Issue No. 18

Inspiring and insightful features, stunning photographs and brilliant reporting on French travel, culture, gastronomy, life in France and a whole lot more...

Inspiring and insightful features, stunning photographs and brilliant reporting on French travel, culture, gastronomy, life in France and a whole lot more...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Plan ahead to<br />

avoid a<br />

possibly<br />

taxing time<br />

in France<br />

For those contemplating the purchase of a<br />

second home in France, or a complete<br />

move, the advantages from a tax<br />

perspective may represent fantastic value.<br />

Jennie Poate, Head of Operations, France<br />

for Beacon Global Wealth Management<br />

explains…<br />

There always seem to be horror stories<br />

doing the rounds about tax in France. But if<br />

you're planning to move here as a retiree or<br />

early retiree and already have some (or all)<br />

of your income stream planned, then you<br />

could well be surprised.<br />

For example: if you're married, you are<br />

taxed as a household and will have two taxfree<br />

allowances added together before<br />

income tax becomes payable. This is<br />

certainly handy if, like most people, one of<br />

you has a higher income than the other. All<br />

pensions receive an abatement or<br />

allowance of 10% before tax is payable –<br />

every little helps.<br />

As an individual in the UK you would pay<br />

40% tax above the £43,300 threshold.<br />

Even as an individual in France you wono't<br />

reach this height until above €70,000. So<br />

even higher earners can pay less tax.<br />

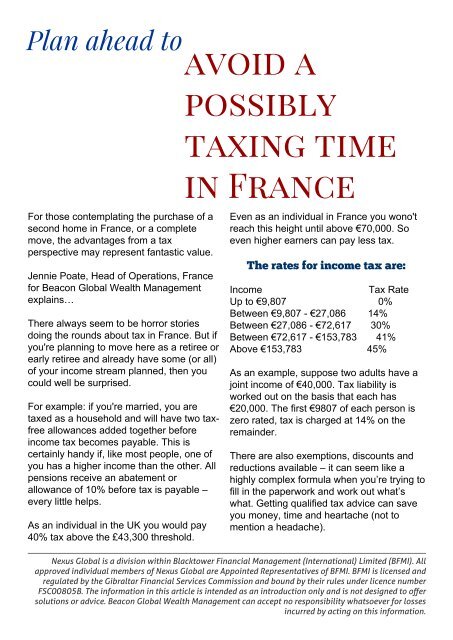

The rates for income tax are:<br />

Income<br />

Tax Rate<br />

Up to €9,807 0%<br />

Between €9,807 - €27,086 14%<br />

Between €27,086 - €72,617 30%<br />

Between €72,617 - €153,783 41%<br />

Above €153,783 45%<br />

As an example, suppose two adults have a<br />

joint income of €40,000. Tax liability is<br />

worked out on the basis that each has<br />

€20,000. The first €9807 of each person is<br />

zero rated, tax is charged at 14% on the<br />

remainder.<br />

There are also exemptions, discounts and<br />

reductions available – it can seem like a<br />

highly complex formula when you’re trying to<br />

fill in the paperwork and work out what’s<br />

what. Getting qualified tax advice can save<br />

you money, time and heartache (not to<br />

mention a headache).<br />

Nexus Global is a division within Blacktower Financial Management (International) Limited (BFMI). All<br />

approved individual members of Nexus Global are Appointed Representatives of BFMI. BFMI is licensed and<br />

regulated by the Gibraltar Financial Services Commission and bound by their rules under licence number<br />

FSC00805B. The information in this article is intended as an introduction only and is not designed to offer<br />

solutions or advice. Beacon Global Wealth Management can accept no responsibility whatsoever for losses<br />

incurred by acting on this information.