Global Mobility Insights NEWSLETTER Frühling / Spring 2024

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Global</strong> <strong>Mobility</strong> <strong>Insights</strong> - <strong>Frühling</strong> / <strong>Spring</strong> <strong>2024</strong><br />

Secondly, with the Swiss salary, the employee is likely to earn far more compared<br />

to local Brazilian employees.<br />

In addition, the employee will usually receive additional bonuses for the assignment<br />

in Brazil, as they are leaving their familiar environment to work in Brazil.<br />

The most common allowances are, among others, reimbursement of rental costs or<br />

a rent difference, international health insurance, tax equalisation, school costs for<br />

the international school for the children, so-called "home leaves", tax consultant<br />

costs for the preparation of the Brazilian tax return, relocation costs, housing<br />

search, compensation for exchange rate fluctuations. This list is not exhaustive.<br />

Due to the different costs of living, the base salary is usually adjusted for these<br />

differences.<br />

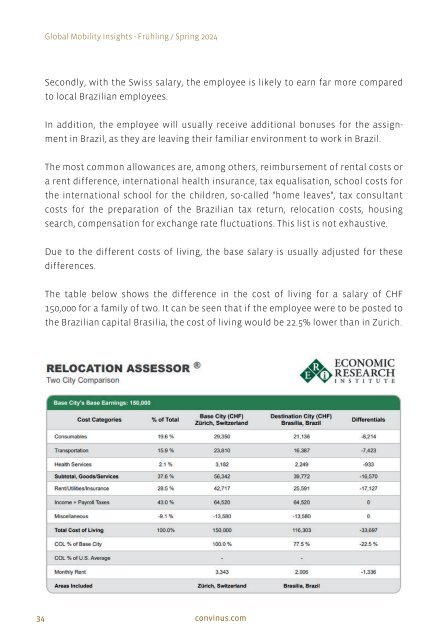

The table below shows the difference in the cost of living for a salary of CHF<br />

150,000 for a family of two. It can be seen that if the employee were to be posted to<br />

the Brazilian capital Brasilia, the cost of living would be 22.5% lower than in Zurich.<br />

34<br />

convinus.com