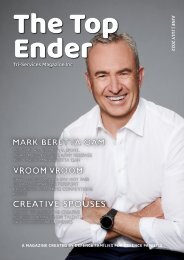

The Top Ender Magazine June July 2023 Edition

This edition of The Top Ender Magazine includes competitions, feature interviews, support articles and more. We interviewed Betty Klimenko AM and have Darwin Triple Crown V8 tickets to give away! Find help and resources that support you to make the most out of your time in the top end of Australia, servicing Darwin, Katherine, Tindal and Pilbara regions.

This edition of The Top Ender Magazine includes competitions, feature interviews, support articles and more. We interviewed Betty Klimenko AM and have Darwin Triple Crown V8 tickets to give away! Find help and resources that support you to make the most out of your time in the top end of Australia, servicing Darwin, Katherine, Tindal and Pilbara regions.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COST OF LIVING<br />

As the cost of living increases, our wallets can<br />

certainly feel the pinch. When it comes to<br />

personal finance we can look at two main<br />

actions; increase our income or decrease our<br />

expenses. If increasing your income is not an<br />

option, then it is certainly time to review your<br />

expenses.<br />

Here are some basic budgeting tips that may help:<br />

• Review your budget: look at all of your accounts<br />

for the past quarter (3 months) and categorise<br />

your budget into main areas, remember to factor in<br />

annual expenses, such as:<br />

• Home and Utility costs: this includes all regular<br />

expenses such as mobile, internet, subscriptions,<br />

virus protection software, cloud storage accounts<br />

etc<br />

• Insurance & Financials: this includes all insurances<br />

from the house or contents, vehicle or boat<br />

insurance, personal health insurance and debt<br />

repayments<br />

• Groceries: those quick trips to the shop add up,<br />

don’t guesstimate here, do the sums and you may<br />

find this is an area of increase.<br />

• Personal & Medical: Toiletries, pharmacy trips, hair<br />

or beauty expenses, hobbies, glasses or other<br />

miscellaneous expenses<br />

• Entertainment & dining out: add up all take-away<br />

foods, nights out, dining, babysitting expenses (if you<br />

have kids).<br />

• Transport & Auto: Think anything vehicle or travel<br />

related. A great tip here is too factor in your annual<br />

expenses such as vehicle registration and license<br />

expenses, have that money factored into your<br />

budget to help stop the scramble each year to pay.<br />

• Children: Baby products, toys, educational items,<br />

subscriptions, school fees, sports, excursions etc.<br />

Once you have reviewed your expenses you will see<br />

clearly the areas that may need to be altered to create<br />

space within the budget for other financial goals.<br />

Set goals - most of us need motivation to save funds,<br />

so it may be a smart strategy to create a vision board<br />

and set milestones for your goals;<br />

1. Immediate goals – within 12months<br />

2. Short term goals – 1-3 years<br />

3. Medium-term goals – 3-10 years<br />

4. Long term goals - +10 years<br />

Grocery bills can be reduced with some forward<br />

planning. We may not have Aldi in the NT but we do<br />

have markets for fresh produce and you can plan to<br />

shop with seasonal produce.<br />

Meal Plan, Food Prep, Pre-cook - these three<br />

options can take time to organise, but it can be<br />

financially beneficial for some big savings!<br />

Identify Needs Versus Wants - when shopping,<br />

consider whether you want or need an item. Look at<br />

other methods to purchase ‘wants’, such as layby<br />

with smaller regular payments. Avoid buy now, pay<br />

later schemes or high interest credit options.<br />

Reduce waste, reuse when suitable - make the most<br />

of sites like Gumtree, Ebay and Facebook<br />

marketplace.<br />

Declutter and sell what you can. You may find your<br />

behaviours around spending start to change! Watch<br />

“Space Invaders” on Channel 9 (9now) for tips on<br />

decluttering.<br />

Focus on reducing debt or savings - once your<br />

expenses are lowered you can focus on paying off<br />

debts quickly or increasing your savings.<br />

Entitlements - know and understand your<br />

entitlements and allowances, including the<br />

implications for your taxable income – you could<br />

also book an appointment with the ADF Financial<br />

Services Consumer Centre.<br />

Entertainment - give yourself a challenging<br />

entertainment budget and see if you can get<br />

creative with having fun on a budget.<br />

Some inexpensive entertainment ideas include;<br />

Board game nights<br />

Shared picnic or<br />

dinner with friends<br />

Movie night<br />

Free entry into<br />

Museum or gallery<br />

Try new recipes<br />

Written by Amanda Letcher<br />

Community Contributor<br />

<strong>The</strong> <strong>Top</strong> <strong>Ender</strong> <strong>Magazine</strong><br />

Bushwalking or bike<br />

riding<br />

Volunteering for an<br />

animal shelter<br />

Free community<br />

events and activities<br />

Reduce alcohol<br />

consumption<br />

Resources:<br />

https://moneysmart.gov.au/saving/simple-ways-to-save-money<br />

https://adfconsumer.gov.au/<br />

https://pay-conditions.defence.gov.au/pacman<br />

48 <strong>The</strong> <strong>Top</strong> <strong>Ender</strong> | Tri-Services <strong>Magazine</strong> Incorporated