You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 2.07 Lead — 13<br />

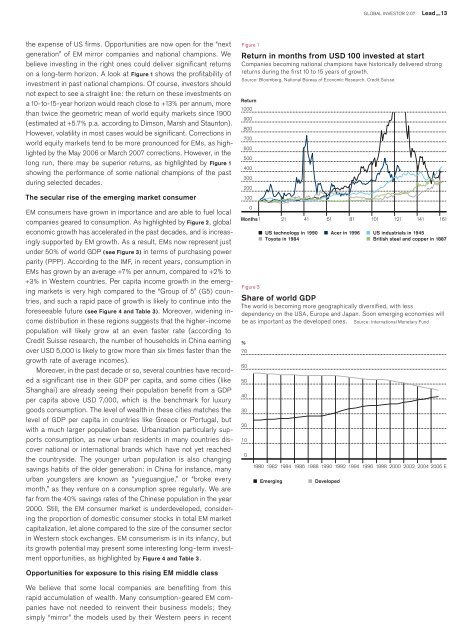

the expense of US firms. Opportunities are now open for the “next<br />

generation” of EM mirror companies and national champions. We<br />

believe investing in the right ones could deliver significant returns<br />

on a long-term horizon. A look at Figure 1 shows the profitability of<br />

investment in past national champions. Of course, investors should<br />

not expect to see a straight line: the return on these investments on<br />

a 10-to-15-year horizon would reach close to +13% per annum, more<br />

than twice the geometric mean of world equity markets since 1900<br />

(estimated at +5.7% p.a. according to Dimson, Marsh and Staunton).<br />

However, volatility in most cases would be significant. Corrections in<br />

world equity markets tend to be more pronounced for EMs, as highlighted<br />

by the May 2006 or March 2007 corrections. However, in the<br />

long run, there may be superior returns, as highlighted by Figure 1<br />

showing the performance of some national champions of the past<br />

during selected decades.<br />

The secular rise of the emerging market consumer<br />

EM consumers have grown in importance and are able to fuel local<br />

companies geared to consumption. As highlighted by Figure 2, <strong>global</strong><br />

economic growth has accelerated in the past decades, and is increasingly<br />

supported by EM growth. As a result, EMs now represent just<br />

under 50% of world GDP (see Figure 3) in terms of purchasing power<br />

parity (PPP). According to the IMF, in recent years, consumption in<br />

EMs has grown by an average +7% per annum, compared to +2% to<br />

+3% in Western countries. Per capita income growth in the emerging<br />

markets is very high compared to the “Group of 5” (G5) countries,<br />

and such a rapid pace of growth is likely to continue into the<br />

foreseeable future (see Figure 4 and Table 3). Moreover, widening income<br />

distribution in these regions suggests that the higher-income<br />

population will likely grow at an even faster rate (according to<br />

Credit Suisse research, the number of households in China earning<br />

over USD 5,000 is likely to grow more than six times faster than the<br />

growth rate of average incomes).<br />

Moreover, in the past decade or so, several countries have recorded<br />

a significant rise in their GDP per capita, and some cities (like<br />

Shanghai) are already seeing their population benefit from a GDP<br />

per capita above USD 7,000, which is the benchmark for luxury<br />

goods consumption. The level of wealth in these cities matches the<br />

level of GDP per capita in countries like Greece or Portugal, but<br />

with a much larger population base. Urbanization particularly supports<br />

consumption, as new urban residents in many countries discover<br />

national or international brands which have not yet reached<br />

the countryside. The younger urban population is also changing<br />

savings habits of the older generation: in China for instance, many<br />

urban youngsters are known as “yueguangjue,” or “broke every<br />

month,” as they venture on a consumption spree regularly. We are<br />

far from the 40% savings rates of the Chinese population in the year<br />

2000. Still, the EM consumer market is underdeveloped, considering<br />

the proportion of domestic consumer stocks in total EM market<br />

capitalization, let alone compared to the size of the consumer sector<br />

in Western stock exchanges. EM consumerism is in its infancy, but<br />

its growth potential may present some interesting long-term investment<br />

opportunities, as highlighted by Figure 4 and Table 3.<br />

Figure 1<br />

Return in months from USD 100 invested at start<br />

Companies becoming national champions have historically delivered strong<br />

returns during the first 10 to 15 years of growth.<br />

Source: Bloomberg, National Bureau of Economic Research, Credit Suisse<br />

Return<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Months1<br />

21 41 61 81 101 121 141 161<br />

Figure 3<br />

US technology in 1990<br />

Toyota in 1984<br />

Acer in 1996 US industrials in 1945<br />

British steel and copper in 1887<br />

Share of world GDP<br />

The world is becoming more geographically diversified, with less<br />

dependency on the USA, Europe and Japan. Soon emerging economies will<br />

be as important as the developed ones. Source: International Monetary Fund<br />

%<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 E<br />

Emerging<br />

Developed<br />

Opportunities for exposure to this rising EM middle class<br />

We believe that some local companies are benefiting from this<br />

rapid accumulation of wealth. Many consumption-geared EM companies<br />

have not needed to reinvent their business models; they<br />

simply “mirror” the models used by their Western peers in recent