Abacus Property Group – Annual Financial Report 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ABACUS PROPERTY GROUP<br />

DIRECTORS’ REPORT<br />

30 June <strong>2018</strong><br />

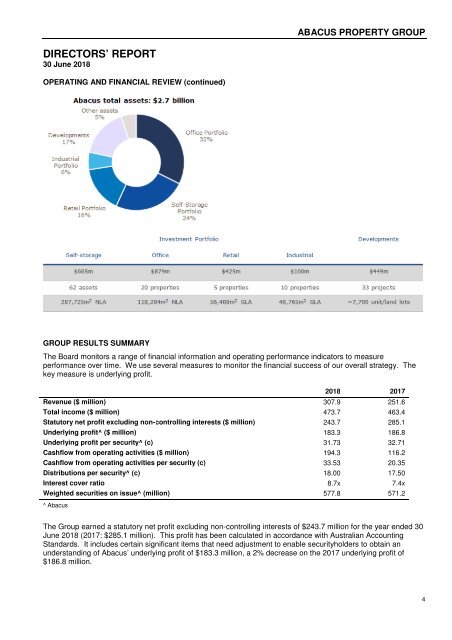

OPERATING AND FINANCIAL REVIEW (continued)<br />

GROUP RESULTS SUMMARY<br />

The Board monitors a range of financial information and operating performance indicators to measure<br />

performance over time. We use several measures to monitor the financial success of our overall strategy. The<br />

key measure is underlying profit.<br />

<strong>2018</strong> 2017<br />

Revenue ($ million) 307.9 251.6<br />

Total income ($ million) 473.7 463.4<br />

Statutory net profit excluding non-controlling interests ($ million) 243.7 285.1<br />

Underlying profit^ ($ million) 183.3 186.8<br />

Underlying profit per security^ (c) 31.73 32.71<br />

Cashflow from operating activities ($ million) 194.3 116.2<br />

Cashflow from operating activities per security (c) 33.53 20.35<br />

Distributions per security^ (c) 18.00 17.50<br />

Interest cover ratio 8.7x 7.4x<br />

Weighted securities on issue^ (million) 577.8 571.2<br />

^ <strong>Abacus</strong><br />

The <strong>Group</strong> earned a statutory net profit excluding non-controlling interests of $243.7 million for the year ended 30<br />

June <strong>2018</strong> (2017: $285.1 million). This profit has been calculated in accordance with Australian Accounting<br />

Standards. It includes certain significant items that need adjustment to enable securityholders to obtain an<br />

understanding of <strong>Abacus</strong>’ underlying profit of $183.3 million, a 2% decrease on the 2017 underlying profit of<br />

$186.8 million.<br />

4