castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

castrol india ltd - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RESULT UPDATE<br />

MORNING INSIGHT October 25, 2012<br />

Arun Agarwal<br />

arun.agarwal@kotak.<strong>com</strong><br />

+91 22 6621 6143<br />

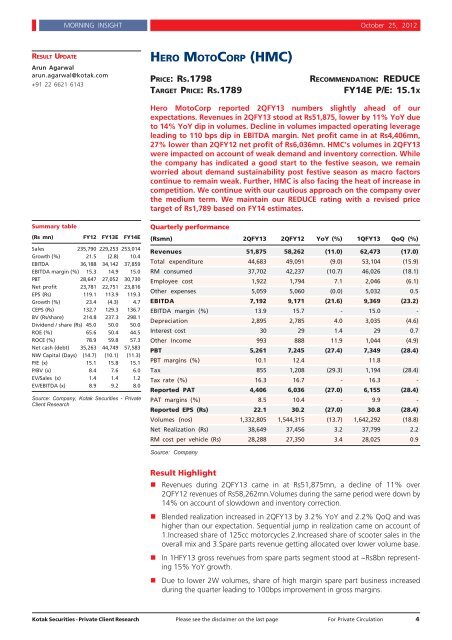

Summary table<br />

(Rs mn) FY12 FY13E FY14E<br />

Sales 235,790 229,253 253,014<br />

Growth (%) 21.5 (2.8) 10.4<br />

EBITDA 36,188 34,142 37,859<br />

EBITDA margin (%) 15.3 14.9 15.0<br />

PBT 28,647 27,052 30,730<br />

Net profit 23,781 22,751 23,816<br />

EPS (Rs) 119.1 113.9 119.3<br />

Growth (%) 23.4 (4.3) 4.7<br />

CEPS (Rs) 132.7 129.3 136.7<br />

BV (Rs/share) 214.8 237.3 298.1<br />

Dividend / share (Rs) 45.0 50.0 50.0<br />

ROE (%) 65.6 50.4 44.5<br />

ROCE (%) 78.9 59.8 57.3<br />

Net cash (debt) 35,263 44,749 57,583<br />

NW Capital (Days) (14.7) (10.1) (11.3)<br />

P/E (x) 15.1 15.8 15.1<br />

P/BV (x) 8.4 7.6 6.0<br />

EV/Sales (x) 1.4 1.4 1.2<br />

EV/EBITDA (x) 8.9 9.2 8.0<br />

Source: Company, Kotak Securities - Private<br />

Client Research<br />

HERO MOTOCORP (HMC)<br />

PRICE: RS.1798 RECOMMENDATION: REDUCE<br />

TARGET PRICE: RS.1789 FY14E P/E: 15.1X<br />

Hero MotoCorp reported 2QFY13 numbers slightly ahead of our<br />

expectations. Revenues in 2QFY13 stood at Rs51,875, lower by 11% YoY due<br />

to 14% YoY dip in volumes. Decline in volumes impacted operating leverage<br />

leading to 110 bps dip in EBITDA margin. Net profit came in at Rs4,406mn,<br />

27% lower than 2QFY12 net profit of Rs6,036mn. HMC's volumes in 2QFY13<br />

were impacted on account of weak demand and inventory correction. While<br />

the <strong>com</strong>pany has indicated a good start to the festive season, we remain<br />

worried about demand sustainability post festive season as macro factors<br />

continue to remain weak. Further, HMC is also facing the heat of increase in<br />

<strong>com</strong>petition. We continue with our cautious approach on the <strong>com</strong>pany over<br />

the medium term. We maintain our REDUCE rating with a revised price<br />

target of Rs1,789 based on FY14 estimates.<br />

Quarterly performance<br />

(Rsmn) 2QFY13 2QFY12 YoY (%) 1QFY13 QoQ (%)<br />

Revenues 51,875 58,262 (11.0) 62,473 (17.0)<br />

Total expenditure 44,683 49,091 (9.0) 53,104 (15.9)<br />

RM consumed 37,702 42,237 (10.7) 46,026 (18.1)<br />

Employee cost 1,922 1,794 7.1 2,046 (6.1)<br />

Other expenses 5,059 5,060 (0.0) 5,032 0.5<br />

EBITDA 7,192 9,171 (21.6) 9,369 (23.2)<br />

EBITDA margin (%) 13.9 15.7 - 15.0 -<br />

Depreciation 2,895 2,785 4.0 3,035 (4.6)<br />

Interest cost 30 29 1.4 29 0.7<br />

Other In<strong>com</strong>e 993 888 11.9 1,044 (4.9)<br />

PBT 5,261 7,245 (27.4) 7,349 (28.4)<br />

PBT margins (%) 10.1 12.4 11.8<br />

Tax 855 1,208 (29.3) 1,194 (28.4)<br />

Tax rate (%) 16.3 16.7 - 16.3 -<br />

Reported PAT 4,406 6,036 (27.0) 6,155 (28.4)<br />

PAT margins (%) 8.5 10.4 - 9.9 -<br />

Reported EPS (Rs) 22.1 30.2 (27.0) 30.8 (28.4)<br />

Volumes (nos) 1,332,805 1,544,315 (13.7) 1,642,292 (18.8)<br />

Net Realization (Rs) 38,649 37,456 3.2 37,799 2.2<br />

RM cost per vehicle (Rs) 28,288 27,350 3.4 28,025 0.9<br />

Source: Company<br />

Result Highlight<br />

� Revenues during 2QFY13 came in at Rs51,875mn, a decline of 11% over<br />

2QFY12 revenues of Rs58,262mn.Volumes during the same period were down by<br />

14% on account of slowdown and inventory correction.<br />

� Blended realization increased in 2QFY13 by 3.2% YoY and 2.2% QoQ and was<br />

higher than our expectation. Sequential jump in realization came on account of<br />

1.Increased share of 125cc motorcycles 2.Increased share of scooter sales in the<br />

overall mix and 3.Spare parts revenue getting allocated over lower volume base.<br />

� In 1HFY13 gross revenues from spare parts segment stood at ~Rs8bn representing<br />

15% YoY growth.<br />

� Due to lower 2W volumes, share of high margin spare part business increased<br />

during the quarter leading to 100bps improvement in gross margins.<br />

Kotak Securities - Private Client Research Please see the disclaimer on the last page For Private Circulation 4