Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

Annual Report 2001 - KSPG AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

Consolidated financial statements <strong>2001</strong> of Kolbenschmidt Pierburg <strong>AG</strong><br />

Notes<br />

Comments on the consolidated balance sheet<br />

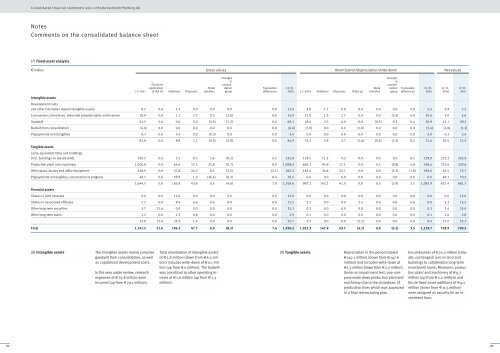

(7) Fixed-asset analysis<br />

€million<br />

1-1-<strong>2001</strong><br />

First-time<br />

application<br />

of IAS 39<br />

Book<br />

Changes<br />

in<br />

consolidation<br />

Translation 12-31-<br />

Additions Disposals transfers group<br />

differences <strong>2001</strong> 1-1-<strong>2001</strong> Additions Disposals Write-up<br />

Intangible assets<br />

Development costs<br />

and other internally created intangible assets 8.7 0.0 4.3 0.0 0.0 0.0 0.0 13.0 3.8 1.7 0.0 0.0 0.0 0.0 0.0 5.5 4.9 7.5<br />

Concessions, franchises, industrial property rights and licenses 18.9 0.0 1.1 2.7 0.3 (2.6) 0.0 15.0 13.9 1.8 2.7 0.0 0.0 (2.6) 0.0 10.4 5.0 4.6<br />

Goodwill 61.5 0.0 0.0 0.0 (0.5) (1.3) 0.4 60.1 18.4 2.3 0.0 0.0 (0.5) 0.3 0.4 20.9 43.1 39.2<br />

Badwill from consolidation (6.6) 0.0 0.0 0.0 0.0 0.0 0.0 (6.6) (3.8) 0.0 0.0 (1.6) 0.0 0.0 0.0 (5.4) (2.8) (1.2)<br />

Prepayments on intangibles 0.3 0.0 3.4 0.0 (0.3) 0.0 0.0 3.4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 3.4<br />

Tangible assets<br />

Land, equivalent titles and buildings<br />

82.8 0.0 8.8 2.7 (0.5) (3.9) 0.4 84.9 32.3 5.8 2.7 (1.6) (0.5) (2.3) 0.4 31.4 50.5 53.5<br />

(incl. buildings on leased land) 330.7 0.0 2.5 0.5 2.6 (0.2) 0.7 335.8 118.5 11.5 0.2 0.0 0.0 0.0 0.1 129.9 212.2 205.9<br />

Production plant and machinery 1,016.8 0.0 65.6 17.5 25.8 (0.7) 8.0 1,098.0 685.2 95.8 17.1 0.0 0.5 (0.8) 4.8 768.4 331.6 329.6<br />

Other plant, factory and office equipment 248.9 0.0 37.8 24.3 8.5 (3.5) (2.1) 265.3 183.4 34.8 23.7 0.0 0.0 (3.1) (1.8) 189.6 65.5 75.7<br />

Prepayments on tangibles, construction in progress 48.1 0.0 59.9 1.3 (36.4) (0.2) 0.4 70.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 48.1 70.5<br />

Financial assets<br />

1,644.5 0.0 165.8 43.6 0.5 (4.6) 7.0 1,769.6 987.1 142.1 41.0 0.0 0.5 (3.9) 3.1 1,087.9 657.4 681.7<br />

Shares in joint ventures 0.0 0.0 12.0 0.0 0.0 0.0 0.0 12.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 12.0<br />

Shares in associated affiliates 7.7 0.0 8.4 0.6 0.0 0.0 0.0 15.5 2.5 0.0 0.0 2.5 0.0 0.0 0.0 0.0 5.2 15.5<br />

Other long-term securities 3.7 21.6 0.0 0.0 0.0 0.0 0.0 25.3 0.3 0.0 0.0 0.0 0.0 0.0 0.0 0.3 3.4 25.0<br />

Other long-term loans 2.5 0.0 1.2 0.8 0.0 0.0 0.0 2.9 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1 2.4 2.8<br />

13.9 21.6 21.6 1.4 0.0 0.0 0.0 55.7 2.9 0.0 0.0 (2.5) 0.0 0.0 0.0 0.4 11.0 55.3<br />

Total 1,741.2 21.6 196.2 47.7 0.0 (8.5) 7.4 1,910.2 1,022.3 147.9 43.7 (4.1) 0.0 (6.2) 3.5 1,119.7 718.9 790.5<br />

(8) Intangible assets The intangible assets mainly comprise<br />

goodwill from consolidation, as well<br />

as capitalized development costs.<br />

In the year under review, research<br />

expenses of €79.8 million were<br />

incurred (up from €79.1 million).<br />

Total amortization of intangible assets<br />

of €5.8 million (down from €6.5 million)<br />

includes write-down of €0.1 million<br />

(up from €0 million). The badwill<br />

was amortized to other operating income<br />

at €1.6 million (up from €1.3<br />

million).<br />

Gross values Amortization/depreciation/write-down<br />

Net values<br />

Book<br />

transfers<br />

Changes<br />

in<br />

consolidation<br />

group<br />

(9) Tangible assets Depreciation in the period totaled<br />

€142.1 million (down from €147.6<br />

million) and includes write-down at<br />

€1.3 million (down from €2.0 million).<br />

Under an impairment test, one company<br />

wrote down production plant and<br />

machinery due to the closedown of<br />

production lines which was approved<br />

in a final restructuring plan.<br />

Translation<br />

differences<br />

12-31-<br />

<strong>2001</strong><br />

12-31-<br />

2000<br />

12-31-<br />

<strong>2001</strong><br />

Encumbrances of €20.2 million (virtually<br />

unchanged) rest on land and<br />

buildings to collateralize long-term<br />

investment loans. Moreover, production<br />

plant and machinery of €9.7<br />

million (up from €2.2 million) and<br />

future fixed-asset additions of €4.0<br />

million (down from €11.5 million)<br />

were assigned as security for an investment<br />

loan.<br />

85

![PDF [1.0 MB] - KSPG AG](https://img.yumpu.com/5513074/1/171x260/pdf-10-mb-kspg-ag.jpg?quality=85)