Annual Report 3 - New Mexico - Energy, Minerals and Natural ...

Annual Report 3 - New Mexico - Energy, Minerals and Natural ...

Annual Report 3 - New Mexico - Energy, Minerals and Natural ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

463) to the statutes have been the reduction of the minimum plant size to 1 MW, adding biomass as an eligible<br />

resource, adding a tax credit dedicated solely to solar, <strong>and</strong> making the credit refundable. Many other details have been<br />

fine-tuned to improve the PTC program’s effectiveness. The rule is now under consideration for further changes due<br />

to the most recent amendments to the statute; however, this does not impede the PTC application review process or<br />

applicants obtaining approval for tax credits. The tax incentive expires at the end of December 2018.<br />

Renewable <strong>Energy</strong> Act (REA) [NMSA 1978, § 62-16]: Established the state’s Renewable Portfolio St<strong>and</strong>ard<br />

(RPS) requiring that independently-owned utilities (IOUs) have 15 percent renewable energy in their portfolios<br />

by 2015 <strong>and</strong> 20 percent by 2020. The IOUs are required to file “Renewable <strong>Energy</strong> Plans” annually to convey how<br />

they intend to meet the RPS requirements. The Rural Electric Cooperatives’ requirement, beginning in 2015, is five<br />

percent by 2015 <strong>and</strong> 10 percent by 2020. To date, the REA has been responsible for the development of over 600<br />

MW of wind farm development <strong>and</strong> over 100 MW of utility-scale solar power, representing over $1.5 billion of instate<br />

capital investment.<br />

ENERGY EFFICIENCY AND CONSERVATION PROGRAM: In these<br />

challenging economic times, energy efficiency is the win-win option for everyone. <strong>Energy</strong> efficiency takes stock of the<br />

current energy consumption <strong>and</strong> determines the measures that will reduce it. These measures may include no-cost<br />

behavioral changes such as turning off lights <strong>and</strong> setting PCs to power-saver mode; low-cost actions such as weatherstripping<br />

doors <strong>and</strong> windows <strong>and</strong> changing to compact fluorescent light bulbs; <strong>and</strong> more comprehensive actions that<br />

add insulation, upgrade heating <strong>and</strong> cooling systems, <strong>and</strong> integrate automated control systems. These may be applied<br />

to residential buildings as well as commercial. <strong>New</strong> construction provides the most opportunities to incorporate costeffective<br />

energy efficiency measures, while renovations greatly extend the productive life of existing buildings. <strong>Energy</strong><br />

efficiency projects are providing jobs throughout <strong>New</strong> <strong>Mexico</strong> <strong>and</strong>, at the end of the day, the building owner reaps the<br />

benefits of lower utility bills.<br />

<strong>Energy</strong> Efficiency <strong>and</strong> Conservation Development<br />

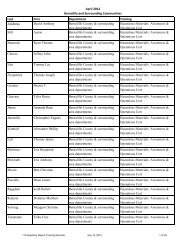

Sustainable Building Tax Credit (SBTC) [NMSA 1978, § 7-2A-21]: Has benefitted <strong>New</strong> Mexicans in 29<br />

counties by incentivizing builders to build highly energy-efficient <strong>and</strong> healthy, comfortable homes. Initiated in late<br />

2007, the number of residential tax credits grew from 2 to over 100 in 2008, then increased to almost triple that<br />

in 2009; applications submitted in 2010 will surpass 2009’s total. Although the residential building industry has<br />

dramatically slowed in this economic downturn, the dem<strong>and</strong> for green homes has had a significant positive effect.<br />

Homeowners who live in these homes are saving up to 40 percent on their utility bills <strong>and</strong> reducing the state’s energy<br />

consumption by almost eight billion BTU annually. The commercial tax credit has generated even larger savings of<br />

over 56 billion BTU in a total of 625,000 square feet of building space. In addition to helping the building industry<br />

in difficult times, the dollars saved from all the energy savings is money that goes back into the local communities.<br />

The energy saved is enough to power over 650 typical homes a year. Contrary to the perceptions of some, energy<br />

efficient green building is not just the domain of luxury homes but, importantly, is very affordable for “middle class”<br />

home construction as well. This is confirmed by the large number of modestly-sized new homes that have qualified<br />

for the SBTC. The tax incentive expires in December 2013.<br />

ANNUAL REPORT 2010<br />

35