Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80<br />

Consolidated financial statements <strong>2001</strong> of Kolbenschmidt Pierburg <strong>AG</strong><br />

Notes<br />

Accounting principles<br />

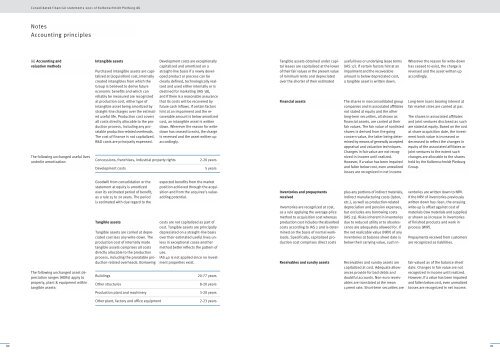

(6) Accounting and<br />

valuation methods<br />

The following unchanged useful lives<br />

underlie amortization:<br />

The following unchanged asset depreciation<br />

ranges (ADRs) apply to<br />

property, plant & equipment within<br />

tangible assets:<br />

Intangible assets<br />

Purchased intangible assets are capitalized<br />

at (acquisition) cost, internally<br />

created intangibles from which the<br />

Group is believed to derive future<br />

economic benefits and which can<br />

reliably be measured are recognized<br />

at production cost, either type of<br />

intangible asset being amortized by<br />

straight-line charges over the estimated<br />

useful life. Production cost covers<br />

all costs directly allocable to the production<br />

process, including any proratable<br />

production-related overheads.<br />

The cost of finance is not capitalized.<br />

R&D costs are principally expensed.<br />

Development costs are exceptionally<br />

capitalized and amortized on a<br />

straight-line basis if a newly developed<br />

product or process can be<br />

clearly defined, technologically realized<br />

and used either internally or is<br />

destined for marketing (IAS 38),<br />

and if there is a reasonable assurance<br />

that its costs will be recovered by<br />

future cash inflows. If certain factors<br />

hint at an impairment and the recoverable<br />

amount is below amortized<br />

cost, an intangible asset is written<br />

down. Wherever the reason for writedown<br />

has ceased to exist, the charge<br />

is reversed and the asset written up<br />

accordingly.<br />

Concessions, franchises, industrial property rights 2-20 years<br />

Development costs 5 years<br />

Goodwill from consolidation or the<br />

statement at equity is amortized<br />

over its estimated period of benefit,<br />

as a rule 15 to 20 years. The period<br />

is estimated with due regard to the<br />

Tangible assets<br />

Tangible assets are carried at depreciated<br />

cost less any write-down. The<br />

production cost of internally made<br />

tangible assets comprises all costs<br />

directly allocable to the production<br />

process, including the proratable production-related<br />

overheads. Borrowing<br />

expected benefits from the market<br />

position achieved through the acquisition<br />

and from the acquiree’s valueadding<br />

potential.<br />

costs are not capitalized as part of<br />

cost. Tangible assets are principally<br />

depreciated on a straight-line basis<br />

over their estimated useful lives unless<br />

in exceptional cases another<br />

method better reflects the pattern of<br />

use.<br />

IAS 40 is not applied since no investment<br />

properties exist.<br />

Buildings 20-77 years<br />

Other structures 8-20 years<br />

Production plant and machinery 3-20 years<br />

Other plant, factory and office equipment 2-23 years<br />

Tangible assets obtained under capital<br />

leases are capitalized at the lower<br />

of their fair values or the present value<br />

of minimum rents and depreciated<br />

over the shorter of their estimated<br />

useful lives or underlying lease terms<br />

(IAS 17). If certain factors hint at an<br />

impairment and the recoverable<br />

amount is below depreciated cost,<br />

a tangible asset is written down.<br />

Wherever the reason for write-down<br />

has ceased to exist, the charge is<br />

reversed and the asset written up<br />

accordingly.<br />

Financial assets The shares in nonconsolidated group Long-term loans bearing interest at<br />

companies and in associated affiliates<br />

not stated at equity and the other<br />

fair market rates are carried at par.<br />

long-term securities, all shown as The shares in associated affiliates<br />

financial assets, are carried at their and joint ventures disclosed as such<br />

fair values. The fair value of nonlisted are stated at equity. Based on the cost<br />

shares is derived from the going at share acquisition date, the invest-<br />

concern value, the latter being determent book value is increased or<br />

mined by means of generally accepted decreased to reflect the changes in<br />

appraisal and valuation techniques. equity of the associated affiliates or<br />

Changes in fair value are not recog- joint ventures to the extent such<br />

nized in income until realized. changes are allocable to the shares<br />

However, if a value has been impaired held by the Kolbenschmidt Pierburg<br />

and fallen below cost, even unrealized<br />

losses are recognized in net income.<br />

Group.<br />

Inventories and prepayments<br />

received<br />

Inventories are recognized at cost,<br />

as a rule applying the average-price<br />

method to acquisition cost whereas<br />

production cost includes the absorbed<br />

costs according to IAS 2 and is determined<br />

on the basis of normal workloads.<br />

Specifically, capitalized production<br />

cost comprises direct costs<br />

plus any portions of indirect materials,<br />

indirect manufacturing costs (labor,<br />

etc.), as well as production-related<br />

depreciation and pension expenses,<br />

but excludes any borrowing costs<br />

(IAS 23). Risks inherent in inventories<br />

due to reduced utility or to obsolescence<br />

are adequately allowed for. If<br />

the net realizable value (NRV) of any<br />

inventories at balance sheet date is<br />

below their carrying value, such in-<br />

ventories are written down to NRV.<br />

If the NRV of inventories previously<br />

written down has risen, the ensuing<br />

write-up is offset against cost of<br />

materials (raw materials and supplies)<br />

or shown as increase in inventories<br />

of finished products and work in<br />

process (WIP).<br />

Prepayments received from customers<br />

are recognized as liabilities.<br />

Receivables and sundry assets Receivables and sundry assets are fair-valued as of the balance sheet<br />

capitalized at cost. Adequate allowances<br />

provide for bad debts and<br />

doubtful accounts. Non-euro receivables<br />

are translated at the mean<br />

current rate. Short-term securities are<br />

date. Changes in fair value are not<br />

recognized in income until realized.<br />

However, if a value has been impaired<br />

and fallen below cost, even unrealized<br />

losses are recognized in net income.<br />

81

![PDF [1.0 MB] - KSPG AG](https://img.yumpu.com/5513074/1/171x260/pdf-10-mb-kspg-ag.jpg?quality=85)