You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 2.07 Services — 56<br />

Thinking outside the box<br />

HOLT software is (almost) all that is needed to <strong>value</strong> nearly any company: a sound and reliable valuation<br />

model and a <strong>global</strong> database of comparable data. With this tool, asset managers can finally focus their attention<br />

on the important things. Interview: Zoe Arnold, freelance writer<br />

Zoe Arnold: Credit Suisse has offered<br />

institutional investors HOLT Value Search<br />

for five years now and it also uses the<br />

software in-house. What exactly does this<br />

program do?<br />

Robin Seydoux: HOLT Value Search<br />

is a software program with a financial<br />

database (balance sheet and P&L numbers,<br />

cash flow data, etc.) on more than 18,000<br />

companies worldwide going back 20 to<br />

25 years. And, more importantly, HOLT is<br />

an excellent tool for measuring market<br />

expectations and projecting future price<br />

movements.<br />

Tell us how these projections<br />

are made.<br />

Robin Seydoux: Based on prior-year<br />

figures and earnings expectations, the<br />

valuation software calculates future cash<br />

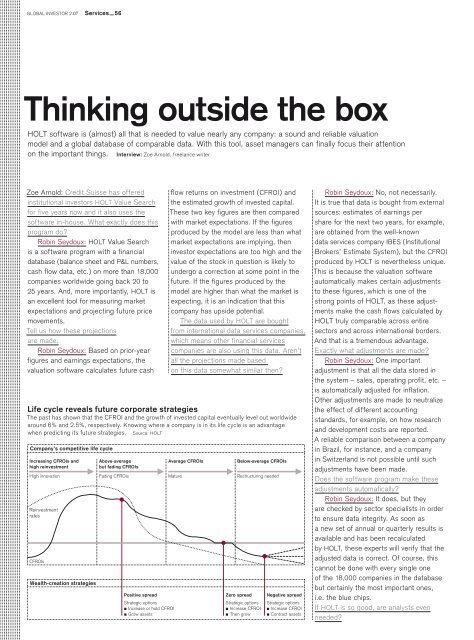

Company’s competitive life cycle<br />

Increasing CFROIs and<br />

high reinvestment<br />

High innovation Fading CFROIs Mature<br />

Reinvestment<br />

rates<br />

CFROIs<br />

Wealth-creation strategies<br />

Above-average<br />

but fading CFROIs<br />

Strategic options<br />

Increase or hold CFROI<br />

Grow assets<br />

flow returns on investment (CFROI) and<br />

the estimated growth of invested capital.<br />

These two key figures are then compared<br />

with market expectations. If the figures<br />

produced by the model are less than what<br />

market expectations are implying, then<br />

investor expectations are too high and the<br />

<strong>value</strong> of the stock in question is likely to<br />

undergo a correction at some point in the<br />

future. If the figures produced by the<br />

model are higher than what the market is<br />

expecting, it is an indication that this<br />

company has upside potential.<br />

The data used by HOLT are bought<br />

from international data services companies,<br />

which means other financial services<br />

companies are also using this data. Aren’t<br />

all the projections made based<br />

on this data somewhat similar then?<br />

Life cycle reveals future corporate strategies<br />

The past has shown that the CFROI and the growth of invested capital eventually level out worldwide<br />

around 6% and 2.5%, respectively. Knowing where a company is in its life cycle is an advantage<br />

when predicting its future strategies. Source: HOLT<br />

Average CFROIs<br />

Below-average CFROIs<br />

Restructuring needed<br />

Positive spread Zero spread Negative spread<br />

Strategic options<br />

Increase CFROI<br />

Then grow<br />

Strategic options<br />

Increase CFROI<br />

Contract assets<br />

Robin Seydoux: No, not necessarily.<br />

It is true that data is bought from external<br />

sources: estimates of earnings per<br />

share for the next two years, for example,<br />

are obtained from the well-known<br />

data services company IBES (Institutional<br />

Brokers’ Estimate System), but the CFROI<br />

produced by HOLT is nevertheless unique.<br />

This is because the valuation software<br />

automatically makes certain adjustments<br />

to these figures, which is one of the<br />

strong points of HOLT, as these adjustments<br />

make the cash flows calculated by<br />

HOLT truly comparable across entire<br />

sectors and across international borders.<br />

And that is a tremendous advantage.<br />

Exactly what adjustments are made?<br />

Robin Seydoux: One important<br />

adjustment is that all the data stored in<br />

the system – sales, operating profit, etc. –<br />

is automatically adjusted for inflation.<br />

Other adjustments are made to neutralize<br />

the effect of different accounting<br />

standards, for example, on how research<br />

and development costs are reported.<br />

A reliable comparison between a company<br />

in Brazil, for instance, and a company<br />

in Switzerland is not possible until such<br />

adjustments have been made.<br />

Does the software program make these<br />

adjustments automatically?<br />

Robin Seydoux: It does, but they<br />

are checked by sector specialists in order<br />

to ensure data integrity. As soon as<br />

a new set of annual or quarterly results is<br />

available and has been recalculated<br />

by HOLT, these experts will verify that the<br />

adjusted data is correct. Of course, this<br />

cannot be done with every single one<br />

of the 18,000 companies in the database<br />

but certainly the most important ones,<br />

i.e. the blue chips.<br />

If HOLT is so good, are analysts even<br />

needed?