Issue No. 18

Inspiring and insightful features, stunning photographs and brilliant reporting on French travel, culture, gastronomy, life in France and a whole lot more...

Inspiring and insightful features, stunning photographs and brilliant reporting on French travel, culture, gastronomy, life in France and a whole lot more...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Planning ahead is always a good idea<br />

You shouldn't just research the area or<br />

house you want to buy; you should also<br />

have a clear idea of how much income you<br />

need to live on in France, and how much of<br />

it will be taxed.<br />

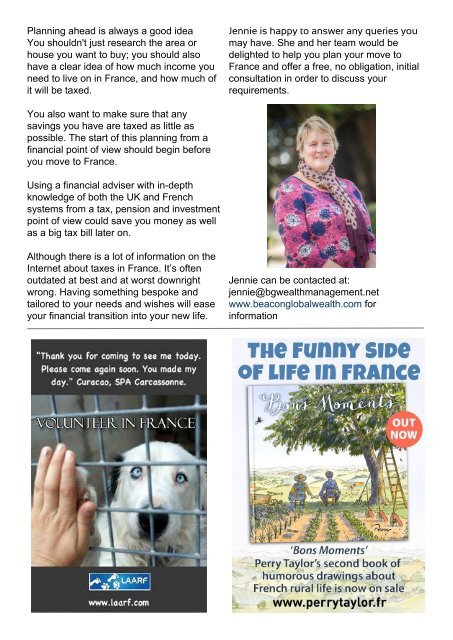

Jennie is happy to answer any queries you<br />

may have. She and her team would be<br />

delighted to help you plan your move to<br />

France and offer a free, no obligation, initial<br />

consultation in order to discuss your<br />

requirements.<br />

You also want to make sure that any<br />

savings you have are taxed as little as<br />

possible. The start of this planning from a<br />

financial point of view should begin before<br />

you move to France.<br />

Using a financial adviser with in-depth<br />

knowledge of both the UK and French<br />

systems from a tax, pension and investment<br />

point of view could save you money as well<br />

as a big tax bill later on.<br />

Although there is a lot of information on the<br />

Internet about taxes in France. It’s often<br />

outdated at best and at worst downright<br />

wrong. Having something bespoke and<br />

tailored to your needs and wishes will ease<br />

your financial transition into your new life.<br />

Jennie can be contacted at:<br />

jennie@bgwealthmanagement.net<br />

www.beaconglobalwealth.com for<br />

information