Abacus Property Group – Annual Financial Report 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTORS’ REPORT<br />

30 June <strong>2018</strong><br />

ABACUS PROPERTY GROUP<br />

OPERATING AND FINANCIAL REVIEW (continued)<br />

CORE SEGMENT RESULTS SUMMARY (continued)<br />

Self-storage<br />

<strong>Abacus</strong>’ self-storage portfolio delivered a segment result of $97.7 million for the year ended 30 June <strong>2018</strong>. This<br />

represents a 38% increase on the FY17’s result of $70.7 million and can be attributed to strong increases in selfstorage<br />

EBITDA, gains on the sale of a non-core portfolio of regional assets and higher fair value increases in the<br />

self-storage portfolio. Portfolio assets totalled $666 million across a total portfolio of 62 assets, an overall net<br />

reduction of three facilities during the period.<br />

Pursuant to the <strong>2018</strong> valuation process 39 self-storage facilities out of 62 or 66% by value were independently<br />

valued during the year to 30 June <strong>2018</strong>. The remaining facilities were subject to internal review and, where<br />

appropriate, their values were adjusted. The valuation process resulted in a net full year revaluation gain of $42.4<br />

million (2017: $27.3 million gain) or 6.8% of investment properties.<br />

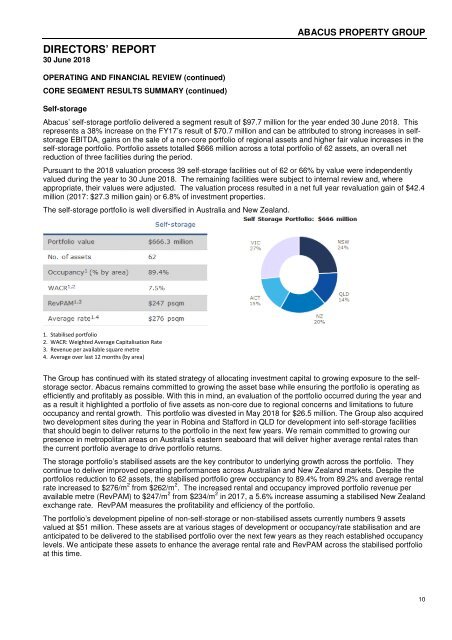

The self-storage portfolio is well diversified in Australia and New Zealand.<br />

1. Stabilised portfolio<br />

2. WACR: Weighted Average Capitalisation Rate<br />

3. Revenue per available square metre<br />

4. Average over last 12 months (by area)<br />

The <strong>Group</strong> has continued with its stated strategy of allocating investment capital to growing exposure to the selfstorage<br />

sector. <strong>Abacus</strong> remains committed to growing the asset base while ensuring the portfolio is operating as<br />

efficiently and profitably as possible. With this in mind, an evaluation of the portfolio occurred during the year and<br />

as a result it highlighted a portfolio of five assets as non-core due to regional concerns and limitations to future<br />

occupancy and rental growth. This portfolio was divested in May <strong>2018</strong> for $26.5 million. The <strong>Group</strong> also acquired<br />

two development sites during the year in Robina and Stafford in QLD for development into self-storage facilities<br />

that should begin to deliver returns to the portfolio in the next few years. We remain committed to growing our<br />

presence in metropolitan areas on Australia’s eastern seaboard that will deliver higher average rental rates than<br />

the current portfolio average to drive portfolio returns.<br />

The storage portfolio’s stabilised assets are the key contributor to underlying growth across the portfolio. They<br />

continue to deliver improved operating performances across Australian and New Zealand markets. Despite the<br />

portfolios reduction to 62 assets, the stabilised portfolio grew occupancy to 89.4% from 89.2% and average rental<br />

rate increased to $276/m 2 from $262/m 2 . The increased rental and occupancy improved portfolio revenue per<br />

available metre (RevPAM) to $247/m 2 from $234/m 2 in 2017, a 5.6% increase assuming a stabilised New Zealand<br />

exchange rate. RevPAM measures the profitability and efficiency of the portfolio.<br />

The portfolio’s development pipeline of non-self-storage or non-stabilised assets currently numbers 9 assets<br />

valued at $51 million. These assets are at various stages of development or occupancy/rate stabilisation and are<br />

anticipated to be delivered to the stabilised portfolio over the next few years as they reach established occupancy<br />

levels. We anticipate these assets to enhance the average rental rate and RevPAM across the stabilised portfolio<br />

at this time.<br />

10