castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INITIATING COVERAGE<br />

MORNING INSIGHT October 25, 2012<br />

Arun Agarwal<br />

arun.agarwal@kotak.<strong>com</strong><br />

+91 22 6621 6143<br />

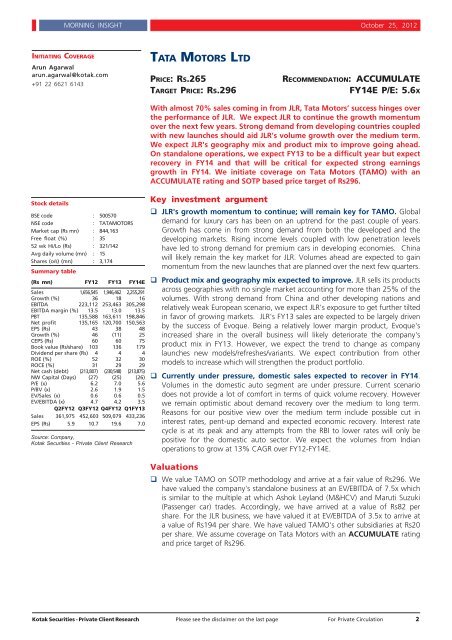

Stock details<br />

BSE code : 500570<br />

NSE code : TATAMOTORS<br />

Market cap (Rs mn) : 844,163<br />

Free float (%) : 35<br />

52 wk Hi/Lo (Rs) : 321/142<br />

Avg daily volume (mn) : 15<br />

Shares (o/s) (mn) : 3,174<br />

Summary table<br />

(Rs mn) FY12 FY13 FY14E<br />

Sales 1,656,545 1,946,462 2,255,291<br />

Growth (%) 36 18 16<br />

EBITDA 223,112 253,463 305,298<br />

EBITDA margin (%) 13.5 13.0 13.5<br />

PBT 135,588 163,611 198,846<br />

Net profit 135,165 120,700 150,563<br />

EPS (Rs) 43 38 48<br />

Growth (%) 46 (11) 25<br />

CEPS (Rs) 60 60 75<br />

Book value (Rs/share) 103 136 179<br />

Dividend per share (Rs) 4 4 4<br />

ROE (%) 52 32 30<br />

ROCE (%) 31 29 29<br />

Net cash (debt) (213,807) (230,548) (213,875)<br />

NW Capital (Days) (27) (25) (26)<br />

P/E (x) 6.2 7.0 5.6<br />

P/BV (x) 2.6 1.9 1.5<br />

EV/Sales (x) 0.6 0.6 0.5<br />

EV/EBITDA (x) 4.7 4.2 3.5<br />

Sales<br />

Q2FY12 Q3FY12 Q4FY12 Q1FY13<br />

361,975 452,603 509,079 433,236<br />

EPS (Rs) 5.9 10.7 19.6 7.0<br />

Source: Company,<br />

Kotak Securities - Private Client Research<br />

TATA MOTORS LTD<br />

PRICE: RS.265 RECOMMENDATION: ACCUMULATE<br />

TARGET PRICE: RS.296 FY14E P/E: 5.6X<br />

With almost 70% sales <strong>com</strong>ing in from JLR, Tata Motors’ success hinges over<br />

the performance of JLR. We expect JLR to continue the growth momentum<br />

over the next few years. Strong demand from developing countries coupled<br />

with new launches should aid JLR's volume growth over the medium term.<br />

We expect JLR's geography mix and product mix to improve going ahead.<br />

On standalone operations, we expect FY13 to be a difficult year but expect<br />

recovery in FY14 and that will be critical for expected strong earnings<br />

growth in FY14. We initiate coverage on Tata Motors (TAMO) with an<br />

ACCUMULATE rating and SOTP based price target of Rs296.<br />

Key investment argument<br />

� JLR's growth momentum to continue; will remain key for TAMO. Global<br />

demand for luxury cars has been on an uptrend for the past couple of years.<br />

Growth has <strong>com</strong>e in from strong demand from both the developed and the<br />

developing markets. Rising in<strong>com</strong>e levels coupled with low penetration levels<br />

have led to strong demand for premium cars in developing economies. China<br />

will likely remain the key market for JLR. Volumes ahead are expected to gain<br />

momentum from the new launches that are planned over the next few quarters.<br />

� Product mix and geography mix expected to improve. JLR sells its products<br />

across geographies with no single market accounting for more than 25% of the<br />

volumes. With strong demand from China and other developing nations and<br />

relatively weak European scenario, we expect JLR's exposure to get further tilted<br />

in favor of growing markets. JLR's FY13 sales are expected to be largely driven<br />

by the success of Evoque. Being a relatively lower margin product, Evoque's<br />

increased share in the overall business will likely deteriorate the <strong>com</strong>pany's<br />

product mix in FY13. However, we expect the trend to change as <strong>com</strong>pany<br />

launches new models/refreshes/variants. We expect contribution from other<br />

models to increase which will strengthen the product portfolio.<br />

� Currently under pressure, domestic sales expected to recover in FY14.<br />

Volumes in the domestic auto segment are under pressure. Current scenario<br />

does not provide a lot of <strong>com</strong>fort in terms of quick volume recovery. However<br />

we remain optimistic about demand recovery over the medium to long term.<br />

Reasons for our positive view over the medium term include possible cut in<br />

interest rates, pent-up demand and expected economic recovery. Interest rate<br />

cycle is at its peak and any attempts from the RBI to lower rates will only be<br />

positive for the domestic auto sector. We expect the volumes from Indian<br />

operations to grow at 13% CAGR over FY12-FY14E.<br />

Valuations<br />

� We value TAMO on SOTP methodology and arrive at a fair value of Rs296. We<br />

have valued the <strong>com</strong>pany's standalone business at an EV/EBITDA of 7.5x which<br />

is similar to the multiple at which Ashok Leyland (M&HCV) and Maruti Suzuki<br />

(Passenger car) trades. Accordingly, we have arrived at a value of Rs82 per<br />

share. For the JLR business, we have valued it at EV/EBITDA of 3.5x to arrive at<br />

a value of Rs194 per share. We have valued TAMO's other subsidiaries at Rs20<br />

per share. We assume coverage on Tata Motors with an ACCUMULATE rating<br />

and price target of Rs296.<br />

Kotak Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 2