Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 2.07 Basics — 21<br />

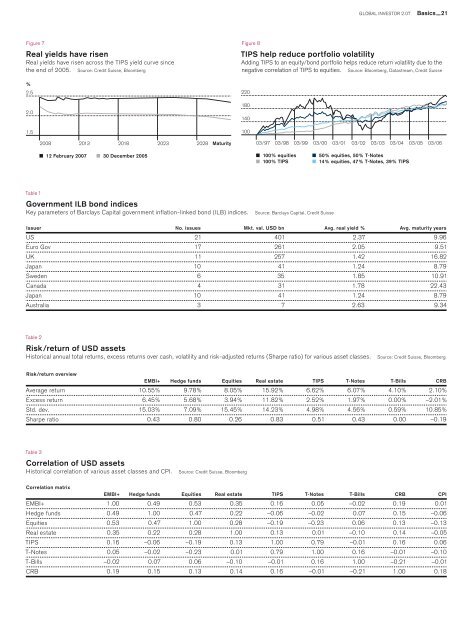

Figure 7<br />

Real yields have risen<br />

Real yields have risen across the TIPS yield curve since<br />

the end of 2005. Source: Credit Suisse, Bloomberg<br />

%<br />

2.5<br />

2.0<br />

1.5<br />

Figure 8<br />

TIPS help reduce portfolio volatility<br />

Adding TIPS to an equity/bond portfolio helps reduce return volatility due to the<br />

negative correlation of TIPS to equities. Source: Bloomberg, Datastream, Credit Suisse<br />

220<br />

180<br />

140<br />

100<br />

2008 2013 2018<br />

2023 2028<br />

Maturity 03/97 03/98 03/99 03/00 03/01 03/02 03/03 03/04 03/05 03/06<br />

12 February 2007<br />

30 December 2005<br />

100% equities<br />

100% TIPS<br />

50% equities, 50% T-Notes<br />

14% equities, 47% T-Notes, 39% TIPS<br />

Table 1<br />

Government ILB bond indices<br />

Key parameters of Barclays Capital government inflation-linked bond (ILB) indices.<br />

Source: Barclays Capital, Credit Suisse<br />

Issuer No. issues Mkt. val. USD bn Avg. real yield % Avg. maturity years<br />

US 21 401 2.37 9.96<br />

Euro Gov 17 261 2.05 9.51<br />

UK 11 257 1.42 16.82<br />

Japan 10 41 1.24 8.79<br />

Sweden 6 35 1.85 10.91<br />

Canada 4 31 1.78 22.43<br />

Japan 10 41 1.24 8.79<br />

Australia 3 7 2.63 9.34<br />

Table 2<br />

Risk/return of USD assets<br />

Historical annual total returns, excess returns over cash, volatility and risk-adjusted returns (Sharpe ratio) for various asset classes.<br />

Source: Credit Suisse, Bloomberg<br />

Risk/return overview<br />

EMBI+ Hedge funds Equities Real estate TIPS T-Notes T-Bills CRB<br />

Average return 10.55% 9.78% 8.05% 15.92% 6.62% 6.07% 4.10% 2.10%<br />

Excess return 6.45% 5.68% 3.94% 11.82% 2.52% 1.97% 0.00% –2.01%<br />

Std. dev. 15.03% 7.09% 15.45% 14.23% 4.98% 4.56% 0.59% 10.85%<br />

Sharpe ratio 0.43 0.80 0.26 0.83 0.51 0.43 0.00 –0.19<br />

Table 3<br />

Correlation of USD assets<br />

Historical correlation of various asset classes and CPI.<br />

Source: Credit Suisse, Bloomberg<br />

Correlation matrix<br />

EMBI+ Hedge funds Equities Real estate TIPS T-Notes T-Bills CRB CPI<br />

EMBI+ 1.00 0.49 0.53 0.35 0.16 0.05 –0.02 0.19 0.01<br />

Hedge funds 0.49 1.00 0.47 0.22 –0.06 –0.02 0.07 0.15 –0.06<br />

Equities 0.53 0.47 1.00 0.28 –0.19 –0.23 0.06 0.13 –0.13<br />

Real estate 0.35 0.22 0.28 1.00 0.13 0.01 –0.10 0.14 –0.05<br />

TIPS 0.16 –0.06 –0.19 0.13 1.00 0.79 –0.01 0.16 0.06<br />

T-Notes 0.05 –0.02 –0.23 0.01 0.79 1.00 0.16 –0.01 –0.10<br />

T-Bills –0.02 0.07 0.06 –0.10 –0.01 0.16 1.00 –0.21 –0.01<br />

CRB 0.19 0.15 0.13 0.14 0.16 –0.01 –0.21 1.00 0.18