Conference Report 2016

Table of contents contains links on page 5. It can be used to skip through chapters.

Table of contents contains links on page 5. It can be used to skip through chapters.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CENTRAL EXECUTIVE COMMITTEE REPORT<br />

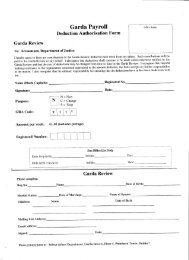

lIfE ASSuRANCE SChEmE<br />

GARDA SIOChANA mEmbERS AND SPOuSES<br />

lIfE ASSuRANCE SChEmE<br />

Pay Codes 151/115<br />

The GRA Life Assurance Scheme since its inception in<br />

1968 has proven to be one of the most innovative and<br />

successful schemes of its type. The impact of collective<br />

bargaining power for a specific group of workers<br />

culminates in significantly enhanced terms and<br />

conditions as compared to what might be achieved on an<br />

individual basis. Tempted by the cumulative premiums of<br />

our membership the insurers are disposed to offering<br />

extremely keen terms in order to avail of the business.<br />

The scheme for our membership has proven to be a<br />

resounding success in terms of the security it provides<br />

for our membership and the unrivalled premium to benefit<br />

ratio. To obtain a similar degree of cover on an individual<br />

basis on the open market a member can expect to pay a<br />

much inflated premium.<br />

To become members of this scheme, members must join<br />

at the earliest opportunity and be members of a<br />

recognised Garda staff association for the duration of<br />

cover until retirement. Thereafter, members may retain<br />

cover up to 70 years of age. As with all Group Schemes<br />

one cannot opt out and later re-enter the Scheme, as such<br />

a scenario would prejudice the ethos of the collective<br />

bargaining power of such a scheme which relies on<br />

consistency of rules and diversity of membership.<br />

The Association through its broker, PenPro, endeavours<br />

to obtain the maximum benefit for our members. The<br />

Scheme has been renewed from 1 April 2015 for a three<br />

year period. When renewing any group protection<br />

scheme, insurers take into account the number of<br />

members, gender mix, and most particularly the average<br />

age of the membership and the claims paid out versus<br />

premiums paid in. As there were no new recruits in the<br />

last number of years, there have been no new entrants to<br />

the scheme, and therefore the average age of the<br />

membership has increased. However, on the plus side,<br />

the claims paid in 2014 was quite good compared with<br />

previous years, see claims table on next page, allowing<br />

for the negotiation of increases in benefit for serving<br />

members in the 40 to 50th birthday (€35,000 increase)<br />

and 50th to 60th birthday (€25,000 increase) age<br />

categories and for retired members in the 60th to 65th<br />

birthday (€15,000 increase) age category. The cost has<br />

remained unchanged.<br />

Benefits/Cost (to apply from 1.4.2015 to 31.3.2018)<br />

Serving Members<br />

Age Next Birthday Benefit Net Cost<br />

20th – 40th Birthday €350,000 €5.10 per week<br />

40th – 50th Birthday €260,000 €5.10 per week<br />

50th --60th Birthday €250,000 €5.10 per week<br />

Retired Members Scheme<br />

50th – 55th Birthday €175,000 €32.50 per month<br />

55th – 60th Birthday €150,000 €32.50 per month<br />

60th – 65th Birthday €100,000 €32.50 per month<br />

65th – 70th Birthday €10,000 € 2.00 per month<br />

The Association is also pleased to advise you of the<br />

following benefits:<br />

• Death cover for children of members aged under 21<br />

years is €7,500<br />

• If a serving member loses a limb or eye or is paralysed as<br />

a result of an accident, a benefit of €15,000 is payable.<br />

• Trainee Gardaí are included for €30,000 Life<br />

Assurance cover for their first 32 weeks, increased to<br />

€60,000 for the next 32 weeks, at no cost to the<br />

Trainee.<br />

Tax Relief<br />

Part of the scheme for Serving Members is approved by<br />

the Revenue Commissioners and this allows 80% of the<br />

premium to qualify for tax relief at the members’ marginal<br />

rate of tax. The tax relief is given as a top line deduction<br />

by Garda pay. The tax relief passes on real savings to<br />

members as illustrated below:<br />

Premium<br />

Weekly<br />

Gross premium €7.50<br />

Premium eligible for tax relief €6.00<br />

Less tax relief @ 40% €2.40<br />

Net premium: €5.10<br />

Deduction Code – Payslip<br />

As the tax relief is given on part of the premium Garda<br />

Pay need to operate two deductions on your payslip as<br />

follows:<br />

GRA Life A Code 7115 €6.00<br />

GRA Life B Code 6151 €1.50<br />

82 Garda Representative Association