Pre Bid response for supply of Laptops for ... - DOITC Rajasthan

Pre Bid response for supply of Laptops for ... - DOITC Rajasthan

Pre Bid response for supply of Laptops for ... - DOITC Rajasthan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

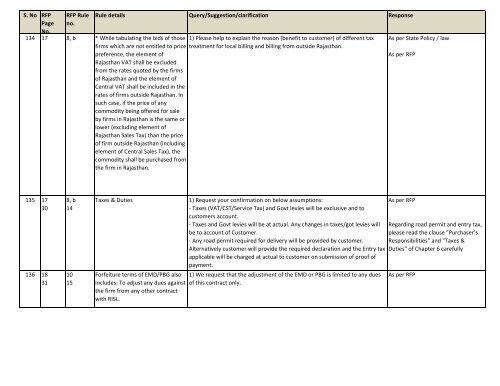

S. No RFP<br />

Page<br />

No.<br />

RFP Rule<br />

no.<br />

Rule details Query/Suggestion/clarification Response<br />

134 17 8, b * While tabulating the bids <strong>of</strong> those<br />

firms which are not entitled to price<br />

preference, the element <strong>of</strong><br />

<strong>Rajasthan</strong> VAT shall be excluded<br />

from the rates quoted by the firms<br />

<strong>of</strong> <strong>Rajasthan</strong> and the element <strong>of</strong><br />

Central VAT shall be included in the<br />

rates <strong>of</strong> firms outside <strong>Rajasthan</strong>. In<br />

such case, if the price <strong>of</strong> any<br />

commodity being <strong>of</strong>fered <strong>for</strong> sale<br />

by firms in <strong>Rajasthan</strong> is the same or<br />

lower (excluding element <strong>of</strong><br />

<strong>Rajasthan</strong> Sales Tax) than the price<br />

<strong>of</strong> firm outside <strong>Rajasthan</strong> (including<br />

element <strong>of</strong> Central Sales Tax), the<br />

commodity shall be purchased from<br />

the firm in <strong>Rajasthan</strong>.<br />

1) Please help to explain the reason (benefit to customer) <strong>of</strong> different tax<br />

treatment <strong>for</strong> local billing and billing from outside <strong>Rajasthan</strong>.<br />

As per State Policy / law<br />

As per RFP<br />

135 17<br />

30<br />

136 18<br />

31<br />

8, b<br />

14<br />

10<br />

15<br />

Taxes & Duties<br />

Forfeiture terms <strong>of</strong> EMD/PBG also<br />

includes: To adjust any dues against<br />

the firm from any other contract<br />

with RISL.<br />

1) Request your confirmation on below assumptions:<br />

- Taxes (VAT/CST/Service Tax) and Govt levies will be exclusive and to<br />

customers account.<br />

- Taxes and Govt levies will be at actual. Any changes in taxes/got levies will<br />

be to account <strong>of</strong> Customer.<br />

- Any road permit required <strong>for</strong> delivery will be provided by customer.<br />

Alternatively customer will provide the required declaration and the Entry tax<br />

applicable will be charged at actual to customer on submission <strong>of</strong> pro<strong>of</strong> <strong>of</strong><br />

payment.<br />

1) We request that the adjustment <strong>of</strong> the EMD or PBG is limited to any dues<br />

<strong>of</strong> this contract only.<br />

As per RFP<br />

Regarding road permit and entry tax,<br />

please read the clause "Purchaser’s<br />

Responsibilities" and "Taxes &<br />

Duties" <strong>of</strong> Chapter 6 carefully<br />

As per RFP