Asian Sky Quarterly 2023 Q4

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET DYNAMICS: BUSINESS JETS<br />

% OF FLEET FOR SALE<br />

Corp. Airliner Long Range Large Medium Light APAC<br />

8%<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0<br />

<strong>Q4</strong> 2020 Q1 2021 Q2 2021 Q3 2021 <strong>Q4</strong> 2021 Q1 2022 Q2 2022 Q3 2022 <strong>Q4</strong> 2022 Q1 <strong>2023</strong> Q2 <strong>2023</strong> Q3 <strong>2023</strong> <strong>Q4</strong> <strong>2023</strong><br />

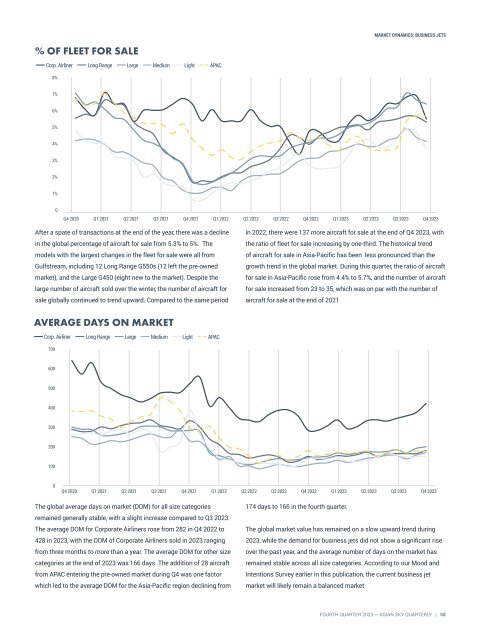

After a spate of transactions at the end of the year, there was a decline<br />

in the global percentage of aircraft for sale from 5.3% to 5%. The<br />

models with the largest changes in the fleet for sale were all from<br />

Gulfstream, including 12 Long Range G550s (12 left the pre-owned<br />

market), and the Large G450 (eight new to the market). Despite the<br />

large number of aircraft sold over the winter, the number of aircraft for<br />

sale globally continued to trend upward. Compared to the same period<br />

in 2022, there were 137 more aircraft for sale at the end of <strong>Q4</strong> <strong>2023</strong>, with<br />

the ratio of fleet for sale increasing by one-third. The historical trend<br />

of aircraft for sale in Asia-Pacific has been less pronounced than the<br />

growth trend in the global market. During this quarter, the ratio of aircraft<br />

for sale in Asia-Pacific rose from 4.4% to 5.7%, and the number of aircraft<br />

for sale increased from 23 to 35, which was on par with the number of<br />

aircraft for sale at the end of 2021.<br />

AVERAGE DAYS ON MARKET<br />

Corp. Airliner Long Range Large Medium Light APAC<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

<strong>Q4</strong> 2020 Q1 2021 Q2 2021 Q3 2021 <strong>Q4</strong> 2021 Q1 2022 Q2 2022 Q3 2022 <strong>Q4</strong> 2022 Q1 <strong>2023</strong> Q2 <strong>2023</strong> Q3 <strong>2023</strong> <strong>Q4</strong> <strong>2023</strong><br />

The global average days on market (DOM) for all size categories<br />

remained generally stable, with a slight increase compared to Q3 <strong>2023</strong>.<br />

The average DOM for Corporate Airliners rose from 282 in <strong>Q4</strong> 2022 to<br />

428 in <strong>2023</strong>, with the DOM of Corporate Airliners sold in <strong>2023</strong> ranging<br />

from three months to more than a year. The average DOM for other size<br />

categories at the end of <strong>2023</strong> was 166 days. The addition of 28 aircraft<br />

from APAC entering the pre-owned market during <strong>Q4</strong> was one factor<br />

which led to the average DOM for the Asia-Pacific region declining from<br />

174 days to 166 in the fourth quarter.<br />

The global market value has remained on a slow upward trend during<br />

<strong>2023</strong>, while the demand for business jets did not show a significant rise<br />

over the past year, and the average number of days on the market has<br />

remained stable across all size categories. According to our Mood and<br />

Intentions Survey earlier in this publication, the current business jet<br />

market will likely remain a balanced market.<br />

FOURTH QUARTER <strong>2023</strong> — ASIAN SKY QUARTERLY | 58