stahlmarkt European Edition 01.2013

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Special: Italy K 23<br />

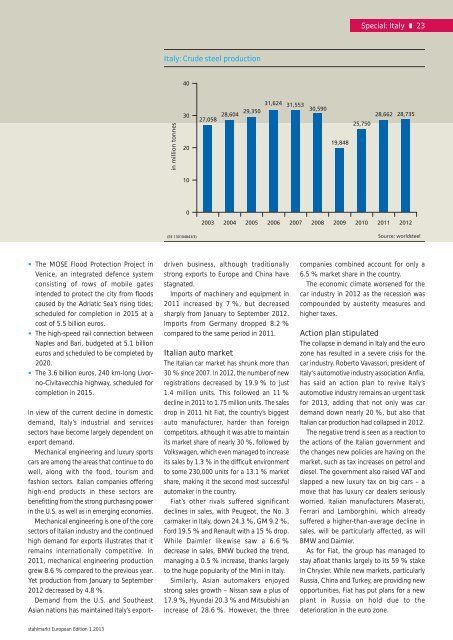

Italy: Crude steel production<br />

40<br />

in million tonnes<br />

30<br />

20<br />

27,058 28,604 29,350 31,624 31,553 30,590<br />

19,848<br />

25,750<br />

28,662 28,735<br />

10<br />

0<br />

(EE 130104843/3)<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

Source: worldsteel<br />

The MOSE Flood Protection Project in<br />

Venice, an integrated defence system<br />

consisting of rows of mobile gates<br />

intended to protect the city from floods<br />

caused by the Adriatic Sea’s rising tides;<br />

scheduled for completion in 2015 at a<br />

cost of 5.5 billion euros.<br />

The high-speed rail connection between<br />

Naples and Bari, budgeted at 5.1 billion<br />

euros and scheduled to be completed by<br />

2020.<br />

The 3.6 billion euros, 240 km-long Livorno-Civitavecchia<br />

highway, scheduled for<br />

completion in 2015.<br />

In view of the current decline in domestic<br />

demand, Italy’s industrial and services<br />

sectors have become largely dependent on<br />

export demand.<br />

Mechanical engineering and luxury sports<br />

cars are among the areas that continue to do<br />

well, along with the food, tourism and<br />

fashion sectors. Italian companies offering<br />

high-end products in these sectors are<br />

benefitting from the strong purchasing power<br />

in the U.S. as well as in emerging economies.<br />

Mechanical engineering is one of the core<br />

sectors of Italian industry and the continued<br />

high demand for exports illustrates that it<br />

remains internationally competitive. In<br />

2011, mechanical engineering production<br />

grew 8.6 % compared to the previous year.<br />

Yet production from January to September<br />

2012 decreased by 4.8 %.<br />

Demand from the U.S. and Southeast<br />

Asian nations has maintained Italy’s exportdriven<br />

business, although traditionally<br />

strong exports to Europe and China have<br />

stagnated.<br />

Imports of machinery and equipment in<br />

2011 increased by 7 %, but decreased<br />

sharply from January to September 2012.<br />

Imports from Germany dropped 8.2 %<br />

compared to the same period in 2011.<br />

Italian auto market<br />

The Italian car market has shrunk more than<br />

30 % since 2007. In 2012, the number of new<br />

registrations decreased by 19.9 % to just<br />

1.4 million units. This followed an 11 %<br />

decline in 2011 to 1.75 million units. The sales<br />

drop in 2011 hit Fiat, the country’s biggest<br />

auto manufacturer, harder than foreign<br />

competitors, although it was able to maintain<br />

its market share of nearly 30 %, followed by<br />

Volkswagen, which even managed to increase<br />

its sales by 1.3 % in the difficult environment<br />

to some 230,000 units for a 13.1 % market<br />

share, making it the second most successful<br />

automaker in the country.<br />

Fiat’s other rivals suffered significant<br />

declines in sales, with Peugeot, the No. 3<br />

carmaker in Italy, down 24.3 %, GM 9.2 %,<br />

Ford 19.5 % and Renault with a 15 % drop.<br />

While Daimler likewise saw a 6.6 %<br />

decrease in sales, BMW bucked the trend,<br />

managing a 0.5 % increase, thanks largely<br />

to the huge popularity of the Mini in Italy.<br />

Similarly, Asian automakers enjoyed<br />

strong sales growth – Nissan saw a plus of<br />

17.9 %, Hyundai 20.3 % and Mitsubishi an<br />

increase of 28.6 %. However, the three<br />

companies combined account for only a<br />

6.5 % market share in the country.<br />

The economic climate worsened for the<br />

car industry in 2012 as the recession was<br />

compounded by austerity measures and<br />

higher taxes.<br />

Action plan stipulated<br />

The collapse in demand in Italy and the euro<br />

zone has resulted in a severe crisis for the<br />

car industry. Roberto Vavassori, president of<br />

Italy‘s automotive industry association Anfia,<br />

has said an action plan to revive Italy’s<br />

automotive industry remains an urgent task<br />

for 2013, adding that not only was car<br />

demand down nearly 20 %, but also that<br />

Italian car production had collapsed in 2012.<br />

The negative trend is seen as a reaction to<br />

the actions of the Italian government and<br />

the changes new policies are having on the<br />

market, such as tax increases on petrol and<br />

diesel. The government also raised VAT and<br />

slapped a new luxury tax on big cars – a<br />

move that has luxury car dealers seriously<br />

worried. Italian manufacturers Maserati,<br />

Ferrari and Lamborghini, which already<br />

suffered a higher-than-average decline in<br />

sales, will be particularly affected, as will<br />

BMW and Daimler.<br />

As for Fiat, the group has managed to<br />

stay afloat thanks largely to its 59 % stake<br />

in Chrysler. While new markets, particularly<br />

Russia, China and Turkey, are providing new<br />

opportunities, Fiat has put plans for a new<br />

plant in Russia on hold due to the<br />

deterioration in the euro zone.<br />

<strong>stahlmarkt</strong> <strong>European</strong> <strong>Edition</strong> 1.2013