Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

92<br />

Consolidated financial statements <strong>2001</strong> of Kolbenschmidt Pierburg <strong>AG</strong><br />

Notes<br />

Comments on the consolidated balance sheet<br />

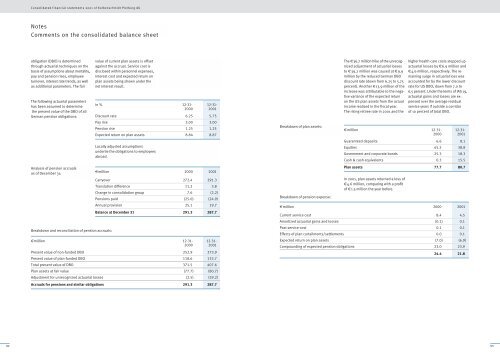

obligation (DBO) is determined<br />

through actuarial techniques on the<br />

basis of assumptions about mortality,<br />

pay and pension rises, employee<br />

turnover, interest rate trends, as well<br />

as additional parameters. The fair<br />

The following actuarial parameters<br />

has been assumed to determine<br />

the present value of the DBO of all<br />

German pension obligations:<br />

Analysis of pension accruals<br />

as of December 31:<br />

Breakdown and reconciliation of pension accruals:<br />

value of current plan assets is offset<br />

against the accrual. Service cost is<br />

disclosed within personnel expenses,<br />

interest cost and expected return on<br />

plan assets being shown under the<br />

net interest result.<br />

in % 12-31- 12-31-<br />

2000 <strong>2001</strong><br />

Discount rate 6.25 5.75<br />

Pay rise 3.00 3.00<br />

Pension rise 1.25 1.25<br />

Expected return on plan assets 8.84 8.87<br />

Locally adjusted assumptions<br />

underlie the obligations to employees<br />

abroad.<br />

€million 2000 <strong>2001</strong><br />

Carryover 272.4 291.3<br />

Translation difference 11.2 3.8<br />

Change in consolidation group 7.6 (2.2)<br />

Pensions paid (25.0) (24.9)<br />

<strong>Annual</strong> provision 25.1 19.7<br />

Balance at December 31 291.3 287.7<br />

€million 12-31- 12-31-<br />

2000 <strong>2001</strong><br />

Present value of non-funded DBO 252.9 273.9<br />

Present value of plan-funded DBO 118.6 133.7<br />

Total present value of DBO 371.5 407.6<br />

Plan assets at fair value (77.7) (80.7)<br />

Adjustment for unrecognized actuarial losses (2.5) (39.2)<br />

Accruals for pensions and similar obligations 291.3 287.7<br />

Breakdown of plan assets:<br />

Breakdown of pension expense:<br />

The €36.7 million hike of the unrecognized<br />

adjustment of actuarial losses<br />

to €39.2 million was caused at €9.9<br />

million by the reduced German DBO<br />

discount rate (down from 6.25 to 5.75<br />

percent). Another €13.9 million of the<br />

increase was attributable to the negative<br />

variance of the expected return<br />

on the US plan assets from the actual<br />

income realized in the fiscal year.<br />

The rising retiree rate in <strong>2001</strong> and the<br />

€million 12-31- 12-31-<br />

2000 <strong>2001</strong><br />

Guaranteed deposits 6.6 8.1<br />

Equities 45.5 38.8<br />

Government and corporate bonds 25.3 18.3<br />

Cash & cash equivalents 0.3 15.5<br />

Plan assets 77.7 80.7<br />

In <strong>2001</strong>, plan assets returned a loss of<br />

€4.6 million, comparing with a profit<br />

of €1.5 million the year before.<br />

higher health care costs stepped up<br />

actuarial losses by €6.9 million and<br />

€4.6 million, respectively. The remaining<br />

surge in actuarial loss was<br />

accounted for by the lower discount<br />

rate for US DBO, down from 7.0 to<br />

6.5 percent. Under the terms of IAS 19,<br />

actuarial gains and losses are expensed<br />

over the average residual<br />

service years if outside a corridor<br />

of 10 percent of total DBO.<br />

€million 2000 <strong>2001</strong><br />

Current service cost 8.4 4.5<br />

Amortized actuarial gains and losses (0.1) 0.1<br />

Past service cost 0.1 0.1<br />

Effects of plan curtailments/settlements 0.0 0.1<br />

Expected return on plan assets (7.0) (6.9)<br />

Compounding of expected pension obligations 23.0 23.9<br />

24.4 21.8<br />

93

![PDF [1.0 MB] - KSPG AG](https://img.yumpu.com/5513074/1/171x260/pdf-10-mb-kspg-ag.jpg?quality=85)