castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MORNING INSIGHT October 25, 2012<br />

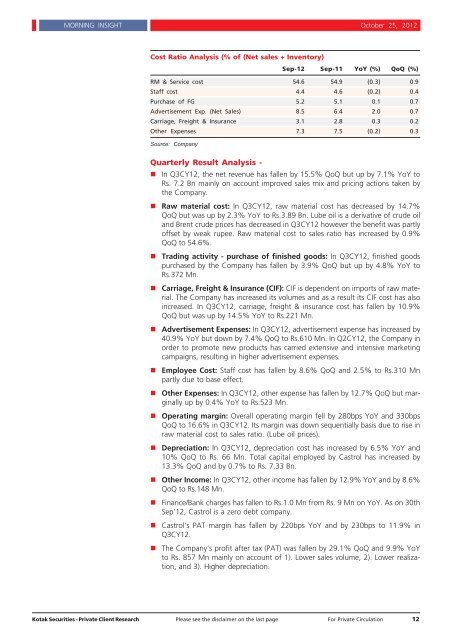

Cost Ratio Analysis (% of (Net sales + Inventory)<br />

Sep-12 Sep-11 YoY (%) QoQ (%)<br />

RM & Service cost 54.6 54.9 (0.3) 0.9<br />

Staff cost 4.4 4.6 (0.2) 0.4<br />

Purchase of FG 5.2 5.1 0.1 0.7<br />

Advertisement Exp. (Net Sales) 8.5 6.4 2.0 0.7<br />

Carriage, Freight & Insurance 3.1 2.8 0.3 0.2<br />

Other Expenses 7.3 7.5 (0.2) 0.3<br />

Source: Company<br />

Quarterly Result Analysis -<br />

� In Q3CY12, the net revenue has fallen by 15.5% QoQ but up by 7.1% YoY to<br />

Rs. 7.2 Bn mainly on account improved sales mix and pricing actions taken by<br />

the Company.<br />

� Raw material cost: In Q3CY12, raw material cost has decreased by 14.7%<br />

QoQ but was up by 2.3% YoY to Rs.3.89 Bn. Lube oil is a derivative of crude oil<br />

and Brent crude prices has decreased in Q3CY12 however the benefit was partly<br />

offset by weak rupee. Raw material cost to sales ratio has increased by 0.9%<br />

QoQ to 54.6%.<br />

� Trading activity - purchase of finished goods: In Q3CY12, finished goods<br />

purchased by the Company has fallen by 3.9% QoQ but up by 4.8% YoY to<br />

Rs.372 Mn.<br />

� Carriage, Freight & Insurance (CIF): CIF is dependent on imports of raw material.<br />

The Company has increased its volumes and as a result its CIF cost has also<br />

increased. In Q3CY12, carriage, freight & insurance cost has fallen by 10.9%<br />

QoQ but was up by 14.5% YoY to Rs.221 Mn.<br />

� Advertisement Expenses: In Q3CY12, advertisement expense has increased by<br />

40.9% YoY but down by 7.4% QoQ to Rs.610 Mn. In Q2CY12, the Company in<br />

order to promote new products has carried extensive and intensive marketing<br />

campaigns, resulting in higher advertisement expenses.<br />

� Employee Cost: Staff cost has fallen by 8.6% QoQ and 2.5% to Rs.310 Mn<br />

partly due to base effect.<br />

� Other Expenses: In Q3CY12, other expense has fallen by 12.7% QoQ but marginally<br />

up by 0.4% YoY to Rs.523 Mn.<br />

� Operating margin: Overall operating margin fell by 280bps YoY and 330bps<br />

QoQ to 16.6% in Q3CY12. Its margin was down sequentially basis due to rise in<br />

raw material cost to sales ratio. (Lube oil prices).<br />

� Depreciation: In Q3CY12, depreciation cost has increased by 6.5% YoY and<br />

10% QoQ to Rs. 66 Mn. Total capital employed by Castrol has increased by<br />

13.3% QoQ and by 0.7% to Rs. 7.33 Bn.<br />

� Other In<strong>com</strong>e: In Q3CY12, other in<strong>com</strong>e has fallen by 12.9% YoY and by 8.6%<br />

QoQ to Rs.148 Mn.<br />

� Finance/Bank charges has fallen to Rs.1.0 Mn from Rs. 9 Mn on YoY. As on 30th<br />

Sep'12, Castrol is a zero debt <strong>com</strong>pany.<br />

� Castrol's PAT margin has fallen by 220bps YoY and by 230bps to 11.9% in<br />

Q3CY12.<br />

� The Company's profit after tax (PAT) was fallen by 29.1% QoQ and 9.9% YoY<br />

to Rs. 857 Mn mainly on account of 1). Lower sales volume, 2). Lower realization,<br />

and 3). Higher depreciation.<br />

Kotak Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 12