Abacus Property Group – Annual Financial Report 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTORS’ REPORT<br />

30 June <strong>2018</strong><br />

ABACUS PROPERTY GROUP<br />

REMUNERATION REPORT (audited) (continued)<br />

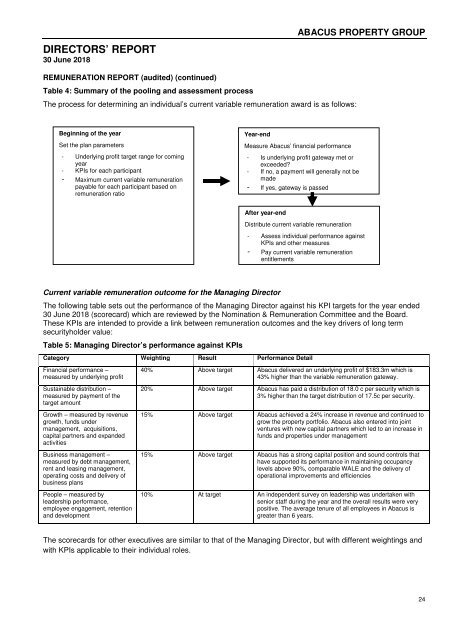

Table 4: Summary of the pooling and assessment process<br />

The process for determining an individual’s current variable remuneration award is as follows:<br />

Beginning of the year<br />

Set the plan parameters<br />

- Underlying profit target range for coming<br />

year<br />

- KPIs for each participant<br />

- Maximum current variable remuneration<br />

payable for each participant based on<br />

remuneration ratio<br />

Year-end<br />

Measure <strong>Abacus</strong>’ financial performance<br />

- Is underlying profit gateway met or<br />

exceeded?<br />

- If no, a payment will generally not be<br />

made<br />

- If yes, gateway is passed<br />

After year-end<br />

Distribute current variable remuneration<br />

- Assess individual performance against<br />

KPIs and other measures<br />

- Pay current variable remuneration<br />

entitlements<br />

Current variable remuneration outcome for the Managing Director<br />

The following table sets out the performance of the Managing Director against his KPI targets for the year ended<br />

30 June <strong>2018</strong> (scorecard) which are reviewed by the Nomination & Remuneration Committee and the Board.<br />

These KPIs are intended to provide a link between remuneration outcomes and the key drivers of long term<br />

securityholder value:<br />

Table 5: Managing Director’s performance against KPIs<br />

Category Weighting Result Performance Detail<br />

<strong>Financial</strong> performance <strong>–</strong><br />

measured by underlying profit<br />

Sustainable distribution <strong>–</strong><br />

measured by payment of the<br />

target amount<br />

Growth <strong>–</strong> measured by revenue<br />

growth, funds under<br />

management, acquisitions,<br />

capital partners and expanded<br />

activities<br />

Business management <strong>–</strong><br />

measured by debt management,<br />

rent and leasing management,<br />

operating costs and delivery of<br />

business plans<br />

People <strong>–</strong> measured by<br />

leadership performance,<br />

employee engagement, retention<br />

and development<br />

40% Above target <strong>Abacus</strong> delivered an underlying profit of $183.3m which is<br />

43% higher than the variable remuneration gateway.<br />

20% Above target <strong>Abacus</strong> has paid a distribution of 18.0 c per security which is<br />

3% higher than the target distribution of 17.5c per security.<br />

15% Above target <strong>Abacus</strong> achieved a 24% increase in revenue and continued to<br />

grow the property portfolio. <strong>Abacus</strong> also entered into joint<br />

ventures with new capital partners which led to an increase in<br />

funds and properties under management<br />

15% Above target <strong>Abacus</strong> has a strong capital position and sound controls that<br />

have supported its performance in maintaining occupancy<br />

levels above 90%, comparable WALE and the delivery of<br />

operational improvements and efficiencies<br />

10% At target An independent survey on leadership was undertaken with<br />

senior staff during the year and the overall results were very<br />

positive. The average tenure of all employees in <strong>Abacus</strong> is<br />

greater than 6 years.<br />

The scorecards for other executives are similar to that of the Managing Director, but with different weightings and<br />

with KPIs applicable to their individual roles.<br />

24