castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RESULT UPDATE<br />

MORNING INSIGHT October 25, 2012<br />

Sumit Pokharna<br />

sumit.pokharna@kotak.<strong>com</strong><br />

+91 22 6621 6313<br />

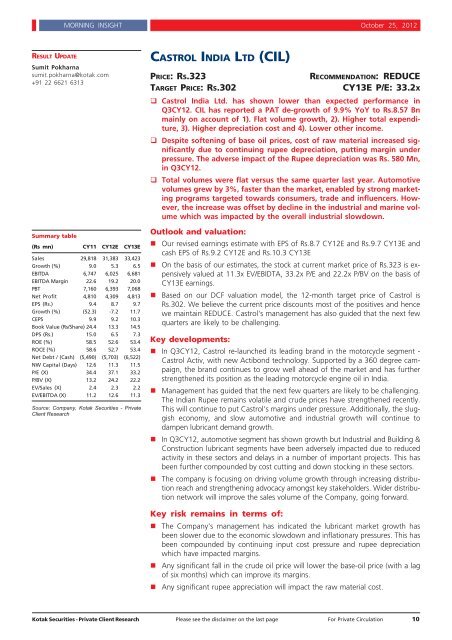

Summary table<br />

(Rs mn) CY11 CY12E CY13E<br />

Sales 29,818 31,383 33,423<br />

Growth (%) 9.0 5.3 6.5<br />

EBITDA 6,747 6,025 6,681<br />

EBITDA Margin 22.6 19.2 20.0<br />

PBT 7,160 6,393 7,068<br />

Net Profit 4,810 4,309 4,813<br />

EPS (Rs.) 9.4 8.7 9.7<br />

Growth (%) (52.3) -7.2 11.7<br />

CEPS 9.9 9.2 10.3<br />

Book Value (Rs/Share) 24.4 13.3 14.5<br />

DPS (Rs.) 15.0 6.5 7.3<br />

ROE (%) 58.5 52.6 53.4<br />

ROCE (%) 58.6 52.7 53.4<br />

Net Debt / (Cash) (5,490) (5,703) (6,522)<br />

NW Capital (Days) 12.6 11.3 11.5<br />

P/E (X) 34.4 37.1 33.2<br />

P/BV (X) 13.2 24.2 22.2<br />

EV/Sales (X) 2.4 2.3 2.2<br />

EV/EBITDA (X) 11.2 12.6 11.3<br />

Source: Company, Kotak Securities - Private<br />

Client Research<br />

CASTROL INDIA LTD (CIL)<br />

PRICE: RS.323 RECOMMENDATION: REDUCE<br />

TARGET PRICE: RS.302 CY13E P/E: 33.2X<br />

� Castrol India Ltd. has shown lower than expected performance in<br />

Q3CY12. CIL has reported a PAT de-growth of 9.9% YoY to Rs.8.57 Bn<br />

mainly on account of 1). Flat volume growth, 2). Higher total expenditure,<br />

3). Higher depreciation cost and 4). Lower other in<strong>com</strong>e.<br />

� Despite softening of base oil prices, cost of raw material increased significantly<br />

due to continuing rupee depreciation, putting margin under<br />

pressure. The adverse impact of the Rupee depreciation was Rs. 580 Mn,<br />

in Q3CY12.<br />

� Total volumes were flat versus the same quarter last year. Automotive<br />

volumes grew by 3%, faster than the market, enabled by strong marketing<br />

programs targeted towards consumers, trade and influencers. However,<br />

the increase was offset by decline in the industrial and marine volume<br />

which was impacted by the overall industrial slowdown.<br />

Outlook and valuation:<br />

� Our revised earnings estimate with EPS of Rs.8.7 CY12E and Rs.9.7 CY13E and<br />

cash EPS of Rs.9.2 CY12E and Rs.10.3 CY13E<br />

� On the basis of our estimates, the stock at current market price of Rs.323 is expensively<br />

valued at 11.3x EV/EBIDTA, 33.2x P/E and 22.2x P/BV on the basis of<br />

CY13E earnings.<br />

� Based on our DCF valuation model, the 12-month target price of Castrol is<br />

Rs.302. We believe the current price discounts most of the positives and hence<br />

we maintain REDUCE. Castrol's management has also guided that the next few<br />

quarters are likely to be challenging.<br />

Key developments:<br />

� In Q3CY12, Castrol re-launched its leading brand in the motorcycle segment -<br />

Castrol Activ, with new Actibond technology. Supported by a 360 degree campaign,<br />

the brand continues to grow well ahead of the market and has further<br />

strengthened its position as the leading motorcycle engine oil in India.<br />

� Management has guided that the next few quarters are likely to be challenging.<br />

The Indian Rupee remains volatile and crude prices have strengthened recently.<br />

This will continue to put Castrol's margins under pressure. Additionally, the sluggish<br />

economy, and slow automotive and industrial growth will continue to<br />

dampen lubricant demand growth.<br />

� In Q3CY12, automotive segment has shown growth but Industrial and Building &<br />

Construction lubricant segments have been adversely impacted due to reduced<br />

activity in these sectors and delays in a number of important projects. This has<br />

been further <strong>com</strong>pounded by cost cutting and down stocking in these sectors.<br />

� The <strong>com</strong>pany is focusing on driving volume growth through increasing distribution<br />

reach and strengthening advocacy amongst key stakeholders. Wider distribution<br />

network will improve the sales volume of the Company, going forward.<br />

Key risk remains in terms of:<br />

� The Company's management has indicated the lubricant market growth has<br />

been slower due to the economic slowdown and inflationary pressures. This has<br />

been <strong>com</strong>pounded by continuing input cost pressure and rupee depreciation<br />

which have impacted margins.<br />

� Any significant fall in the crude oil price will lower the base-oil price (with a lag<br />

of six months) which can improve its margins.<br />

� Any significant rupee appreciation will impact the raw material cost.<br />

Kotak Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 10