Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

102<br />

Consolidated financial statements <strong>2001</strong> of Kolbenschmidt Pierburg <strong>AG</strong><br />

Notes<br />

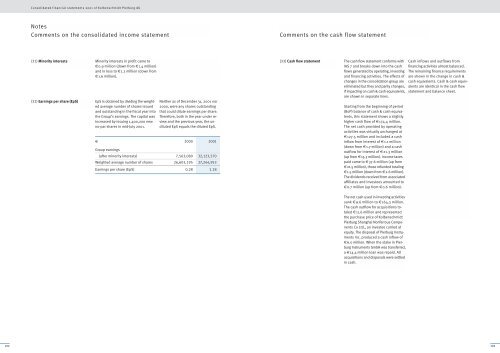

Comments on the consolidated income statement<br />

(31) Minority interests Minority interests in profit came to<br />

€0.9 million (down from €1.4 million)<br />

and in loss to €1.2 million (down from<br />

€1.6 million).<br />

(32) Earnings per share (EpS) EpS is obtained by dividing the weighted<br />

average number of shares issued<br />

and outstanding in the fiscal year into<br />

the Group’s earnings. The capital was<br />

increased by issuing 1,400,200 new<br />

no-par shares in mid-July <strong>2001</strong>.<br />

Neither as of December 31, <strong>2001</strong> nor<br />

2000, were any shares outstanding<br />

that could dilute earnings per share.<br />

Therefore, both in the year under review<br />

and the previous year, the undiluted<br />

EpS equals the diluted EpS.<br />

€ 2000 <strong>2001</strong><br />

Group earnings<br />

(after minority interests) 7,563,080 32,123,570<br />

Weighted average number of shares 26,603,195 27,244,953<br />

Earnings per share (EpS) 0.28 1.18<br />

Comments on the cash flow statement<br />

(33) Cash flow statement The cash flow statement conforms with<br />

IAS 7 and breaks down into the cash<br />

flows generated by operating, investing<br />

and financing activities. The effects of<br />

changes in the consolidation group are<br />

eliminated but they and parity changes,<br />

if impacting on cash & cash equivalents,<br />

are shown in separate lines.<br />

Starting from the beginning of period<br />

(BoP) balance of cash & cash equivalents,<br />

this statement shows a slightly<br />

higher cash flow of €174.4 million.<br />

The net cash provided by operating<br />

activities was virtually unchanged at<br />

€127.5 million and included a cash<br />

inflow from interest of €1.1 million<br />

(down from €1.7 million) and a cash<br />

outflow for interest of €21.3 million<br />

(up from €15.3 million). Income taxes<br />

paid came to €37.6 million (up from<br />

€21.5 million), those refunded totaling<br />

€1.5 million (down from €2.6 million).<br />

The dividends received from associated<br />

affiliates and investees amounted to<br />

€0.7 million (up from €0.6 million).<br />

The net cash used in investing activities<br />

sank €9.6 million to €164.3 million.<br />

The cash outflow for acquisitions totaled<br />

€11.6 million and represented<br />

the purchase price of Kolbenschmidt<br />

Pierburg Shanghai Nonferrous Components<br />

Co Ltd., an investee carried at<br />

equity. The disposal of Pierburg Instruments<br />

Inc. produced a cash inflow of<br />

€6.0 million. When the stake in Pierburg<br />

Instruments GmbH was transferred,<br />

a €14.4 million loan was repaid. All<br />

acquisitions and disposals were settled<br />

in cash.<br />

Cash inflows and outflows from<br />

financing activities almost balanced.<br />

The remaining finance requirements<br />

are shown in the change in cash &<br />

cash equivalents. Cash & cash equivalents<br />

are identical in the cash flow<br />

statement and balance sheet.<br />

103

![PDF [1.0 MB] - KSPG AG](https://img.yumpu.com/5513074/1/171x260/pdf-10-mb-kspg-ag.jpg?quality=85)