Abacus Property Group – Annual Financial Report 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ABACUS PROPERTY GROUP<br />

DIRECTORS’ REPORT<br />

30 June <strong>2018</strong><br />

REMUNERATION REPORT (audited) (continued)<br />

Executive remuneration<br />

Snapshot<br />

<strong>Abacus</strong> is a high conviction investor and manager of real estate assets in the Australian and New Zealand<br />

markets.<br />

<strong>Abacus</strong>’ primary focus is to acquire long dated assets in the core sectors of self-storage and office sectors that<br />

contribute to and drive recurring earnings growth to fulfil our distribution policy. In addition, core investment<br />

opportunities in the retail and industrial sectors will also be considered at appropriate times in the property cycle.<br />

<strong>Abacus</strong> will continue on a limited scale, to invest in core plus/opportunistic investments across higher risk return<br />

projects in residential development, office, retail and industrial depending upon the nature of the opportunity, the<br />

property cycle and capital availability. The preferred funding sources for this type of investment will be within<br />

<strong>Abacus</strong>’ third party capital platform in order to achieve a higher level of investment returns.<br />

Remuneration incentives have been set up to ensure executives are not encouraged to take undue risks.<br />

Short and long dated variable remunerations are structured in such a way that different contributions by each<br />

executive can be appropriated rewarded.<br />

Long dated variable remuneration, which is subject to clawback, is linked to <strong>Abacus</strong>’ security price that reflects<br />

the market assessment of the business’s longer term ability to deliver sustainable distributions and growth.<br />

Objective<br />

The remuneration policy for executives supports the <strong>Group</strong>’s overall objective of producing sustainable earnings<br />

and continuing growth in security value.<br />

Total remuneration levels are positioned at market median, with higher rewards possible if justified by<br />

performance. The policy framework is designed to align the interests of executives and securityholders through<br />

the use of variable remuneration linked to an underlying profit gateway range and to the <strong>Abacus</strong> security price<br />

over the vesting period for deferred remuneration. The variable remuneration strategy is designed to drive<br />

sustainable and growing underlying profit that covers the distribution level implicit in the <strong>Abacus</strong> security price.<br />

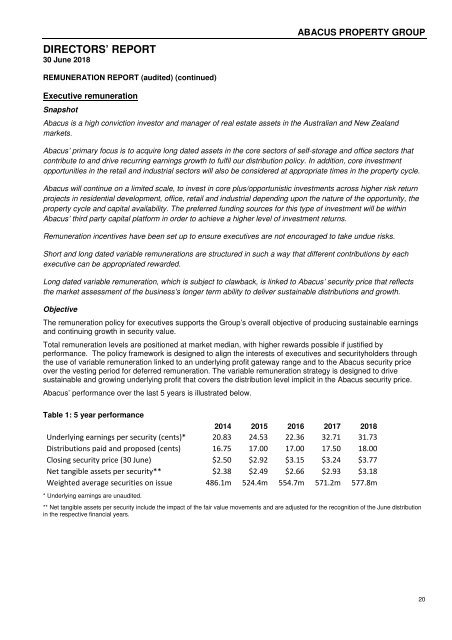

<strong>Abacus</strong>’ performance over the last 5 years is illustrated below.<br />

Table 1: 5 year performance<br />

2014 2015 2016 2017 <strong>2018</strong><br />

Underlying earnings per security (cents)* 20.83 24.53 22.36 32.71 31.73<br />

Distributions paid and proposed (cents) 16.75 17.00 17.00 17.50 18.00<br />

Closing security price (30 June) $2.50 $2.92 $3.15 $3.24 $3.77<br />

Net tangible assets per security** $2.38 $2.49 $2.66 $2.93 $3.18<br />

Weighted average securities on issue 486.1m 524.4m 554.7m 571.2m 577.8m<br />

* Underlying earnings are unaudited.<br />

** Net tangible assets per security include the impact of the fair value movements and are adjusted for the recognition of the June distribution<br />

in the respective financial years.<br />

20