Steel Market 01 / 2020

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

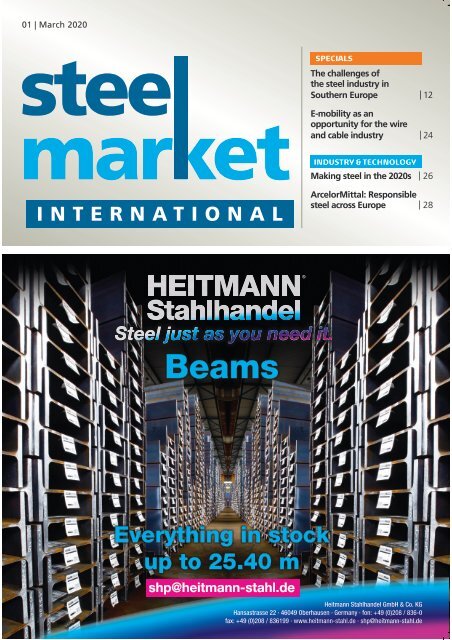

<strong>01</strong> | March <strong>2020</strong><br />

SPECIALS<br />

The challenges of<br />

the steel industry in<br />

Southern Europe | 12<br />

E-mobility as an<br />

opportunity for the wire<br />

and cable industry | 24<br />

INDUSTRY & TECHNOLOGY<br />

Making steel in the <strong>2020</strong>s | 26<br />

INTERNATIONAL<br />

ArcelorMittal: Responsible<br />

steel across Europe | 28<br />

®<br />

Beams<br />

Everything in stock<br />

up to 25.40 m<br />

shp@heitmann-stahl.de<br />

Heitmann Stahlhandel GmbH & Co. KG<br />

Hansastrasse 22 · 46049 Oberhausen · Germany · fon: +49 (0)208 / 836-0<br />

fax: +49 (0)208 / 836199 · www.heitmann-stahl.de · shp@heitmann-stahl.de

Structural Hollow Sections<br />

Warm / Cold<br />

Everything in stock<br />

up to 18.10 m<br />

shp@heitmann-stahl.de<br />

Heitmann Stahlhandel GmbH & Co. KG<br />

Hansastrasse 22 · 46049 Oberhausen · Germany · fon: +49 (0)208 / 836-0<br />

fax: +49 (0)208 / 836199 · www.heitmann-stahl.de · shp@heitmann-stahl.de

Editorial<br />

»Climate-neutral steel production will<br />

fundamentally change the industry.<br />

Even a virus won‘t be able to change that.«<br />

Dear readers,<br />

Within the steel industry a lot of<br />

thought is put into current challenges<br />

– trade wars and punitive<br />

tariffs, rising raw material prices,<br />

the automobile industry’s declining<br />

sales figures, investments to<br />

tackle climate change, opportunities<br />

and risks of digitalisation. Then,<br />

suddenly, a small virus, called SARS-<br />

CoV-2, enters the scene and makes everything<br />

else take a back seat. International<br />

trade shows are being postponed, entire plants are<br />

closing down and supply chains are being disrupted.<br />

What does all this mean? Will the global economy collapse<br />

or will we get away with a slight cold? The full<br />

scale of the consequences won’t reveal itself for another<br />

couple of weeks or even months.<br />

Philipp Isenbart,<br />

editor-in-chief<br />

In this issue, we will focus on the industry’s ongoing challenges<br />

because they will soon catch up with us again.<br />

One concern is the situation in Southern Europe, especially<br />

in Italy. Credit insurance expert Coface describes it<br />

as »very risky« (page 12). We’ll also look at the pipe and<br />

wire industries, which are undergoing exciting developments<br />

(page 24). Exclusive statements by the CEOs of<br />

XOM Materials (page 34) and Van Leeuwen (page 36)<br />

give insights into new trends in the trade. But before<br />

trade comes production: several articles take a closer<br />

look at the future of climate-neutral steel production<br />

(pages 26, 28, 30). This topic will fundamentally change<br />

the industry over the next couple of years. Even a virus<br />

won’t be able to change that.<br />

On this note, I hope you’ll enjoy reading this issue – and<br />

above all, stay healthy!<br />

<strong>01</strong> | <strong>2020</strong> 3

Contents <strong>01</strong> | <strong>2020</strong><br />

12<br />

SPECIAL: Italy and Southern Europe<br />

The two Coface experts Marcos Carias (left)<br />

and Christiane von Berg took a close<br />

look at the steel industry in Southern<br />

Europe.<br />

28<br />

INDUSTRY & TECHNOLOGY<br />

ArcelorMittal aims to produce steel in<br />

a climate-neutral manner. The photo<br />

shows the Midrex plant in Hamburg,<br />

Germany.<br />

INDUSTRY & TECHNOLOGY<br />

News<br />

6 Hot metal desfurization and dedusting<br />

system successfully commissioned at<br />

ArcelorMittal Monlevade<br />

7 Sublance system for Tangshan Reafon<br />

and Hegang Laoting<br />

8 Coke oven gas injection systems for<br />

ROGESA‘ s blast furnaces<br />

9 Global <strong>Steel</strong> Wire places order for<br />

a Six-Strand Billet Caster<br />

10 Al Gharbia commissions new LSAW<br />

large-diameter pipe mill<br />

11 Jindal Stainless modernises solution<br />

for AOD converters<br />

Worldwide<br />

26 Making steel in the <strong>2020</strong>s<br />

27 Kentucky: Nucor Corporation is<br />

investing in a new mill<br />

28 ArcelorMittal: Responsible steel<br />

across Europe<br />

30 H2FUTURE: voestalpine‘s »green« hydrogen<br />

pilot facility commences operation<br />

31 SSAB initiates study in Finland<br />

32 Phase-out of mineral oil /<br />

phase-in of metals?<br />

TRADE & SERVICE<br />

33 thyssenkrupp invests in customer<br />

shopping experience<br />

SPECIALS<br />

Italy and Southern Europe<br />

12 Interview: The challenges of the steel<br />

industry in Southern Europe<br />

15 »Consumption level back to normal«<br />

16 The future of the Ilva steelworks<br />

is still uncertain<br />

18 New combustion system for<br />

ArcelorMittal Asturias<br />

19 Caleotto: Feralpi to take over<br />

Duferco’s holding<br />

wire & Tube <strong>2020</strong><br />

20 New date for wire and Tube<br />

Düsseldorf<br />

21 Energy-efficient systems for heat<br />

transfer are in demand<br />

22 wire+Tube – a brief history of a<br />

worldwide success<br />

24 Increasingly electrified<br />

34 Interview: »Room for improvement«<br />

36 The Van Leeuwen Pipe and Tube Group<br />

has purchased Benteler Distribution<br />

STANDARDS<br />

5 World crude steel production<br />

38 People<br />

39 Advertiser’s index<br />

42 In the next issue / Imprint<br />

Copyright: Coface; ArcelorMittal<br />

4 <strong>01</strong> | <strong>2020</strong>

World crude steel production<br />

24<br />

January January % change<br />

6 Months<br />

<strong>2020</strong> 2<strong>01</strong>9 January 20/19 <strong>2020</strong> 2<strong>01</strong>9<br />

(1) - HADEED only.<br />

(2) - the 64 countries included in this table accounted for approximately 99% of total world crude steel production in 2<strong>01</strong>8.<br />

e - estimated<br />

% change<br />

Austria 631 685 -8,0 631 685 -8,0<br />

Belgium 505 e 635 -20,5 505 635 -20,5<br />

Bulgaria 45 e 45 1,1 45 45 1,1<br />

Croatia 10 e 16 -37,8 10 16 -37,8<br />

Czech Republic 400 440 -9,1 400 440 -9,1<br />

Finland 332 330 0,6 332 330 0,6<br />

France 1 294 1 238 4,5 1 294 1 238 4,5<br />

Germany 2 845 e 3 455 -17,7 2 845 3 455 -17,7<br />

Greece 95 e 124 -23,4 95 124 -23,4<br />

Hungary 165 e 156 5,8 165 156 5,8<br />

Italy 1 874 1 971 -4,9 1 874 1 971 -4,9<br />

Luxembourg 100 e 189 -47,1 100 189 -47,1<br />

Netherlands 598 617 -3,2 598 617 -3,2<br />

Poland 640 e 845 -24,2 640 845 -24,2<br />

Slovenia 55 e 58 -4,9 55 58 -4,9<br />

Spain 760 e 1 152 -34,0 760 1 152 -34,0<br />

Sweden 425 462 -8,1 425 462 -8,1<br />

United Kingdom 666 606 9,8 666 606 9,8<br />

Other E.U. (28) (e) 855 e 941 -9,1 855 941 -9,1<br />

European Union (28) 12 293 13 964 -12,0 12 293 13 964 -12,0<br />

Bosnia-Herzegovina 70 e 72 -2,7 70 72 -2,7<br />

Macedonia 25 e 18 37,5 25 18 37,5<br />

Norway 62 60 2,9 62 60 2,9<br />

Serbia 135 176 -23,3 135 176 -23,3<br />

Turkey 3 <strong>01</strong>4 2 569 17,3 3 <strong>01</strong>4 2 569 17,3<br />

Europe 3 306 2 895 14,2 3 306 2 895 14,2<br />

Byelorussia 230 e 216 6,5 230 216 6,5<br />

Kazakhstan 350 e 217 61,3 350 217 61,3<br />

Moldova 20 e 12 66,7 20 12 66,7<br />

Russia 6 000 e 6 256 -4,1 6 000 6 256 -4,1<br />

Ukraine 1 843 1 850 -0,4 1 843 1 850 -0,4<br />

Uzbekistan 50 e 46 8,7 50 46 8,7<br />

C.I.S. (6) 8 493 8 597 -1,2 8 493 8 597 -1,2<br />

Canada 1 090 e 1 166 -6,5 1 090 1 166 -6,5<br />

Cuba 20 e 19 6,8 20 19 6,8<br />

El Salvador 10 e 8 17,8 10 8 17,8<br />

Guatemala 25 e 26 -3,9 25 26 -3,9<br />

Mexico 1 375 e 1 636 -15,9 1 375 1 636 -15,9<br />

United States 7 707 7 518 2,5 7 707 7 518 2,5<br />

North America 10 227 10 373 -1,4 10 227 10 373 -1,4<br />

Argentina 298 371 -19,6 298 371 -19,6<br />

Brazil 2 680 3 <strong>01</strong>5 -11,1 2 680 3 <strong>01</strong>5 -11,1<br />

Chile 110 e 81 35,0 110 81 35,0<br />

Colombia 95 e 96 -1,5 95 96 -1,5<br />

Ecuador 50 e 51 -1,6 50 51 -1,6<br />

Paraguay 5 e 2 131,2 5 2 131,2<br />

Peru 90 e 1<strong>01</strong> -10,6 90 1<strong>01</strong> -10,6<br />

Uruguay 5 e 6 -22,7 5 6 -22,7<br />

Venezuela 0 e 4 -100,0 0 4 -100,0<br />

South America 3 333 3 728 -10,6 3 333 3 728 -10,6<br />

Egypt 575 e 722 -20,4 575 722 -20,4<br />

Libya 65 e 29 123,7 65 29 123,7<br />

South Africa 398 e 521 -23,7 398 521 -23,7<br />

Africa 1 038 1 272 -18,4 1 038 1 272 -18,4<br />

Iran 2 895 e 1 971 46,9 2 895 1 971 46,9<br />

Qatar 230 221 3,9 230 221 3,9<br />

Saudi Arabia (1) 412 469 -12,2 412 469 -12,2<br />

United Arab Emirates 303 304 -0,3 303 304 -0,3<br />

Middle East 3 841 2 966 29,5 3 841 2 966 29,5<br />

China 84 269 e 78 594 7,2 84 269 78 594 7,2<br />

India 9 288 9 591 -3,2 9 288 9 591 -3,2<br />

Japan 8 244 8 142 1,3 8 244 8 142 1,3<br />

South Korea 5 753 6 252 -8,0 5 753 6 252 -8,0<br />

Pakistan 260 e 255 2,0 260 255 2,0<br />

Taiwan, China 1 700 e 1 990 -14,6 1 700 1 990 -14,6<br />

Thailand 365 e 340 7,3 365 340 7,3<br />

Vietnam 1 530 e 1 746 -12,4 1 530 1 746 -12,4<br />

Asia 111 409 106 909 4,2 111 409 106 909 4,2<br />

Australia 440 468 -5,9 440 468 -5,9<br />

New Zealand 55 56 -1,6 55 56 -1,6<br />

Oceania 495 523 -5,4 495 523 -5,4<br />

Total 64 countries (2) 154 436 151 228 2,1 154 436 151 228 2,1<br />

<strong>01</strong> | <strong>2020</strong> 5

Industry & Technology<br />

News<br />

Hot metal desfurization and dedusting system successfully<br />

commissioned at ArcelorMittal Monlevade<br />

ArcelorMittal Monlevade has commenced operation<br />

of a 130-tonne-hot-metal desulfurization station<br />

(DeS) and a new dedusting system supplied by Primetals<br />

Technologies. The desulfurization station represents<br />

the first installation of Primetals Technologies<br />

combining a volumetric dosing device for Magnesium<br />

(Mg) and a pressure dispenser for Calcium Oxide<br />

(CaO). Low sulfur levels of lesser than 0.005%<br />

(50ppm) can be achieved. The consumption of desulfurization<br />

agents is significantly reduced and processing<br />

times are reduced to less than 30 minutes compared<br />

to treatment in a torpedo car. A handling system<br />

for 130-t-hot-metals ladles was also part of the<br />

project. The new equipment is part of an expansion<br />

and quality improvement program at ArcelorMittal<br />

Monlevade.<br />

Danieli to modernize the Algoma steel plate mill in Ontario<br />

Danieli, along with Danieli Automation<br />

and Danieli Taranis, are the<br />

supplier team chosen for a complete<br />

upgrade of the 166-in. wide plate<br />

mill of Algom a <strong>Steel</strong> in Sault Ste.<br />

Maire, Ontario. The project will allow<br />

Algoma to expand its product portfolio<br />

to include wider plate products,<br />

to better control shape and surface<br />

quality and to improve logistics –<br />

making it possible to offer enhanced<br />

ship on time performance. The plant<br />

will be completely re-automated by<br />

Danieli Automation from Level 0<br />

through to Level 2 systems. Along<br />

with new process equipment and new<br />

digital drives, this will allow Algoma to<br />

perform normalized – or controlled<br />

– rolling, so that it can supply new<br />

grades of plate to the shipbuilding,<br />

energy and bridge building sectors.<br />

Additionally, Danieli Taranis will provide<br />

engineering and post-commissioning<br />

support. Danieli’s scope of<br />

work will include an overhaul of the<br />

complete plant automation system<br />

and the installation of a new primary<br />

de-scaler, a new hot-leveler and a<br />

new cooling bed. A new dividing<br />

shear, piling system, ‚top-to-bottom‘<br />

automated inspection system and<br />

plate marking machine will upgrade<br />

the finishing area.<br />

New AOD converter torque retainer from SMS group<br />

For North American Stainless (NAS) in Ghent, Kentucky, SMS group has commissioned a torque retainer for<br />

the 160-tonne AOD converter no. 1. The aim of the revamp was to reduce the torque that had previously been<br />

causing uncontrolled vibrations and damage to the bull gear, bearings, and foundations of the converter drive<br />

during AOD converter operation. As a result, the uncontrolled vibrations in the gear unit and converter vessel<br />

were substantially reduced. The target values were achieved under production conditions shortly after commissioning.<br />

SMS group supplied the torque retainer as a compact electrohydraulic unit. The scope of supply also<br />

included the engineering, supervision of the erection and installation work, and technical assistance during<br />

commissioning. Both the cold and hot commissioning were completed jointly with the customer.<br />

First coil at Nucor <strong>Steel</strong> Gallatin‘s pickling and galvanizing line<br />

Pickling and galvanizing of the first coil in September<br />

2<strong>01</strong>9, marked the production start of the new »heatto-coat«<br />

process line at Nucor <strong>Steel</strong> Gallatin in Ghent,<br />

Kentucky. SMS group delivered the whole line, and<br />

notes that the »heat-to-coat« technology is characterized<br />

by the compact and operator-friendly U-shape<br />

design, the turbulence pickling system, the high-power<br />

inductive heating system, the FOEN galvanizing equipment<br />

and the Drever after-pot cooling system. The line<br />

is designed to produce 500,000 tonnes of galvanized<br />

hot strip per year with a maximum capacity of 180 tonnes<br />

per hour and a large strip cross section (up to 6.35<br />

millimeter thickness and up to 1,854 millimeter width),<br />

which sets a new standard in hot strip galvanizing. The<br />

»heat-to-coat« process based on SMS patented technology<br />

permits the production of galvanized steel strip<br />

with durable corrosion protection, an appealing visual<br />

appearance, as well as an increased mechanical<br />

load-capacity while still maintaining low production<br />

and investment costs, SMS group says.<br />

6 <strong>01</strong> | <strong>2020</strong>

News<br />

Industry & Technology<br />

North Star BlueScope <strong>Steel</strong>: Single-strand continuous caster<br />

North Star BlueScope <strong>Steel</strong>, located in Delta, Ohio, has selected SMS group as the supplier for its new singlestrand<br />

thin-slab continuous caster. The new casting machine will have a thickness range of 95 to 110 millimeters<br />

and a width range of 900 to 1,595 millimeters. It will allow North Start BlueScope <strong>Steel</strong> to increase<br />

thin-slab production from 2.2 million tonnes (2.4 million short tons) to over 3.3 million tonnes (3.6 million<br />

short tons) per year. To digitalize the casting process, SMS group is going to supply a range of innovative<br />

technology packages. The new casting machine will be equipped with X-Pact ® Width Control, X-Pact Solid<br />

Control that includes width-dependent air-mist secondary cooling and solidification control, Level 2 X-Pact<br />

Cast Optimizer and the HD mold mold monitoring system.<br />

Sublance system for Tangshan Reafon and Hegang Laoting<br />

Danieli Corus has signed two contracts<br />

for in total four sublance<br />

systems to be installed in China.<br />

Tangshan Reafon Iron & <strong>Steel</strong> has<br />

contracted Danieli Corus to implement<br />

a sublance-based BOF process<br />

control system with SDM Process<br />

Model for one of the 210-ton converters<br />

at the Tangshan, Hebei<br />

plant. Hegang Laoting ordered<br />

three sublance systems with SDM<br />

Process Model and ASCON slag<br />

control system, to be implemented<br />

at the 120-ton converters of BOF<br />

Shop No. 2 at their plant in the Laoting<br />

Economic Development Area,<br />

Danieli‘s DMS SkinPass 4Hi at SDI in Pittsburgh<br />

Hebei Province. This order follows<br />

those placed by Hegang Laoting<br />

for the supply of three systems for<br />

BOF Plant No. 1, in 2<strong>01</strong>8 and 2<strong>01</strong>9.<br />

Copyright: Danieli<br />

<strong>Steel</strong> Dynamics ordes skin-pass mill from Fives<br />

<strong>Steel</strong> Dynamics, Inc. (SDI) has selected Fives for a high<br />

efficiency skin-pass mill - DMS SkinPass 4Hi - at the<br />

GalvTech facility of its Techs Division in Pittsburgh,<br />

Pennsylvania. For high quality strip finishing, a skinpass<br />

mill is essential to remove the yield-point elongation<br />

effect and greatly improve the surface roughness<br />

and flatness. The DMS SkinPass 4Hi, a new skin-pass<br />

mill from Fives, is designed to improve performance<br />

and surface quality of a continuous galvanizing line.<br />

The mill is a wet process type with a maximum rolling<br />

force of 5500 kN. SDI and Fives ignited a preferred<br />

partnership last year, having signed a major contract<br />

for the design and supply of a new continuous galvanizing<br />

line (CGL No. 3) and an upgrade of the continuous<br />

galvanizing line (CGL No. 2), both located in Columbus,<br />

Mississippi.<br />

Now Arvedi ESP line to steel producer in Hebei Province<br />

A Chinese steel producer located in Hebei Province has placed an order with Primetals Technologies for the supply<br />

of an Arvedi ESP (Endless Strip Production) line. The casting-rolling facility will be part of a new steelmaking<br />

facility with one BOF currently under construction. The Arvedi ESP line is capable of rolling strip to a reproducible<br />

strip thicknesses down to 0.7 mm, The Arvedi ESP plant will allow the steel producer to better serve the highly<br />

attractive local and export markets for high-quality, thin-gauge strip products, Primetals notes, adding that the<br />

180-meter-long plant is far more compact than conventional casting and rolling mills. According to news service<br />

Kallanish <strong>Steel</strong>, the customer is Taihang Iron & <strong>Steel</strong>.<br />

<strong>01</strong> | <strong>2020</strong> 7

Industry & Technology<br />

News<br />

World‘s largest clutch-operated screw press<br />

AVIC Shaanxi Hongyuan Aviation<br />

Forging Co., Ltd. has put the world‘s<br />

largest clutch-operated screw<br />

press into operation at its site in<br />

Xi’an, Shaanxi Province. The<br />

SPKA-type clutch-operated screw<br />

press, which was supplied by SMS<br />

group, has a screw diameter of<br />

1,330 millimeters, a hard-on-hard<br />

blow force of 365 MN, a gross power<br />

of 27,000 kJ and a weight of<br />

2,900 tonnes. It is already the worldwide<br />

third clutch-operated screw<br />

press of this size supplied by SMS<br />

group, and with its performance<br />

data exceeds the other two existing<br />

presses delivered before.<br />

The clutch-operated screw press<br />

requires far less stroke to achieve<br />

the preset ram speed than a conventional<br />

slipping-wheel screw<br />

press. The maximum ram speed is<br />

attained after just 10% of the ram<br />

stroke, and remains at a constant<br />

level until the ram hits the part<br />

being forged. This type of press is<br />

particularly suitable for high-energy<br />

forging as typically used for turbine<br />

blades or structural aircraft<br />

components, for example.<br />

Quenching and HSD lines successfully commissioned<br />

Quenching and HSD lines from SMS group at Daehan Sinpyeong. South Korean Daehan <strong>Steel</strong> Co., Ltd.<br />

has re-started production with new SMS group quenching and high-speed lines following the successful<br />

modernization of the Sinpyeong bar mill. The Final Acceptance Certificate (FAC) was signed two months<br />

ahead of the original schedule, SMS group notes. The main target of the modernization was to reduce the<br />

ferro-alloys content in the billets, which results in a substantial reduction in production costs. The upgrade<br />

also aimed to improve the production efficiency with a product range from 16 to 35 millimeters rebar and<br />

steel grades up to SD600.<br />

Coke oven gas injection systems for ROGESA‘ s blast furnaces<br />

ROGESA Roheisengesellschaft Saar mbH, the pig iron<br />

plant in Germany’s state of Saarland, owned jointly by<br />

Dillinger Hütten und Saarstahl, has awarded Paul<br />

Wurth with the order to design and supply coke oven<br />

gas injection systems for the company’s blast furnaces<br />

No. 4 and No. 5. With this new technology, coke oven<br />

gas will become a metallurgical process gas instead of<br />

being used to produce energy at a low efficiency level.<br />

In its new role, coke oven gas will partially replace<br />

both pulverized coal and metallurgical coke as reducing<br />

agents in the blast furnace process, thus contributing<br />

to reducing the carbon intensity in the blast<br />

furnace as well as the carbon footprint of the overall<br />

ironmaking operations.<br />

ROGESA, the pig iron plant in Saarland, Germany<br />

Copyright: ROGESA<br />

World‘s first DUE plant commissioned<br />

Danieli is currently commissioning the world’s first DUE<br />

plant at Shougang Jingtang, Caofeidian Industrial Area,<br />

Tangshan city, Hebei province. This new concept in thinslab<br />

casting and rolling unifies all the winning features<br />

that have been demonstrated up to now in a single production<br />

line, using either endless or coil-to-coil rolling in<br />

separate production lines while eliminating the limiting<br />

factors of each. The single-strand thin-slab caster regularly<br />

produces slabs reduced from 130 mm (mould exit)<br />

to 110 mm (TSC exit), using Danieli’s Dynamic Soft<br />

Reduction technology. Coil-to-coil rolling is already a<br />

consolidated production practice as is semi-endless<br />

rolling, the latter being the natural step to achieve the<br />

true casting/rolling functionality in endless mode.<br />

8 <strong>01</strong> | <strong>2020</strong>

News<br />

Industry & Technology<br />

Global <strong>Steel</strong> Wire places order for a Six-Strand Billet Caster<br />

Global <strong>Steel</strong> Wire S.A. (Celsa Group), located in Santander, Spain, has placed the order for the upgrade of their continuous<br />

billet casting machine with SMS Concast. <strong>Steel</strong> production at Global <strong>Steel</strong> Wire S.A. (GSW) is focused on wire rod in special<br />

steel grades for the automotive and special engineering industries. Currently, the existing caster produces roughly<br />

900,000 tonnes of steel per year in 180 millimeter square sections. The aim of the modernization is to increase the production<br />

flexibility by broadening the range of cast formats by the addition of 200 to 240 millimeter square sections, increasing<br />

the casting speeds, and consequently enhancing the productivity and the quality of the cast products. The upgrade is<br />

to be implemented with minimized interruption of production. The start-up of the upgraded machine is scheduled for<br />

early 2021. The order includes the installation of CONDRIVE mold oscillation drive systems on all strands. CONDRIVE has<br />

already been tested and has been successfully running on one strand at Global <strong>Steel</strong> Wire since October 2<strong>01</strong>8.<br />

Ural <strong>Steel</strong> selects Danieli DANCU Technology for BF modernization<br />

As part of a large scale, technical<br />

overhaul project on Blast Furnaces No.<br />

2 and 3 at the Ural <strong>Steel</strong> plant in Novotroitsk,<br />

Russian steel producer Metalloinvest<br />

has selected Danieli technology<br />

to upgrade Blast Furnace No.<br />

3’s charging system. The furnace will<br />

be equipped with a modern chutetype<br />

distributor based on hydraulics<br />

for maximum reliability and availability.<br />

The Danieli distributor (DANCU) has<br />

only a few moving parts, and it is the<br />

most straightforward, robust design<br />

in the industry. All main components<br />

are either failure-free or redundant,<br />

ensuring unparalleled reliability. To<br />

allow implementation without large-scale<br />

modifications to the existing<br />

top structure of Ural <strong>Steel</strong> plant’s Blast<br />

Furnace No. 3, Danieli Centro Metallics<br />

and Danieli Corus have developed<br />

the Compact DANCU, which has a<br />

slightly shorter maximum chute<br />

length, the plantbuilder underlines.<br />

Copyright: Danieli<br />

Danieli‘s DANCU at Ural <strong>Steel</strong><br />

in Novotroitsk<br />

Sublance systems for Severstal Cherepovets<br />

Severstal has contracted Danieli Corus to design and supply three sublance systems for three 350t converters at the<br />

BOF Shop at Cherepovets. Danieli Corus is the market leader in sublance-based BOF process control, and the implementation<br />

of this technology will contribute to Severstal’s objective of achieving lower steel production costs while<br />

maintaining efficiency and quality. Sublance technology, in combination with a state-of-the-art process model, enables<br />

shorter tap-to-tap times, higher hit rates and reduced consumption of oxygen, energy and flux materials, while<br />

improving operating conditions. Danieli Corus systems have a proven, unparalleled capability of trouble-free operation<br />

for multiple decades in the hostile environment above the converter hood.<br />

China’s Jingye Group will be taking over<br />

certain assets of British <strong>Steel</strong><br />

According to a statement from the UK Official Receiver’s<br />

(OR) office, »the Official Receiver and Special<br />

Managers from EY can confirm that a sales contract has<br />

been entered into with Jingye <strong>Steel</strong> (UK) Ltd and Jingye<br />

<strong>Steel</strong> (UK) Holding Ltd (together, Jingye), to acquire the<br />

business and assets of British <strong>Steel</strong> Limited (BSL), including<br />

the steelworks at Scunthorpe, UK mills and shares<br />

of FN <strong>Steel</strong> BV, British <strong>Steel</strong> France Rail SAS and TSP Engineering.«<br />

British <strong>Steel</strong> had entered administration in<br />

May when former owners Greybull Capital had declared<br />

the company as bankrupt. It has since continued to operate<br />

under the direction of special managers appointed<br />

by the UK government’s OR. »Jingye plans to invest £1.2<br />

billion in the business over the next decade in upgrading<br />

the plants and machinery, improving the new company’s<br />

environmental performance and boosting energy efficiency<br />

to place the operations on a more competitive<br />

and sustainable footing,« the Chinese steelmaker says.<br />

<strong>01</strong> | <strong>2020</strong> 9

Industry & Technology<br />

News<br />

Al Gharbia commissions new LSAW large-diameter pipe mill<br />

Arab steel producer, Al Gharbia<br />

Pipe Company, has commissioned<br />

a new Longitudinal Submerged<br />

Arc Welded (LSAW) large-diameter<br />

pipe mill in the Khalifa Industrial<br />

Zone Abu Dhabi (KIZAD). A<br />

consortium built it with Larsen &<br />

Toubro and SMS group as the<br />

contractor for engineering, procurement<br />

and construction (EPC).<br />

The plant is designed for a production<br />

capacity of 240,000 metric<br />

tons per year. The products<br />

manufactured are mainly designed<br />

for onshore & offshore<br />

line pipes including sour gas applications.<br />

Al Gharbia intends to<br />

produce pipes with a length of<br />

up to 12.2 meters and an outer<br />

diameter of 18 to 56 inches.<br />

Material qualities up to X80 will<br />

be processed, with a maximum<br />

wall thickness of 44.5 millimetres.<br />

One of the production line’s special<br />

features is the JCO tube forming<br />

process developed by SMS group.<br />

According to the company, the<br />

operator can quickly change to<br />

other tube dimensions and produce<br />

small batch sizes.<br />

Grange Resources receives steel plate conveyor from Aumund<br />

Australian company Grange Resources recently replaced its belt conveyor at its Port Latte pellet plant<br />

with a steel plate conveyor from Aumund. According to the German conveyor engineers, the new belt<br />

conveyor is designed for hot material (KZB-H) of up to 1000 °C. This enables the hot iron ore pellets to be<br />

transported continuously and trouble-free from the shaft furnace to the condenser. Grange Resources<br />

intends to use this measure to avoid regular plant shutdowns. These were previously unavoidable because<br />

the belts of the old plant required replacing approximately every 40 days. It also increased productions<br />

costs. According to Aumund, commissioning is expected to take place in May of this year.<br />

Spain: Acerinox relies on torque support from SMS group<br />

SMS group has commissioned a torque arm for the<br />

120-ton AOD converter No. 2 at Acerinox Europa in<br />

Cádiz, Spain. The conversion aimed to minimise the<br />

destructive forces acting on the gear unit, bearings<br />

and foundation during operation of the converter. By<br />

using the new electrohydraulic torque support, it was<br />

also possible to achieve a significant reduction of the<br />

uncontrolled vibrations of the gear unit and the converter<br />

vessel, says SMS group. According to them, the<br />

target values concerning the reduction of the torque<br />

were exceeded only a short time after commissioning.<br />

Gear unit of an AOD converter with vertical torque support<br />

Copyright: SMS group<br />

Noodle.ai and SMS digital launch AI-driven<br />

application for the steel industry<br />

The Mechanical Properties Variability (MPV) application<br />

has created the possibility to get a grip on the variability of<br />

mechanical material properties in the steel production<br />

process. The new approach, created by Noodle.ai and SMS<br />

digital, is based on the ability to »sense« correlations using<br />

artificial intelligence (AI). The application makes predictions<br />

and concrete recommendations. The focus lies on a<br />

property’s yield strength, tensile strength and elongation.<br />

The application detects patterns within the recorded production<br />

data and can identify causes for deviations from<br />

the required mechanical material properties. It can predict<br />

when major fluctuations occur and specify the input parameters<br />

and PDI settings. Using the Process Data Input<br />

(PDI), the specified values for the material property’s yield<br />

strength, tensile strength and elongation can be set. As a<br />

result, the MPV application can help steel manufacturers<br />

save costs in several ways, e.g. by reducing alloying costs<br />

through better control of variability.<br />

10 <strong>01</strong> | <strong>2020</strong>

News<br />

Industry & Technology<br />

Posco SS Vina from Vietnam sells rebar rolling mill<br />

Vietnamese company Posco SS Vina has sold its rebar rolling mill to Hilco Industrial Acquisitions. Danieli delivered the mill<br />

in 2<strong>01</strong>5. It consists among other things of a walking-beam furnace, 18 mill stands and a cold shear. Posco SS Vina intends<br />

to concentrate its remaining section mill on the manufacture of products such as H-beams. In December last year, it was<br />

already announced that the Japanese Yamato Kogyo Group had acquired a 49 per cent stake in the company.<br />

NLMK and Paul Wurth complete relining of blast furnace<br />

Blast furnace no. 6 at the NLMK<br />

Group’s main plant in Lipetsk, Russia,<br />

has been completely relined. It has a<br />

frame diameter of 12 meters and a<br />

useful volume of 3,813 cubic meters. It<br />

is equipped with 32 blowing moulds<br />

and designed for a nominal output of<br />

3.4 million tons of pig iron per year.<br />

The new blast furnace designed and<br />

equipped by Paul Wurth has now<br />

been blown in. The supplies included<br />

the blast furnace steel jacket and the<br />

hearth using super-microporous carbon<br />

material and a ceramic cup. The<br />

company also provided all other refractory<br />

materials, cooling elements,<br />

tuyères and their cooling rings.<br />

Furthermore, it supplied low-energy<br />

blast connections and a completely<br />

new hot blast ring pipe. Also, the original<br />

Bell Less Top (BLT) system, which<br />

was the first installation of this kind in<br />

the former Soviet Union, was modernised<br />

in 1978.<br />

Photo: Paul Wurth<br />

The new blast furnace No. 6 at NLMK in<br />

Lipetsk, Russia<br />

Jindal Stainless modernises solution for AOD converters<br />

Primetals Technologies has commissioned a new Level 2<br />

system at Jindal Stainless on AOD converter No. 1. According<br />

to a press release, initial experiences in operation<br />

have shown that production processes are much more<br />

stable. The core of this level 2 process automation is a<br />

dynamic process model, which enables both a preliminary<br />

calculation and an online simulation of the process. According<br />

to Primetals, errors can be avoided by pre-calculating<br />

the melts, as the feed materials can be prepared in<br />

good time. »The exact calculation of the temperature and<br />

coal flow during production in real-time improves the<br />

process accuracy and the quality of the stainless steel produced«,<br />

the company writes. A further advantage of the<br />

modernisation is a »Digital Twin« through which all-important<br />

process data will be collected. This data can be<br />

used for further optimisation or new development.<br />

China <strong>Steel</strong> Corporation upgrades RH plant in Kaoshiung<br />

Taiwanese steel producer China<br />

<strong>Steel</strong> Corporation (CSC) has placed<br />

an order with SMS Mevac for the<br />

modernisation of the oldest RH<br />

plant in its Kaoshiung steelworks.<br />

CSC uses it the plant for hydrogen<br />

degassing to produce a high-quality<br />

heavy plate. SMS Mevac will<br />

equip the plant with a new<br />

four-stage steam jet vacuum<br />

pump. As a result of the increase<br />

in suction capacity up to 600 kilograms<br />

per hour at 0.67 mbar,<br />

plant leaks can be more easily<br />

Source: SMS group<br />

compensated, according to SMS<br />

group. Also, shorter evacuation<br />

times will be achieved. Furthermore,<br />

the new vacuum pump can<br />

be operated with condensation<br />

temperatures of up to 38 °C. This<br />

increases the flexibility of the RH<br />

plant, especially during hot summer<br />

months.<br />

A new steam jet vacuum pump<br />

will ensure greater efficiency and<br />

flexibility at CSC.<br />

<strong>01</strong> | <strong>2020</strong> 11

Special<br />

Italy and Southern Europe<br />

»Very risky«<br />

The challenges of the steel industry in Southern Europe<br />

What is the situation of the steel industry in Southern Europe, especially in Italy and Spain?<br />

What are the challenges, and where lie the opportunities and prospects? Two Coface experts,<br />

Marcos Carias, economist for Southern Europe, and Christiane von Berg, economist for Northern<br />

Europe, took a close look at the industry. The two credit insurer’s experts describe their findings<br />

in an interview with <strong>Steel</strong> <strong>Market</strong> European Edition.<br />

How do you assess the situation in<br />

the South European steel industry?<br />

Christiane von Berg: The industry is in a<br />

very difficult situation worldwide, but<br />

the steel sector is showing particularly<br />

worrying signs in Southern Europe. Both<br />

Spain and Italy have seen their strongest<br />

monthly decline in output in recent<br />

times: -26% in August for Italy and -27%<br />

in December for Spain. Though much of<br />

this is due to the sluggish state of global<br />

and European growth, it is worth noting<br />

that these numbers are even worse than<br />

during the worst months of the global<br />

financial crisis in 08-09, or the Eurozone<br />

crisis in 2<strong>01</strong>1-2<strong>01</strong>3.<br />

Why is this the case? For one, the<br />

»disappointing but not quite terrible«<br />

aggregate macroeconomic figures are<br />

hiding disparities in manufacturing and<br />

services. While the services sector has<br />

remained broadly resilient, the manufacturing<br />

industry has been suffering<br />

pressure on several fronts: tightening<br />

environmental standards, trade shocks<br />

from Brexit and the Sino-American trade<br />

war. Notably, the European automotive<br />

industry has been badly hit, and this is,<br />

of course, one of the main clients for<br />

Southern European <strong>Steel</strong>. Domestically,<br />

the construction sector has also been<br />

underwhelming. After showing signs of<br />

a rebound in early 2<strong>01</strong>9, Italian cons-<br />

truction activity reverted to its chronic<br />

sluggishness in the second semester, and<br />

the signs of a slowdown in the Spanish<br />

real-estate cycle are becoming increasingly<br />

clear. And then, of course, there<br />

are the well-known global trends affecting<br />

the entire industry: a compressing<br />

Christiane von Berg<br />

margin between the prices of inputs<br />

(iron ore) and the final product, global<br />

overcapacity.<br />

Marcos Carias: Finally, there are country-specific<br />

supply issues, many of them<br />

related to public policy. In Italy, there is<br />

this long-standing legal standoff between<br />

ArcelorMittal and the government<br />

over the takeover of the former<br />

Ilva plant in Taranto. For the government,<br />

the largest plant in Europe is too<br />

big to fail: 8 000 jobs are on the line.<br />

But for ArcelorMittal, the plant is too<br />

polluting to save – it is said to be responsible<br />

for the city’s above-average<br />

cancer rates, among other environmental<br />

externalities. Under the pressure<br />

of 5-star movement (5SM) lawmakers,<br />

the government revoked a legal<br />

shield that protected investors from<br />

legal liabilities related to environmental<br />

crimes, convincing ArcelorMittal that it<br />

was better off backing out of the deal.<br />

Meanwhile, in Spain, the government’s<br />

decisive move in the direction of renew-<br />

able energy will involve a complex transition<br />

period for the heavy industry<br />

where energy sourcing will be more<br />

costly and less predictable.<br />

Marcos Carias<br />

Copyright: Coface<br />

How sustainable is the industry?<br />

Carias: If we are talking about economic<br />

viability/activity, these countries<br />

need a combination of innovation and<br />

restructuring to restore profitability.<br />

Global overcapacity looks like it is here<br />

to stay at least over the medium term,<br />

and these countries are not cost-competitive<br />

enough to compete in the<br />

lower-end market segment. They need<br />

to consolidate assets and/or move up<br />

the value chain, but the national policy<br />

incentives do not help here.<br />

Regarding environmental sustain-<br />

ability, it is a very uphill path; indeed,<br />

as steel is a notoriously polluting industry<br />

responsible for around 5% of global<br />

»Spain and Italy have<br />

seen their strongest<br />

monthly decline in output<br />

in recent times: -26%<br />

in August for Italy and -27%<br />

in December for Spain.«<br />

Christiane von Berg, Coface,<br />

economist for<br />

Northern Europe<br />

carbon emissions, and we can only expect<br />

carbon prices to rise. A lot will<br />

depend on the progress and pace of<br />

adoption of cutting-edge technologies,<br />

for instance, molten oxide electrolysis.<br />

Support from public institutions will be<br />

12 <strong>01</strong> | <strong>2020</strong>

Italy and Southern Europe<br />

Special<br />

crucial for incentivising R/D and softening<br />

the pain of the transition. For<br />

the Ex-Ilva plant, Taranto qualifies for<br />

aid from the upcoming European Just<br />

Transition Fund. Beyond that, it remains<br />

to be seen if governments and<br />

the EU will live up to the ambitious<br />

goals of the European Green Deal.<br />

Finally, companies facing these kinds<br />

of challenges cannot afford to ignore<br />

socio-political sustainability. Every time<br />

massive layoffs take place; this adds<br />

fuel to the fire of populism. The counterpart<br />

is the slow but steady erosion<br />

of Europe’s technocratic centre; politicians<br />

that are more likely to favour<br />

level-headed long-term policies. To go<br />

back to the Taranto example, investor<br />

protection would not have suffered so<br />

brutally if the 5SM was not in office,<br />

and this is the direct result of stagnant<br />

living conditions for workers. Of course,<br />

firms must make adjustments in difficult<br />

times. However, failing to factor in<br />

the welfare of workers will eventually<br />

result in a political backlash, and this<br />

backlash has a very tangible impact on<br />

the bottom line. This part of the conversation<br />

is not exclusive to the steel<br />

industry; it concerns the business community<br />

as a whole.<br />

I do not mean to underestimate<br />

the hardships of these sustainability<br />

challenges. I think they are surmountable,<br />

but it will involve compromises,<br />

risk-taking and goodwill from all parties<br />

concerned.<br />

Copyright: ArcelorMittal<br />

What do you think are the biggest<br />

challenges for the industry?<br />

Carias: In the long run, the biggest<br />

challenge is to adapt to these structural<br />

trends in a demanding environment<br />

that will remain less than ideal.<br />

Even in the best scenario, the growth<br />

in demand will be slower than the<br />

reduction of overcapacity, which makes<br />

it difficult for companies to make the<br />

risky investments needed to adapt to<br />

the sustainability imperatives I highlighted<br />

before. In the commercial<br />

sphere, it will also be important to<br />

diversify the clientele by getting a foot-<br />

hold in emerging markets with good<br />

The Spanish situation is less worrying. The picture shows the Spanish plant<br />

of ArcelorMittal.<br />

medium-term growth prospects. On dition, but construction is starting to<br />

the short term, we will have to deal slow down noticeably. The extent of<br />

with the nasty surprise of the coronavirus<br />

outbreak. Some weeks ago, it couple of months, but Fiat-Chrysler<br />

the damage won’t be knowable for a<br />

looked like a rebound in Germany, has already signalled that it’s looking<br />

and the easing of trade tensions to close one of its European plants in<br />

would give the manufacturing industry<br />

a chance to catch its breath. But in Wuhan. We should note that this<br />

response to supply-chain disruptions<br />

Italy just had its worst monthly industrial<br />

production numbers in two years but will be of a magnitude and it comes<br />

will be a one-off, temporary setback,<br />

December (-3.8 year on year), and this in a very bad moment.<br />

is before the virus started making waves. Things have changed a lot since 2003,<br />

Spain is in a much better cyclical con-<br />

but it can be useful to (prudently) use<br />

<strong>01</strong> | <strong>2020</strong> 13

Special<br />

Italy and Southern Europe<br />

the SARS epidemic as a benchmark.<br />

Back then, the outbreak cost the Chinese<br />

economy 1% of GDP, but industrial<br />

activity rebounded fairly quickly, as<br />

both the global and Chinese economies<br />

were riding on a vigorous expansion<br />

cycle. This time, the initial shock is likely<br />

to be stronger, and there are fewer reasons<br />

to expect a rebound. The only silver<br />

lining for steel producers outside of<br />

China could be a drop in the global iron<br />

ore prices resulting from subdued Chinese<br />

demand.<br />

Is the industry prepared for them?<br />

Carias: To varying degrees. At least by<br />

the region’s historical standards, lever-<br />

age is relatively low, and this, of<br />

course, means a certain capability<br />

to absorb shocks and get back<br />

on its feet, assuming we eventually<br />

get a rebound in activity.<br />

It will be very difficult for<br />

medium and small-scale operations<br />

to survive in the long<br />

term unless they are particularly<br />

innovative or well placed<br />

in the value chain; the sector’s<br />

incentives are aligned towards<br />

consolidation. We see some reactivity<br />

in this dimension in Spain, with<br />

Sidenor allegedly planning to mobilise<br />

100 million euros for acquisitions in<br />

the Basque Country region. In Italy,<br />

nothing of substance is likely to happen<br />

until the Taranto stalemate gets<br />

resolved. In any case, either Arcelor-<br />

Mittal stays and then preparedness<br />

depends on the wider strategy of the<br />

group; or they leave, and then Italian<br />

steel is in for a very significant and<br />

possibly permanent contraction.<br />

Where do you see the biggest<br />

weaknesses and strengths of the<br />

industry?<br />

Von Berg: For weaknesses, they cor-<br />

respond to the challenges we’ve<br />

covered so far, and I would enumerate<br />

them as follows: the unavoidable adaptation<br />

to stricter environmental<br />

standards, the need for consolidation,<br />

the unreliability of public policy, global<br />

overcapacity, sluggish demand.<br />

Regarding strengths, we must not<br />

forget that steel remains at the core<br />

of the European economic project<br />

and that a healthy domestic steel industry<br />

is crucial for manufacturing at<br />

large. I am sure this is not lost on<br />

policymakers, especially given the<br />

historical role steel has played in the<br />

construction of European institutions<br />

and the single market. If the industry<br />

is willing to make the necessary changes,<br />

it would be reasonable for policymakers<br />

to grade it on a curve without<br />

sacrificing the long-term objective of<br />

»Even in the best<br />

scenario, the growth in<br />

demand will be slower than the<br />

reduction of overcapacity, which<br />

makes it difficult for companies to<br />

make the risky investments<br />

needed to adapt to the<br />

sustainability imperatives.«<br />

Marcos Carias, Coface, economist<br />

carbon neutrality. The EU remains,<br />

for the moment, an institution of<br />

technocrats, and these are people<br />

with whom one can reach reason-<br />

able compromises.<br />

Despite the high labour and energy<br />

costs, productivity in terms of output<br />

was high in Southern Europe<br />

compared to their northern neighbours<br />

during the post-crisis expan-<br />

sion. And while energy in Spain will<br />

be expensive on the short term, in the<br />

long term the country will be ahead<br />

of the curve in achieving a sustain-<br />

able energy infrastructure and this<br />

will eventually result in lower costs.<br />

One only has to look at the stock market<br />

performance of Spanish renew-<br />

able energy firms to see that there is<br />

a future here.<br />

for Southern Europe<br />

How do you assess the financial<br />

situation of the South European<br />

steel industry?<br />

Carias: The financials are not the worst<br />

thing about this sector, at least from a<br />

bird’s eye view, but here we see a dif-<br />

ference between Spain and Italy. Lever-<br />

age in Spain went down steeply after<br />

the Eurozone crisis and is at what can<br />

be considered low levels for heavy industry,<br />

with a net debt ratio of around<br />

8%, which is in contrast with Italy, where<br />

leverage bounced back after reaching<br />

30% in 2<strong>01</strong>1 and now hovers around<br />

35%. Though this is close to the histo-<br />

rical norm, it is troubling given the<br />

decreasing revenue and output.<br />

What is your outlook: From the<br />

credit insurer‘s point of view,<br />

will the South European steel<br />

industry be a safe business<br />

partner in the future or<br />

rather a risky one?<br />

Carias: We downgraded the Italian<br />

metals sector to »very risky«<br />

in our latest quarterly assessment<br />

review, the strongest risk level on<br />

our four-level scale, and this situation<br />

is unlikely to improve in the foreseeable<br />

future. Risk is also high in Spain,<br />

given the surprisingly low end-of-year<br />

figures, but the situation is not yet nearly<br />

as dire as it is in Italy.<br />

What would companies have to do<br />

to be financially stable in the long<br />

term?<br />

Von Berg: Consolidate, invest in innovation<br />

and diversify export markets.<br />

The industry remains somewhat overexposed<br />

to Europe and the automotive<br />

industry. The logical step is to get<br />

a foothold in African markets, and,<br />

to a great extent, efforts are already<br />

underway as Algeria is one of the<br />

largest export destinations. Africa is<br />

a place with great opportunities, but<br />

also great risks (exposure to climate<br />

risk, political instability), and it is increasingly<br />

important to be mindful of<br />

country risk. These are all elements<br />

that we study with great vigilance at<br />

Coface.<br />

•<br />

14 <strong>01</strong> | <strong>2020</strong>

Italy and Southern Europe<br />

Special<br />

»Consumption level back<br />

to normal«<br />

Orders for machine tools took a negative turn<br />

In 2<strong>01</strong>9, the number of orders for machine tools took a negative turn in Italy. In the fourth quarter,<br />

the UCIMU index of machine tool orders registered a 16% downturn compared with the same<br />

period in the previous year. The absolute value of the index was 105.5 (base 100 in 2<strong>01</strong>5).<br />

UCIMU-SISTEMI PER PRODURRE is the Italian association for machine tool, robots, automation<br />

systems and ancillary products (NC, tools, components, accessories).<br />

The overall numbers were affected<br />

both by the negative performance<br />

of the domestic market and by<br />

weak foreign demand. Domestic orders<br />

showed a 21.2% drop compared with<br />

the fourth quarter of 2<strong>01</strong>8. The absolute<br />

value of the index was 172, so despite<br />

the reduction, still positive.<br />

Foreign orders dropped by 13.8%<br />

compared with the October-December<br />

period in 2<strong>01</strong>8. The absolute value of<br />

the index stood at 91.5. On an annual<br />

basis, the total index recorded a 17.9%<br />

decrease compared with the previous<br />

year. This result was due to the drop in<br />

both the domestic (-23.9%) and the<br />

foreign markets (-15.4%).<br />

»The downturn registered in the<br />

fourth quarter of 2<strong>01</strong>9 confirmed our<br />

expectations,« said Massimo Carboniero,<br />

President of UCIMU-SISTEMI PER<br />

PRODURRE. »It shows that people are<br />

less inclined to invest, both domestically<br />

and abroad. On the domestic front,<br />

the index of orders placed in Italy in<br />

2<strong>01</strong>9 showed a progressive reduction,<br />

which proves that the Italian consumption<br />

level of production systems is<br />

dropping back to what is typical for our<br />

market. After all, we could not expect<br />

the Italian demand to maintain the<br />

growth level we experienced in the<br />

three years of 2<strong>01</strong>6-2<strong>01</strong>8.«<br />

»That said, we do need to prevent a<br />

new freeze on investments, which would<br />

take our manufacturing industry back<br />

many years and nullify the good results<br />

UCIMU-members are focusing on Asian customers, supplying them with for<br />

example laser cutting tools.<br />

obtained thanks to the >Industry 4.0<<br />

Plan, with the risk of interrupting the<br />

ongoing process of technological transformation<br />

in our Italian industry.«<br />

Investments needed<br />

The results of a survey conducted by<br />

UCIMU in 2<strong>01</strong>4 on the total number of<br />

machines in operation in Italy showed<br />

a dangerous amount of ageing of the<br />

production systems installed in Italian<br />

manufacturing facilities. In ten years,<br />

from 2005 to 2<strong>01</strong>4, the factories in the<br />

country innovated very little and the<br />

average age of machines turned out to<br />

be the highest ever, almost 13 years.<br />

»Even if the competitiveness tools<br />

implemented by the >Industry 4.0<<br />

Plan contributed to recover from that<br />

obsolescence, we cannot assume that<br />

everything is solved because, in the<br />

meantime, our foreign competitors<br />

keep on investing and we must take<br />

them in due consideration if we want<br />

to preserve the competitiveness of the<br />

Italian manufacturing industry.«<br />

In this regard, the association thinks<br />

that the new tax measures included in<br />

the <strong>2020</strong> Budget Law, in place of Super-<br />

and Hyper-Depreciation are technically<br />

suited to support the upgrade of machines<br />

and equipment and the transformation<br />

of the Italian industry from a digital<br />

point of view. What UCIMU does not<br />

regard as appropriate is their applicability<br />

period, which is always 12 months.<br />

»For this reason,« continues Massimo<br />

Carboniero, »we have requested the<br />

Copyright: UMICU-SISTEMI PER PRODURRE<br />

<strong>01</strong> | <strong>2020</strong> 15

Special<br />

Italy and Southern Europe<br />

government to consider immediately<br />

implementing a new three-year innovation<br />

plan to support the investments in<br />

production technologies and have tax<br />

credits with differentiated rates as a key<br />

measure. Only in this way, with a mid/<br />

long-term plan, can enterprises realistically<br />

plan their investments and the actions<br />

to be undertaken to continue the<br />

process of transformation and the<br />

upgrade of the Italian manufacturing<br />

industry, which has started, but it is certainly<br />

not yet accomplished.«<br />

Complicated situation<br />

On the foreign front, the situation is<br />

– according to UCIMU – very complicated,<br />

as different factors are contributing<br />

to the uncertainty of the mid/<br />

short-term scenario: the general economic<br />

and political instability of many<br />

areas in the world; the evident difficulty<br />

of Germany, struggling to start<br />

up again, burdened by the big question<br />

in the automotive sector regarding<br />

the development of electric vehicles;<br />

the sanctions concerning exports to<br />

important end markets for the enterprises<br />

working in manufacturing sectors,<br />

first of all, Russia and Iran; the<br />

slowdown of China and the protectionist<br />

behaviour of some important<br />

countries, such as the United States.<br />

While waiting for a clearer situation,<br />

Italian machine tool manufacturers,<br />

who have always been very flexible<br />

and quick in reorganising their sales<br />

in the areas characterised by the most<br />

dynamic demand, are currently focusing<br />

specific attention on two continuously<br />

developing areas: the ASEAN<br />

countries and India. Involved in a rapid<br />

and significant process of industrial<br />

and infrastructural development,<br />

these areas have no appropriate local<br />

industry of automation and production<br />

systems. Therefore, to support<br />

their pace of development, they must<br />

acquire state-of-the-art technologies<br />

from abroad. Made in Italy is a valid<br />

response to this demand. •<br />

ArcelorMittal and commissioners<br />

agree to invest in modernization<br />

The future of the Ilva steelworks is still uncertain<br />

In the southern Italian town of Taranto, the steelworkers dare to hope again. ArcelorMittal and<br />

the Italian government have agreed to invest in modernizing the notorious polluter together.<br />

This means that both parties have (at least for now) put a stop to ArcelorMittal’s withdrawal from<br />

the sales agreement.<br />

<strong>Market</strong> experts observe that<br />

the latest turn of events in<br />

the drama of keeping the<br />

steelworks Ilva up and running has<br />

taken some of the pressure off the<br />

Italian government, which owns the<br />

plant in Taranto. The Italian government<br />

wanted to negotiate the request<br />

for an interim injunction against ArcelorMittal’s<br />

withdrawal from the sales<br />

agreement at the civil court in Milan<br />

on 6 March; however, just a few days<br />

before the hearing, ArcelorMittal and<br />

the Ilva commissioners managed to<br />

reach an agreement. ArcelorMittal<br />

will go ahead with the purchase of the<br />

steelworks and the Italian government<br />

will withdraw its request for an interim<br />

injunction. Furthermore, both<br />

sides have agreed to amendments<br />

made to the original lease and sales<br />

contract. The new version now includes<br />

conditions for the Italian government<br />

to make a substantial equity investment,<br />

which will be at least as big as<br />

ArcelorMittal’s remaining liabilities and<br />

which will have to be made by 30 November<br />

<strong>2020</strong>. At the heart of the new<br />

plan is the investment in carbon-<br />

reduced steel production technologies.<br />

Health Hazards<br />

In early February, the situation still looked<br />

very different. Investor ArcelorMittal<br />

had sent a very strong message to<br />

show how determined it was to reverse<br />

the purchase of the loss-making Ilva<br />

steelworks made in November 2<strong>01</strong>8 by<br />

withdrawing its management team<br />

from Taranto. The management of the<br />

largest steel group in the world felt<br />

justified in using a termination clause in<br />

the contract. The clause stated that in<br />

the case of ArcelorMittal’s approximately<br />

4.2-billion-euro takeover and redevelopment,<br />

the company wouldn’t have<br />

to pay for the previous operators’ ecological<br />

damages until the completion of<br />

their redevelopment works in 2023. For<br />

this reason, the government at the time<br />

promised the Luxembourg-based investor<br />

»legal immunity«.<br />

In 2<strong>01</strong>9, the succeeding government<br />

threatened to take away the steel giant’s<br />

previously agreed-upon immunity.<br />

This resulted in ArcelorMittal losing<br />

interest in investing its own money into<br />

16 <strong>01</strong> | <strong>2020</strong>

Italy and Southern Europe<br />

Special<br />

In 2<strong>01</strong>8 ArcelorMittal purchased the steelworks.<br />

Copyright: ArcelorMittal<br />

transforming the polluter in southern<br />

Italy into »Europe’s most modern steel<br />

mill« and turning the polluted and<br />

polluting factory site into a green oasis.<br />

This happened even though the first<br />

step in redeveloping the site had already<br />

been implemented right after the<br />

takeover. Back then, ArcelorMittal invested<br />

300 million euros in a roof for<br />

the coal and iron ore tips.<br />

Receivership<br />

Right from the start, the takeover of<br />

»southern Italy’s dying colossus« (Tagesspiegel)<br />

seems to have been ill-fated.<br />

In January 2<strong>01</strong>9, just a few months<br />

after ArcelorMittal signed a one-year<br />

lease agreement for the Ilva mill, the<br />

European Court of Human Rights<br />

found Italy guilty of ongoing health<br />

hazards caused by the steelworks in<br />

Taranto. Studies revealed that pollution<br />

caused by the plant had been<br />

responsible for a rise in cancer rates<br />

and circulatory diseases in the area.<br />

After approximately 150 citizens<br />

living in close proximity to Ilva filed a<br />

lawsuit, the court in Strasbourg decided<br />

that Italy had not done enough<br />

to stop the problem, even though the<br />

health hazards were well known (ca.<br />

400 premature deaths and thousands<br />

of people getting sick). According to<br />

the verdict, public authorities had<br />

postponed the implementation of an<br />

environmental plan from 2<strong>01</strong>4 to<br />

2023. At the same time, they put regulations<br />

in place which allowed the<br />

mill to continue its operation despite<br />

the known health risks. For the<br />

200,000 people living in the city at the<br />

Ionian Sea, it’s like being stuck between<br />

a rock and a hard place. Most<br />

people know about the consequences<br />

of the mill’s large-scale pollution but<br />

a permanent closure of the region’s<br />

largest employer would result in 8,200<br />

people losing their jobs. On top of<br />

that, another 6,000 jobs would be at<br />

»Several protest<br />

rallies held over the past<br />

few months have shown<br />

how important the mill is for<br />

the job market in the<br />

economically-weak<br />

region of Apulia.«<br />

risk at the mill’s 150 suppliers. Several<br />

protest rallies held over the past few<br />

months have shown how important<br />

the mill – which covers an area two<br />

and half times as big as the city itself<br />

- is for the job market in the economically-weak<br />

region of Apulia.<br />

The corporation’s downfall and<br />

with it the downfall of the city didn’t<br />

begin with ArcelorMittal’s takeover<br />

of the mill. The steelworks started as<br />

a state-owned enterprise in 1965 just<br />

outside of Taranto. In 1995, the mill<br />

was bought by the entrepreneurial<br />

Riva family from Milan. Due to the<br />

severe environmental pollution it<br />

caused, the family lost its management<br />

rights. An administrative receiver<br />

was appointed to move forward<br />

with the redevelopment works. In<br />

the end, a triarchy of government<br />

commissioners was supposed to modernize<br />

the ailing steel juggernaut,<br />

which back then still had 20,000 employees,<br />

and to make the necessary<br />

modifications for it to meet the requirements<br />

of the fiercely-contested<br />

and cyclically-fluctuating global<br />

steel market.<br />

ArcelorMittal’s takeover (buying<br />

price: 1.8 billion euros) and the steel<br />

giant’s announcement to invest 1.2<br />

billion euros into modernizing and<br />

another 1.15 billion euros into implementing<br />

an environmental plan had<br />

filled operators, employees, and the<br />

city with the hope that this might not<br />

be the end. By revoking ArcelorMittal’s<br />

»legal immunity« from prosecution<br />

for ecological crimes committed by<br />

previous operators, the Italian government<br />

had given the steel giant what<br />

the press called »a welcome excuse to<br />

opt out of the project, which within a<br />

year had become a millstone around<br />

its neck« (Tagesspiegel). •<br />

<strong>01</strong> | <strong>2020</strong> 17

Special<br />

Italy and Southern Europe<br />

New combustion system for ArcelorMittal Asturias<br />

ArcelorMittal Asturias, Spain, has<br />

awarded SMS group the order to supply<br />

a new combustion system for the<br />

existing walking beam furnaces 2N,<br />

3N and 4N in the Aviles hot strip mill.<br />

The supply consists of replacing the<br />

existing burners with the SMS<br />

EcoFlamePLUS dual fuel burners in<br />

the zones that will be upgraded and<br />

converted to basic oxygen furnace<br />

(BOF) gas utilisation, instead of the<br />

simple replacement of the gas feeding<br />

lances. Twenty-two burners will<br />

be replaced on each furnace. This<br />

solution will guarantee more efficient<br />

The modifications will help to decrease<br />

CO 2<br />

emissions.<br />

combustion, an optimal flame mix<br />

resulting in a reduction of NOx emissions.<br />

These modifications will enable<br />

Copyright: SMS group<br />

ArcelorMittal to drastically reduce<br />

NOx emissions to lower than 150 mg/<br />

Nm3 and decrease global CO 2<br />

emissions.<br />

The new burners can be fed<br />

either with a mix of BOF gas and natural<br />

gas (NG) or with BOF gas only,<br />

making the ArcelorMittal works more<br />

sustainable and environmentally<br />

friendly. Converting the three furnaces<br />

to heating and pre-soaking using<br />

100% BOF or natural gas will maximise<br />

the BOF gas flow rate in every<br />

operative condition. Switching between<br />

the two gases will be performed<br />

automatically.<br />

•<br />

Cloud solution for demand<br />

Spanish stainless steel producer Acerinox intends to plan demand by the client, product and region. The objective<br />

is to make a profound change in the company’s supply chain processes by developing a five-year strategic<br />

plan. This transformation aims to improve customer service and save costs by reducing inventories. Thanks to the<br />

Oracle Demand Planning Cloud solution, Acerinox will adopt a completely different work method to plan demand.<br />

The solution, which will add a competitive advantage when it comes to making the corresponding decisions<br />

throughout the supply chain, aligns itself to the behaviour of the market in real-time. It incorporates statistical<br />

algorithms that generate a precise forecast for each customer and makes it possible to plan demand by product<br />

type, by region, by the customer and by channel. All this leads to a reduction in stocks while guaranteeing<br />

supply. This project is part of the 360º Planning Project that Acerinox is developing together with Minsait, an<br />

Indra Group consultancy firm, which will redefine how Acerinox manages its supply chain, allowing it to respond<br />

to market demands in the coming years. RCL Consulting has implemented the Oracle solution. •<br />

Corinth Pipeworks to supply pipes to Chile<br />

Corinth Pipeworks Pipe Industry SA has<br />

been awarded a contract by Anglo<br />

American Sur S.A. for the manufacture<br />

and supply of steel pipes for the Los<br />

Bronces Pipeline Replacement project.<br />

The contract, covering the pipe material<br />

for the 35 km slurry pipeline in Chile,<br />

includes the supply of 24” LSAW pipes in<br />

heavy wall thickness up to 31.75 mm and<br />

three Layer Polyethylene (3LPE) Coating.<br />

The overall quantity of 13,700 Tn of steel<br />

pipes will be manufactured at Corinth<br />

Pipeworks’ plant in Greece in <strong>2020</strong>. The<br />

pipeline is located in the Andean Mountains<br />

at an average altitude of 3,500 m<br />

above sea level, and the pipes will require<br />

extremely strict geometrical<br />

tolerances to ensure uniform flow<br />

through the entirety of the pipeline. •<br />

The contract covers 35 km slurry pipeline.<br />

Copyright: Corinth Pipeworks<br />

18 <strong>01</strong> | <strong>2020</strong>

Italy and Southern Europe<br />

Special<br />

Raccortubi Norsk appoints new Managing Director<br />

Raccortubi Norsk, the UK branch of<br />

Raccortubi Group, based in Aberdeen,<br />

has appointed Andy Troup as Managing<br />

Director. »The internal reorganisation<br />

comes inevitably after the<br />

steady growth of the branch since its<br />

acquisition in 2<strong>01</strong>5 and will promote a<br />

further successful step in the history<br />

of the company,« the company states.<br />

Peter Ray will remain on the Board of<br />

Directors and will be actively focused,<br />

more than ever before, on the commercial<br />

relationship with key customers,<br />

frame agreements and complete<br />

projects handling. Andy Troup has<br />

been giving his contribution to the<br />

Andy Troup (right) and Peter Ray<br />

company for more than two years<br />

now, as Business Development Manager,<br />

building a good knowledge of<br />

the internal offering of Raccortubi<br />

Group and developing important<br />

relationships with current and new<br />

customers, while at the same time<br />

Marcegaglia acquires Palini & Bertoli<br />

progressively dealing with more operational<br />

issues. »We are always fine-tuning<br />

our internal resources to<br />

support our continuous growth, aiming<br />

at providing the best service to<br />

our clients by guaranteeing continuity<br />

to Raccortubi Norsk’s operations,«<br />

says Luca Pentericci, President of Raccortubi<br />

Group. »We wish to thank<br />

both Peter and Andy for their commitment<br />

and the new enthusiastic<br />

challenges ahead. Please join us in<br />

congratulating Andy Troup as he takes<br />

on these new responsibilities.«<br />

The reorganisation has been fully<br />

effective since 1 January <strong>2020</strong>. •<br />

Marcegaglia is a global industrial group in the steel processing sector with a turnover of more than 5.3 billion<br />

euros. Through Marcegaglia Plates, a company dedicated to heavy quarto plates rolling, the group finalised the<br />

purchase of 100% of the capital of Palini & Bertoli from the Russian company Evraz. »Palini & Bertoli Srl is an<br />

important company in the sector, with a production capacity of 500,000 tons per year, developed on a wide<br />

qualitative and dimensional range,« Marcegaglia states.The new acquisition, which is part of the strategy to<br />

strengthen its presence on the European market, will lead the Marcegaglia group to be one of the leading<br />

players in heavy quarto plates rolling, with a total production of 1 million tons per year.<br />

•<br />

Copyright: Raccortubi<br />

Caleotto: Feralpi to take over Duferco’s holding<br />

The Feralpi Group will be taking over<br />

the 50% share currently held by Duferco<br />

Italia Holding in the Lecco company<br />

Caleotto SpA, thereby obtaining<br />

full control. The new arrangement is<br />

awaiting the formal approval of the<br />

Anti-Trust Authority. Five years after<br />

forming the equal joint venture that<br />

led Feralpi and Duferco to taking over<br />

and relaunching the major rolling mill<br />

in Lecco, situated in the centre of a<br />

well-established drawing mill district<br />

devoted to export, the share structure<br />

will change. This decision is a result of<br />

the industrial development taking<br />

place in both groups. Feralpi has significantly<br />

developed in the special steels<br />

sector, i.e. the wire rod produced by<br />

Caleotto, which is considered to be a<br />

strategic sector for the Group. Duferco<br />

has major investments in progress<br />

relating to the rolling mill process for<br />

beams and rolled products, including<br />