Asian Sky Quarterly 2023 Q4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL PRE-OWNED MARKET UPDATE<br />

HEAVY JETS - SHORT TERM MEDIAN VALUE CHANGE<br />

35%<br />

Increase Decrease Total<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

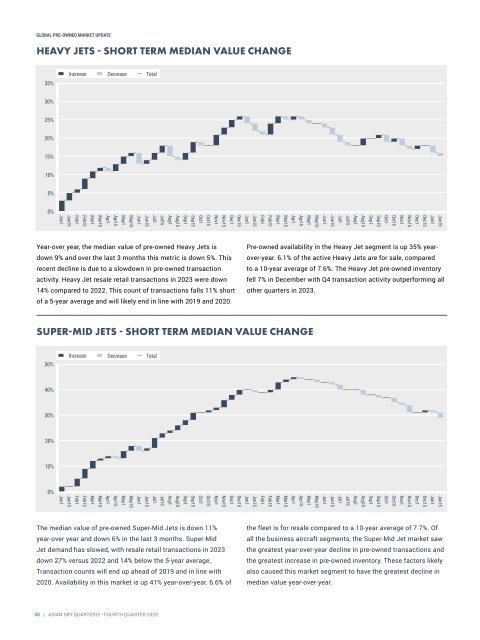

Year-over year, the median value of pre-owned Heavy Jets is<br />

down 9% and over the last 3 months this metric is down 5%. This<br />

recent decline is due to a slowdown in pre-owned transaction<br />

activity. Heavy Jet resale retail transactions in <strong>2023</strong> were down<br />

14% compared to 2022. This count of transactions falls 11% short<br />

of a 5-year average and will likely end in line with 2019 and 2020.<br />

Pre-owned availability in the Heavy Jet segment is up 35% yearover-year.<br />

6.1% of the active Heavy Jets are for sale, compared<br />

to a 10-year average of 7.6%. The Heavy Jet pre-owned inventory<br />

fell 7% in December with <strong>Q4</strong> transaction activity outperforming all<br />

other quarters in <strong>2023</strong>.<br />

SUPER-MID JETS - SHORT TERM MEDIAN VALUE CHANGE<br />

50%<br />

Increase Decrease Total<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

Feb1<br />

Feb15<br />

Mar1<br />

Mar15<br />

Apr1<br />

Apr15<br />

May1<br />

May15<br />

Jun1<br />

Jun15<br />

Jul1<br />

Jul15<br />

Aug1<br />

Aug15<br />

Sep1<br />

Sep15<br />

Oct1<br />

Oct15<br />

Nov1<br />

Nov15<br />

Dec1<br />

Dec15<br />

Jan1<br />

Jan15<br />

The median value of pre-owned Super-Mid Jets is down 11%<br />

year-over year and down 6% in the last 3 months. Super-Mid<br />

Jet demand has slowed, with resale retail transactions in <strong>2023</strong><br />

down 27% versus 2022 and 14% below the 5-year average.<br />

Transaction counts will end up ahead of 2019 and in line with<br />

2020. Availability in this market is up 41% year-over-year. 6.6% of<br />

the fleet is for resale compared to a 10-year average of 7.7%. Of<br />

all the business aircraft segments, the Super-Mid Jet market saw<br />

the greatest year-over-year decline in pre-owned transactions and<br />

the greatest increase in pre-owned inventory. These factors likely<br />

also caused this market segment to have the greatest decline in<br />

median value year-over-year.<br />

33 | ASIAN SKY QUARTERLY - FOURTH QUARTER <strong>2023</strong>