Abacus Property Group – Annual Financial Report 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTORS’ REPORT<br />

30 June <strong>2018</strong><br />

ABACUS PROPERTY GROUP<br />

REMUNERATION REPORT (audited) (continued)<br />

Deferred variable remuneration (continued)<br />

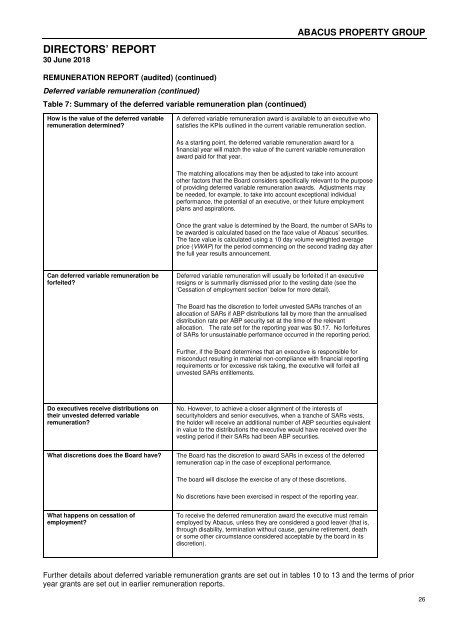

Table 7: Summary of the deferred variable remuneration plan (continued)<br />

How is the value of the deferred variable<br />

remuneration determined?<br />

A deferred variable remuneration award is available to an executive who<br />

satisfies the KPIs outlined in the current variable remuneration section.<br />

As a starting point, the deferred variable remuneration award for a<br />

financial year will match the value of the current variable remuneration<br />

award paid for that year.<br />

The matching allocations may then be adjusted to take into account<br />

other factors that the Board considers specifically relevant to the purpose<br />

of providing deferred variable remuneration awards. Adjustments may<br />

be needed, for example, to take into account exceptional individual<br />

performance, the potential of an executive, or their future employment<br />

plans and aspirations.<br />

Once the grant value is determined by the Board, the number of SARs to<br />

be awarded is calculated based on the face value of <strong>Abacus</strong>’ securities.<br />

The face value is calculated using a 10 day volume weighted average<br />

price (VWAP) for the period commencing on the second trading day after<br />

the full year results announcement.<br />

Can deferred variable remuneration be<br />

forfeited?<br />

Deferred variable remuneration will usually be forfeited if an executive<br />

resigns or is summarily dismissed prior to the vesting date (see the<br />

‘Cessation of employment section’ below for more detail).<br />

The Board has the discretion to forfeit unvested SARs tranches of an<br />

allocation of SARs if ABP distributions fall by more than the annualised<br />

distribution rate per ABP security set at the time of the relevant<br />

allocation. The rate set for the reporting year was $0.17. No forfeitures<br />

of SARs for unsustainable performance occurred in the reporting period.<br />

Further, if the Board determines that an executive is responsible for<br />

misconduct resulting in material non-compliance with financial reporting<br />

requirements or for excessive risk taking, the executive will forfeit all<br />

unvested SARs entitlements.<br />

Do executives receive distributions on<br />

their unvested deferred variable<br />

remuneration?<br />

No. However, to achieve a closer alignment of the interests of<br />

securityholders and senior executives, when a tranche of SARs vests,<br />

the holder will receive an additional number of ABP securities equivalent<br />

in value to the distributions the executive would have received over the<br />

vesting period if their SARs had been ABP securities.<br />

What discretions does the Board have?<br />

The Board has the discretion to award SARs in excess of the deferred<br />

remuneration cap in the case of exceptional performance.<br />

The board will disclose the exercise of any of these discretions.<br />

No discretions have been exercised in respect of the reporting year.<br />

What happens on cessation of<br />

employment?<br />

To receive the deferred remuneration award the executive must remain<br />

employed by <strong>Abacus</strong>, unless they are considered a good leaver (that is,<br />

through disability, termination without cause, genuine retirement, death<br />

or some other circumstance considered acceptable by the board in its<br />

discretion).<br />

Further details about deferred variable remuneration grants are set out in tables 10 to 13 and the terms of prior<br />

year grants are set out in earlier remuneration reports.<br />

26