Abacus Property Group – Annual Financial Report 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

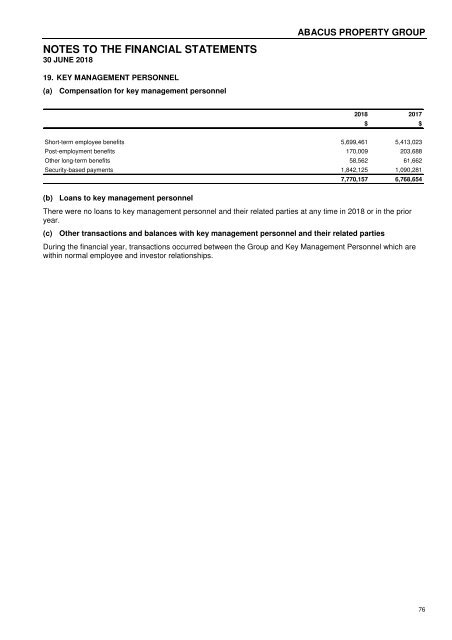

ABACUS PROPERTY GROUP<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

30 JUNE <strong>2018</strong><br />

17. COMMITMENTS AND CONTINGENCIES<br />

<strong>Abacus</strong><br />

(a) Operating lease commitments <strong>–</strong> <strong>Group</strong> as lessee<br />

The <strong>Group</strong> has entered into a commercial lease on its offices. The lease has a term of five years with an option to<br />

renew for another five years.<br />

Future minimum rentals payable under non-cancellable operating leases as at 30 June <strong>2018</strong> are as follows:<br />

<strong>2018</strong> 2017<br />

$'000<br />

$'000<br />

Within one year 1,034 1,030<br />

After one year but not more than five years 3,357 3,227<br />

More than five years - 1,163<br />

4,391 5,420<br />

(b) Operating lease commitments <strong>–</strong> <strong>Group</strong> as lessor<br />

Future minimum rentals receivable under non-cancellable operating leases as at 30 June <strong>2018</strong> are as follows:<br />

<strong>2018</strong> 2017<br />

$'000<br />

$'000<br />

Within one year 65,911 72,465<br />

After one year but not more than five years 163,353 163,080<br />

More than five years 62,749 76,649<br />

292,013 312,194<br />

These amounts do not include contingent rentals which may become receivable under certain leases on the basis<br />

of retail sales in excess of stipulated minimums and, in addition, do not include recovery of outgoings.<br />

(c) Capital and other commitments<br />

At 30 June <strong>2018</strong> the <strong>Group</strong> had numerous commitments and contingent liabilities which principally related to<br />

property acquisition settlements, loan facility guarantees for the <strong>Group</strong>'s interest in the jointly controlled property<br />

developments and funds management vehicles, commitments relating to property refurbishing costs and unused<br />

mortgage loan facilities to third parties.<br />

Commitments planned and/or contracted at reporting date but not recognised as liabilities are as follows:<br />

<strong>2018</strong> 2017<br />

$'000<br />

$'000<br />

Within one year<br />

- gross settlement of property acquisitions 15,750 -<br />

- property refurbishment costs 6,574 15,136<br />

- property development costs 19,546 11,176<br />

- unused portion of loan facilities to outside parties 35,694 28,087<br />

77,564 54,399<br />

Contingent liabilities:<br />

Within one year<br />

- corporate guarantee 3,520 18,712<br />

3,520 18,712<br />

71