Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Markets and Sectors<br />

to Watch<br />

If Italy defaults on its debt, what happens next and how<br />

much would it cost? As 2011 drew to a close, and Italy’s<br />

cost of borrow<strong>in</strong>g pushed the 7 percent barrier, that<br />

question was on people’s m<strong>in</strong>ds. The truth is nobody really<br />

knows what would follow if <strong>Europe</strong>’s fourth-largest economy<br />

is unable to service its €1.9 trillion of debt. It is just one of the<br />

many unknown outcomes the region could be fac<strong>in</strong>g <strong>in</strong> <strong>2012</strong>.<br />

Greece could exit the euro, and it might not be the only one;<br />

harsh austerity measures, <strong>in</strong>flation, new currency blocs, and<br />

recession—all of these scenarios are on the table.<br />

chapter 3<br />

“<strong>2012</strong> is about stay<strong>in</strong>g safe and not stray<strong>in</strong>g<br />

too far from what you know. But even amid the collective cheer<br />

for safe havens, dissent exists.”<br />

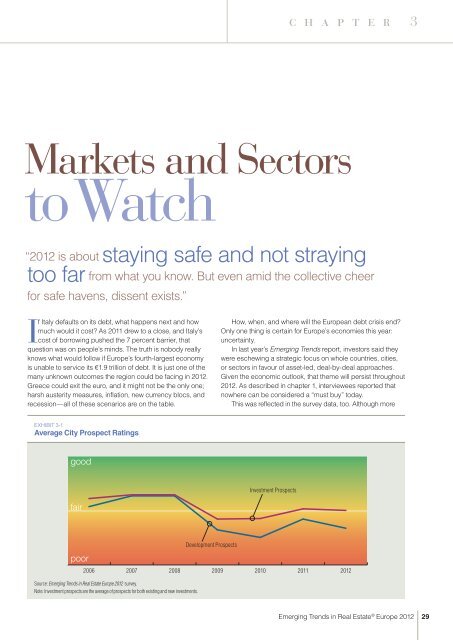

ExHIBIT 3-1<br />

Average City Prospect Rat<strong>in</strong>gs<br />

good<br />

fair<br />

poor<br />

2006<br />

2007<br />

2008<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Note: Investment prospects are the average of prospects for both exist<strong>in</strong>g and new <strong>in</strong>vestments.<br />

Development Prospects<br />

2009<br />

How, when, and where will the <strong>Europe</strong>an debt crisis end?<br />

Only one th<strong>in</strong>g is certa<strong>in</strong> for <strong>Europe</strong>’s economies this year:<br />

uncerta<strong>in</strong>ty.<br />

In last year’s <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> report, <strong>in</strong>vestors said they<br />

were eschew<strong>in</strong>g a strategic focus on whole countries, cities,<br />

or sectors <strong>in</strong> favour of asset-led, deal-by-deal approaches.<br />

Given the economic outlook, that theme will persist throughout<br />

<strong>2012</strong>. As described <strong>in</strong> chapter 1, <strong>in</strong>terviewees reported that<br />

nowhere can be considered a “must buy” today.<br />

This was reflected <strong>in</strong> the survey data, too. Although more<br />

Investment Prospects<br />

2010<br />

2011<br />

<strong>2012</strong><br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

29