Annual Report 2009 - Asian Productivity Organization

Annual Report 2009 - Asian Productivity Organization

Annual Report 2009 - Asian Productivity Organization

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

employee, of which the beneficiary is the APO. The purpose of this insurance is to pay for the severance<br />

payments, and approximately 57% of the liability for severance payments was insured as of the balance<br />

sheet date. In addition, the <strong>Organization</strong> manages a money market fund in Japanese yen for the purpose<br />

of severance payments. Net gains on the fund for severance payments for the years ended 31 December<br />

<strong>2009</strong> and 2008 were $30,602 and $36,250, respectively, and were included in miscellaneous revenues.<br />

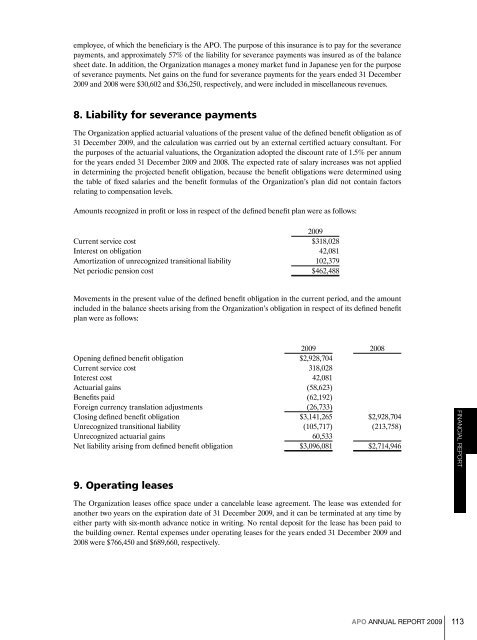

8. Liability for severance payments<br />

The <strong>Organization</strong> applied actuarial valuations of the present value of the defined benefit obligation as of<br />

31 December <strong>2009</strong>, and the calculation was carried out by an external certified actuary consultant. For<br />

the purposes of the actuarial valuations, the <strong>Organization</strong> adopted the discount rate of 1.5% per annum<br />

for the years ended 31 December <strong>2009</strong> and 2008. The expected rate of salary increases was not applied<br />

in determining the projected benefit obligation, because the benefit obligations were determined using<br />

the table of fixed salaries and the benefit formulas of the <strong>Organization</strong>’s plan did not contain factors<br />

relating to compensation levels.<br />

Amounts recognized in profit or loss in respect of the defined benefit plan were as follows:<br />

<strong>2009</strong><br />

Current service cost $318,028<br />

Interest on obligation 42,081<br />

Amortization of unrecognized transitional liability 102,379<br />

Net periodic pension cost $462,488<br />

Movements in the present value of the defined benefit obligation in the current period, and the amount<br />

included in the balance sheets arising from the <strong>Organization</strong>’s obligation in respect of its defined benefit<br />

plan were as follows:<br />

<strong>2009</strong> 2008<br />

Opening defined benefit obligation $2,928,704<br />

Current service cost 318,028<br />

Interest cost 42,081<br />

Actuarial gains (58,623)<br />

Benefits paid (62,192)<br />

Foreign currency translation adjustments (26,733)<br />

Closing defined benefit obligation $3,141,265 $2,928,704<br />

Unrecognized transitional liability (105,717) (213,758)<br />

Unrecognized actuarial gains 60,533<br />

Net liability arising from defined benefit obligation $3,096,081 $2,714,946<br />

9. Operating leases<br />

The <strong>Organization</strong> leases office space under a cancelable lease agreement. The lease was extended for<br />

another two years on the expiration date of 31 December <strong>2009</strong>, and it can be terminated at any time by<br />

either party with six-month advance notice in writing. No rental deposit for the lease has been paid to<br />

the building owner. Rental expenses under operating leases for the years ended 31 December <strong>2009</strong> and<br />

2008 were $766,450 and $689,660, respectively.<br />

FINANCIAL REPORT<br />

APO ANNUAL REPORT <strong>2009</strong> 113