Abacus Property Group – Annual Financial Report 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ABACUS PROPERTY GROUP<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

30 JUNE <strong>2018</strong><br />

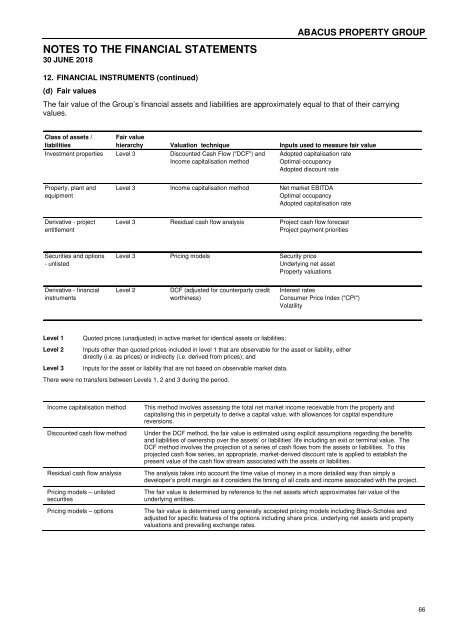

12. FINANCIAL INSTRUMENTS (continued)<br />

(a) Credit risk (continued)<br />

Credit risk exposures<br />

The <strong>Group</strong>’s maximum exposure to credit risk at the reporting date was:<br />

Carrying Amount<br />

<strong>2018</strong> 2017<br />

$'000<br />

$'000<br />

Receivables 21,145 18,457<br />

Secured property loans 330,291 346,667<br />

Other financial assets 7,987 42,543<br />

Cash and cash equivalents 103,256 56,267<br />

462,679 463,934<br />

As at 30 June <strong>2018</strong>, the <strong>Group</strong> had the following concentrations of credit risk:<br />

- Secured property loans: cross-collateralised loans which were secured by two large developments at<br />

Riverlands and Camellia and other small developments collectively represent 56% (2017: 48%) of the<br />

portfolio.<br />

Secured property loans<br />

The <strong>Group</strong> has a total investment of $330.3 million in secured property loans as at 30 June <strong>2018</strong> (2017: $346.7<br />

million). Of these loans $76.0 million has been renewed / extended beyond the original term on commercial<br />

terms (2017 $64.5 million).<br />

There was no movement in the allowance for impairment in respect of secured property loans and receivables<br />

during the year where no loans are past due and not impaired.<br />

61