Asian Sky Quarterly 2020Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

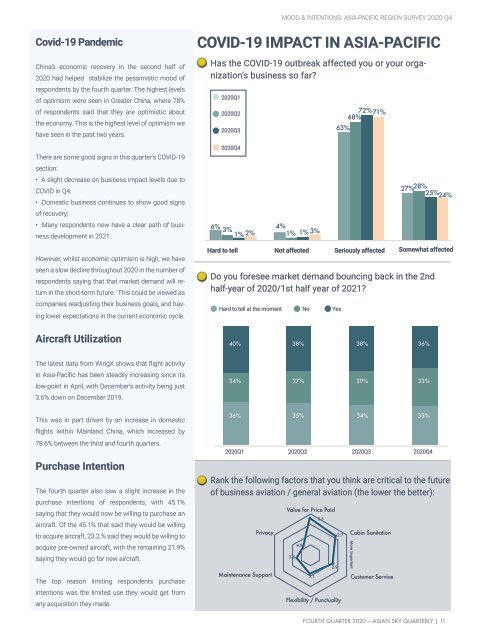

MOOD & INTENTIONS: ASIA-PACIFIC REGION SURVEY 2020 Q4<br />

Covid-19 Pandemic<br />

China’s economic recovery in the second half of<br />

2020 had helped stabilize the pessimistic mood of<br />

respondents by the fourth quarter. The highest levels<br />

of optimism were seen in Greater China, where 78%<br />

of respondents said that they are optimistic about<br />

the economy. This is the highest level of optimism we<br />

have seen in the past two years.<br />

COVID-19 IMPACT IN ASIA-PACIFIC<br />

Has the COVID-19 outbreak affected you or your organization’s<br />

business so far?<br />

2020Q1<br />

2020Q2<br />

2020Q3<br />

68%<br />

63%<br />

72% 71%<br />

25% 24%<br />

There are some good signs in this quarter’s COVID-19<br />

section:<br />

• A slight decrease on business impact levels due to<br />

COVID in Q4;<br />

• Domestic business continues to show good signs<br />

of recovery;<br />

• Many respondents now have a clear path of business<br />

development in 2021.<br />

<strong>2020Q4</strong><br />

6% 4%<br />

3%<br />

2% 1% 3%<br />

1% 1%<br />

27% 28%<br />

However, whilst economic optimism is high, we have<br />

seen a slow decline throughout 2020 in the number of<br />

respondents saying that that market demand will return<br />

in the short-term future. This could be viewed as<br />

companies readjusting their business goals, and having<br />

lower expectations in the current economic cycle.<br />

Hard to tell Not affected Seriously affected Somewhat affected<br />

Do you foresee market demand bouncing back in the 2nd<br />

half-year of 2020/1st half year of 2021?<br />

Hard to tell at the moment<br />

No<br />

Yes<br />

Aircraft Utilization<br />

40%<br />

38%<br />

38%<br />

36%<br />

The latest data from WingX shows that flight activity<br />

in Asia-Pacific has been steadily increasing since its<br />

low-point in April, with December’s activity being just<br />

24%<br />

27%<br />

29%<br />

32%<br />

3.6% down on December 2019.<br />

This was in part driven by an increase in domestic<br />

flights within Mainland China, which increased by<br />

78.6% between the third and fourth quarters.<br />

Purchase Intention<br />

The fourth quarter also saw a slight increase in the<br />

purchase intentions of respondents, with 45.1%<br />

saying that they would now be willing to purchase an<br />

aircraft. Of the 45.1% that said they would be willing<br />

to acquire aircraft, 23.2.% said they would be willing to<br />

acquire pre-owned aircraft, with the remaining 21.9%<br />

saying they would go for new aircraft.<br />

The top reason limiting respondents purchase<br />

intentions was the limited use they would get from<br />

any acquisition they made.<br />

36%<br />

2020Q1<br />

2020Q2<br />

2020Q3<br />

Rank the following factors that you think are critical to the future<br />

of business aviation / general aviation (the lower the better):<br />

Privacy<br />

Maintenance Support<br />

Value for Price Paid<br />

2.5<br />

3.6<br />

35%<br />

4.0<br />

3.1<br />

2.9<br />

2.7<br />

Flexibility / Punctuality<br />

Cabin Sanitation<br />

More Important<br />

34%<br />

Customer Service<br />

33%<br />

<strong>2020Q4</strong><br />

FOURTH QUARTER 2020 — ASIAN SKY QUARTERLY | 11