You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 2.07 Switching — 49<br />

—3.—Cell lifetime: Modern PV elements based on silicon technology<br />

have lifetimes of over 40 years and pay off their production<br />

energy in 1− 5 years.<br />

Japan and Germany leaders, USA yet to arise<br />

The leading producers of PV cells are Japan and Europe (mainly<br />

Germany) with a 45% and 28% share of total <strong>global</strong> 2005 shipments,<br />

respectively, clearly dominating the market. The USA is still<br />

lagging behind, with a mere 8.5% market share, on a level with<br />

China (8.3%). However, the proposed FY 2008 US budget calls for<br />

USD 137 million in funding for the Solar America Initiative (SAI), a<br />

major new R&D effort to achieve cost-competitive solar energy<br />

technologies across all market sectors by 2015. US solar cell companies<br />

are expanding, and the Silicon Valley start-up Nanosolar last<br />

year announced the construction of a manufacturing facility that<br />

will produce an output of 430 megawatts (MW) per year, almost<br />

triple the existing solar production capacity of the USA today. Conservative<br />

estimates given by the European Photovoltaic Industry<br />

Association (EPIA) see worldwide PV systems capacity exceeding<br />

400 GWp, or 3% of the <strong>global</strong> electricity demand in year 2025, implying<br />

average annual CO2 savings of 353 million tons per year,<br />

equivalent to 150 coal-fired power plants. Worldwide revenues of<br />

the PV industry are expected to soar from USD 11 billion in 2005 to<br />

USD 220 billion in 2025 (Figure 3). And these figures do not even<br />

take into account ground-breaking developments in nanotechnology-based<br />

PV research.<br />

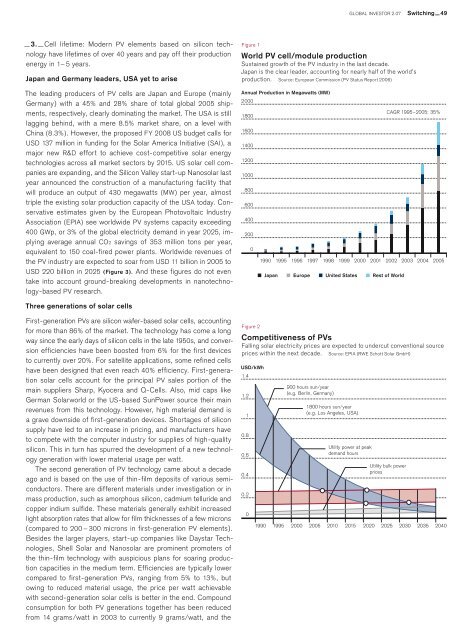

Figure 1<br />

World PV cell/module production<br />

Sustained growth of the PV industry in the last decade.<br />

Japan is the clear leader, accounting for nearly half of the world’s<br />

production. Source: European Commission (PV Status Report 2006)<br />

Annual Production in Megawatts (MW)<br />

2000<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

1990 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005<br />

Japan Europe United States Rest of World<br />

CAGR 1995–2005: 35%<br />

Three generations of solar cells<br />

First-generation PVs are silicon wafer-based solar cells, accounting<br />

for more than 86% of the market. The technology has come a long<br />

way since the early days of silicon cells in the late 1950s, and conversion<br />

efficiencies have been boosted from 6% for the first devices<br />

to currently over 20%. For satellite applications, some refined cells<br />

have been designed that even reach 40% efficiency. First-generation<br />

solar cells account for the principal PV sales portion of the<br />

main suppliers Sharp, Kyocera and Q-Cells. Also, mid caps like<br />

German Solarworld or the US-based SunPower source their main<br />

revenues from this technology. However, high material demand is<br />

a grave downside of first-generation devices. Shortages of silicon<br />

supply have led to an increase in pricing, and manufacturers have<br />

to compete with the computer industry for supplies of high-quality<br />

silicon. This in turn has spurred the development of a new technology<br />

generation with lower material usage per watt.<br />

The second generation of PV technology came about a decade<br />

ago and is based on the use of thin-film deposits of various semiconductors.<br />

There are different materials under investigation or in<br />

mass production, such as amorphous silicon, cadmium telluride and<br />

copper indium sulfide. These materials generally exhibit increased<br />

light absorption rates that allow for film thicknesses of a few microns<br />

(compared to 200 − 300 microns in first-generation PV elements).<br />

Besides the larger players, start-up companies like Daystar Technologies,<br />

Shell Solar and Nanosolar are prominent promoters of<br />

the thin-film technology with auspicious plans for soaring production<br />

capacities in the medium term. Efficiencies are typically lower<br />

compared to first-generation PVs, ranging from 5% to 13%, but<br />

owing to reduced material usage, the price per watt achievable<br />

with second-generation solar cells is better in the end. Compound<br />

consumption for both PV generations together has been reduced<br />

from 14 grams/watt in 2003 to currently 9 grams/watt, and the<br />

Figure 2<br />

Competitiveness of PVs<br />

Falling solar electricity prices are expected to undercut conventional source<br />

prices within the next decade. Source: EPIA (RWE Schott Solar GmbH)<br />

USD/kWh<br />

1.4<br />

1.2<br />

1<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

900 hours sun/year<br />

(e.g. Berlin, Germany)<br />

1800 hours sun/year<br />

(e.g. Los Angeles, USA)<br />

Utility power at peak<br />

demand hours<br />

Utility bulk power<br />

prices<br />

1990 1995 2000 2005 2010 2015 2020 2025 2030 2035<br />

2040