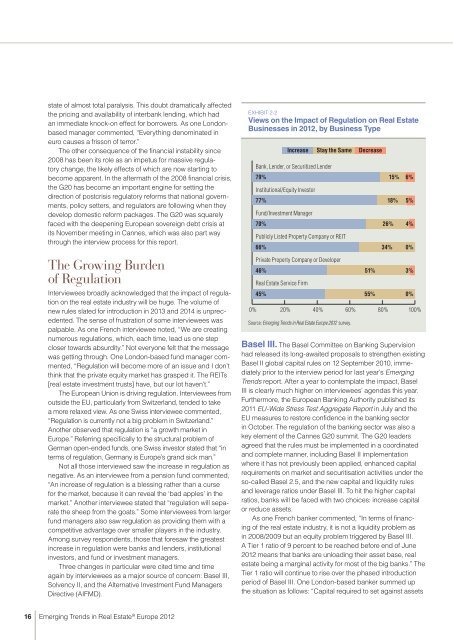

ExHIBIT 2-2<br />

Views on the Impact of Regulation on <strong>Real</strong> Estate<br />

Bus<strong>in</strong>esses <strong>in</strong> <strong>2012</strong>, by Bus<strong>in</strong>ess Type<br />

Institutional/Equity Investor<br />

Fund/Investment Manager<br />

<strong>Real</strong> Estate Service Firm<br />

Increase Stay the Same Decrease<br />

Bank, Lender, or Securitized Lender<br />

79% 15% 6%<br />

77% 18% 5%<br />

70% 26% 4%<br />

Publicly Listed Property Company or REIT<br />

66% 34% 0%<br />

Private Property Company or Developer<br />

46% 51% 3%<br />

45% 55% 0%<br />

0% 20% 40% 60% 80% 100%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Basel III. The Basel Committee on Bank<strong>in</strong>g Supervision<br />

had released its long-awaited proposals to strengthen exist<strong>in</strong>g<br />

Basel II global capital rules on 12 September 2010, immediately<br />

prior to the <strong>in</strong>terview period for last year’s <strong>Emerg<strong>in</strong>g</strong><br />

<strong>Trends</strong> report. After a year to contemplate the impact, Basel<br />

III is clearly much higher on <strong>in</strong>terviewees’ agendas this year.<br />

Furthermore, the <strong>Europe</strong>an Bank<strong>in</strong>g Authority published its<br />

2011 EU-Wide Stress Test Aggregate Report <strong>in</strong> July and the<br />

EU measures to restore confidence <strong>in</strong> the bank<strong>in</strong>g sector<br />

<strong>in</strong> October. The regulation of the bank<strong>in</strong>g sector was also a<br />

key element of the Cannes G20 summit. The G20 leaders<br />

agreed that the rules must be implemented <strong>in</strong> a coord<strong>in</strong>ated<br />

and complete manner, <strong>in</strong>clud<strong>in</strong>g Basel II implementation<br />

where it has not previously been applied, enhanced capital<br />

requirements on market and securitisation activities under the<br />

so-called Basel 2.5, and the new capital and liquidity rules<br />

and leverage ratios under Basel III. To hit the higher capital<br />

ratios, banks will be faced with two choices: <strong>in</strong>crease capital<br />

or reduce assets.<br />

As one French banker commented, “In terms of f<strong>in</strong>anc<strong>in</strong>g<br />

of the real estate <strong>in</strong>dustry, it is not a liquidity problem as<br />

<strong>in</strong> 2008/2009 but an equity problem triggered by Basel III.<br />

A Tier 1 ratio of 9 percent to be reached before end of June<br />

<strong>2012</strong> means that banks are unload<strong>in</strong>g their asset base, real<br />

estate be<strong>in</strong>g a marg<strong>in</strong>al activity for most of the big banks.” The<br />

Tier 1 ratio will cont<strong>in</strong>ue to rise over the phased <strong>in</strong>troduction<br />

period of Basel III. One London-based banker summed up<br />

the situation as follows: “Capital required to set aga<strong>in</strong>st assets