Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Emerging Trends in Real Estate® Europe 2012 - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

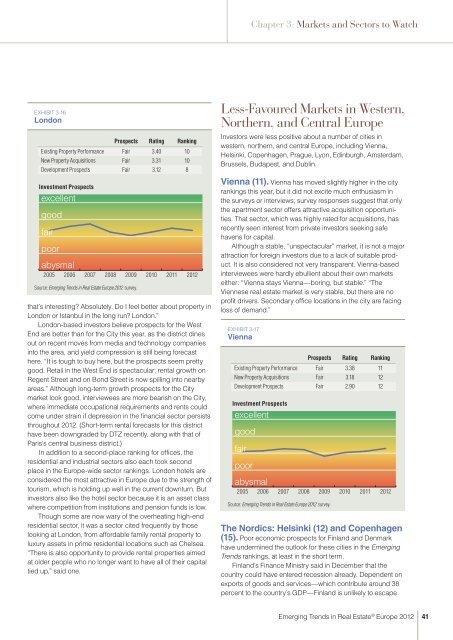

ExHIBIT 3-16<br />

London<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 3.40 10<br />

New Property Acquisitions Fair 3.31 10<br />

Development Prospects Fair 3.12 8<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

that’s <strong>in</strong>terest<strong>in</strong>g? Absolutely. Do I feel better about property <strong>in</strong><br />

London or Istanbul <strong>in</strong> the long run? London.”<br />

London-based <strong>in</strong>vestors believe prospects for the West<br />

End are better than for the City this year, as the district d<strong>in</strong>es<br />

out on recent moves from media and technology companies<br />

<strong>in</strong>to the area, and yield compression is still be<strong>in</strong>g forecast<br />

here. “It is tough to buy here, but the prospects seem pretty<br />

good. Retail <strong>in</strong> the West End is spectacular; rental growth on<br />

Regent Street and on Bond Street is now spill<strong>in</strong>g <strong>in</strong>to nearby<br />

areas.” Although long-term growth prospects for the City<br />

market look good, <strong>in</strong>terviewees are more bearish on the City,<br />

where immediate occupational requirements and rents could<br />

come under stra<strong>in</strong> if depression <strong>in</strong> the f<strong>in</strong>ancial sector persists<br />

throughout <strong>2012</strong>. (Short-term rental forecasts for this district<br />

have been downgraded by DTZ recently, along with that of<br />

Paris’s central bus<strong>in</strong>ess district.)<br />

In addition to a second-place rank<strong>in</strong>g for offices, the<br />

residential and <strong>in</strong>dustrial sectors also each took second<br />

place <strong>in</strong> the <strong>Europe</strong>-wide sector rank<strong>in</strong>gs. London hotels are<br />

considered the most attractive <strong>in</strong> <strong>Europe</strong> due to the strength of<br />

tourism, which is hold<strong>in</strong>g up well <strong>in</strong> the current downturn. But<br />

<strong>in</strong>vestors also like the hotel sector because it is an asset class<br />

where competition from <strong>in</strong>stitutions and pension funds is low.<br />

Though some are now wary of the overheat<strong>in</strong>g high-end<br />

residential sector, it was a sector cited frequently by those<br />

look<strong>in</strong>g at London, from affordable family rental property to<br />

luxury assets <strong>in</strong> prime residential locations such as Chelsea.<br />

“There is also opportunity to provide rental properties aimed<br />

at older people who no longer want to have all of their capital<br />

tied up,” said one.<br />

Chapter 3: Markets and Sectors to Watch<br />

Less-Favoured Markets <strong>in</strong> Western,<br />

Northern, and Central <strong>Europe</strong><br />

Investors were less positive about a number of cities <strong>in</strong><br />

western, northern, and central <strong>Europe</strong>, <strong>in</strong>clud<strong>in</strong>g Vienna,<br />

Hels<strong>in</strong>ki, Copenhagen, Prague, Lyon, Ed<strong>in</strong>burgh, Amsterdam,<br />

Brussels, Budapest, and Dubl<strong>in</strong>.<br />

Vienna (11). Vienna has moved slightly higher <strong>in</strong> the city<br />

rank<strong>in</strong>gs this year, but it did not excite much enthusiasm <strong>in</strong><br />

the surveys or <strong>in</strong>terviews; survey responses suggest that only<br />

the apartment sector offers attractive acquisition opportunities.<br />

That sector, which was highly rated for acquisitions, has<br />

recently seen <strong>in</strong>terest from private <strong>in</strong>vestors seek<strong>in</strong>g safe<br />

havens for capital.<br />

Although a stable, “unspectacular” market, it is not a major<br />

attraction for foreign <strong>in</strong>vestors due to a lack of suitable product.<br />

It is also considered not very transparent. Vienna-based<br />

<strong>in</strong>terviewees were hardly ebullient about their own markets<br />

either: “Vienna stays Vienna—bor<strong>in</strong>g, but stable.” “The<br />

Viennese real estate market is very stable, but there are no<br />

profit drivers. Secondary office locations <strong>in</strong> the city are fac<strong>in</strong>g<br />

loss of demand.”<br />

ExHIBIT 3-17<br />

Vienna<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2012</strong> survey.<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Exist<strong>in</strong>g Property Performance Fair 3.38 11<br />

New Property Acquisitions Fair 3.18 12<br />

Development Prospects Fair 2.90 12<br />

Investment Prospects<br />

excellent<br />

good<br />

fair<br />

poor<br />

abysmal<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

The Nordics: Hels<strong>in</strong>ki (12) and Copenhagen<br />

(15). Poor economic prospects for F<strong>in</strong>land and Denmark<br />

have underm<strong>in</strong>ed the outlook for these cities <strong>in</strong> the <strong>Emerg<strong>in</strong>g</strong><br />

<strong>Trends</strong> rank<strong>in</strong>gs, at least <strong>in</strong> the short term.<br />

F<strong>in</strong>land’s F<strong>in</strong>ance M<strong>in</strong>istry said <strong>in</strong> December that the<br />

country could have entered recession already. Dependent on<br />

exports of goods and services—which contribute around 38<br />

percent to the country’s GDP—F<strong>in</strong>land is unlikely to escape<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2012</strong><br />

41