Asian Sky Quarterly 2020Q4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

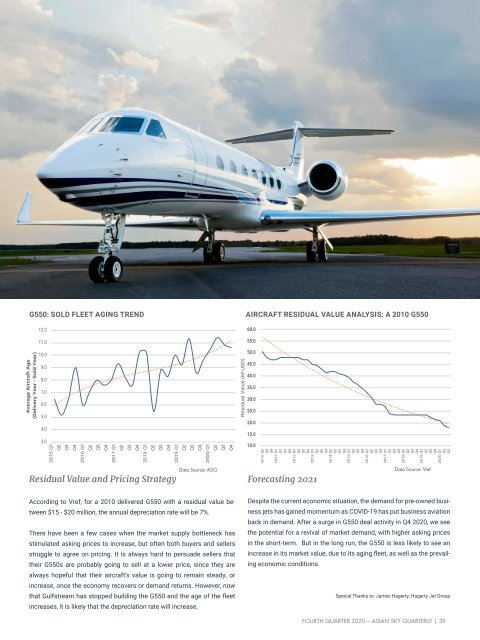

G550: SOLD FLEET AGING TREND<br />

Average Aircraft Age<br />

(Delivery Year - Sold Year)<br />

12.0<br />

11.0<br />

10.0<br />

9.0<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2015 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2016 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2017 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2018 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2019 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2020 Q1<br />

Q2<br />

Q3<br />

Q4<br />

Residual Value and Pricing Strategy<br />

Data Source: ASG<br />

Residual Value (M USD)<br />

AIRCRAFT RESIDUAL VALUE ANALYSIS: A 2010 G550<br />

60.0<br />

55.0<br />

50.0<br />

45.0<br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

2010 Q2<br />

Q3<br />

Q4<br />

2011 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2012 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2013 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2014 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2015 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2016 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2017 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2018 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2019 Q1<br />

Q2<br />

Q3<br />

Q4<br />

2020 Q1<br />

Q2<br />

Q3<br />

Forecasting 2021<br />

Data Source: Vref<br />

According to Vref, for a 2010 delivered G550 with a residual value between<br />

$15 - $20 million, the annual depreciation rate will be 7%.<br />

There have been a few cases when the market supply bottleneck has<br />

stimulated asking prices to increase, but often both buyers and sellers<br />

struggle to agree on pricing. It is always hard to persuade sellers that<br />

their G550s are probably going to sell at a lower price, since they are<br />

always hopeful that their aircraft’s value is going to remain steady, or<br />

increase, once the economy recovers or demand returns. However, now<br />

that Gulfstream has stopped building the G550 and the age of the fleet<br />

increases, it is likely that the depreciation rate will increase.<br />

Despite the current economic situation, the demand for pre-owned business<br />

jets has gained momentum as COVID-19 has put business aviation<br />

back in demand. After a surge in G550 deal activity in Q4 2020, we see<br />

the potential for a revival of market demand, with higher asking prices<br />

in the short-term. But in the long run, the G550 is less likely to see an<br />

increase in its market value, due to its aging fleet, as well as the prevailing<br />

economic conditions.<br />

Special Thanks to: James Hagerty, Hagerty Jet Group<br />

FOURTH QUARTER 2020 — ASIAN SKY QUARTERLY | 39